Data on options markets show that investors are expecting a new peak for Bitcoin (BTC). Especially recently, with Bitcoin exceeding the level of 50 thousand dollars, it has been observed that there has been a significant increase in call options for higher levels such as 60 thousand, 65 thousand and 75 thousand dollars.

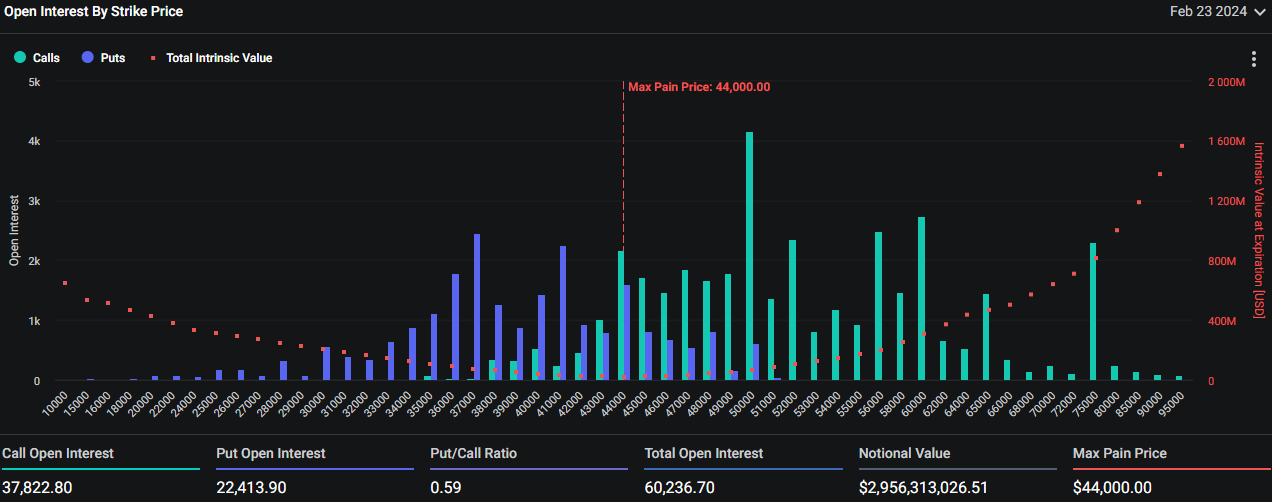

On Deribit, the world’s largest cryptocurrency-focused options exchange, it was determined that the 60 thousand dollar strike price was in demand, especially for the end of February, while the interest in the 75 thousand dollar strike price in the end of June futures options increased. This shows that investors have positive expectations regarding the future price movements of Bitcoin.

Call options give investors the right to buy the relevant asset at a certain price on a certain date, while put options give the right to sell it. A call option buyer implicitly expects the market to rise. So the concentration of Bitcoin calls at $60,000 and above indicates that a significant portion of market participants have particular interest or expectation that the Bitcoin price will rise above this level before the next month-end expiration date.

The increased expectation with the approval of the first US spot Bitcoin ETF created excitement in the cryptocurrency markets. However, the Bitcoin halving event, which will take place in April, has also created new excitement among investors. These events may increase demand for Bitcoin, contributing to higher prices.

Especially recently, Bitcoin exceeding the level of 50 thousand dollars, the positive atmosphere in the market and the increasing interest of investors show that the trust in Bitcoin and the expectation of rising prices are increasing. However, it should be noted that cryptocurrency markets are inherently highly volatile and subject to sudden price fluctuations. Therefore, investors should always be careful and not neglect to manage their risks.

You can follow the current price movement here.