The gold price stabilized around the critical $1,800 level on Wednesday as the decline in the US dollar and Treasury yields softened an increase in investors’ appetite for riskier assets. Expert analysts’ evaluations and analyzes on the effects of developments on the market. cryptocoin.com compiled for our readers.

According to Michael Hewson, gold is unlikely to find direction in the near term

“Gold is currently in a largely range-driven market,” commented Michael Hewson, chief market analyst at CMC Markets UK. The analyst adds that the precious metal is unlikely to find direction in the near term, as record high Eurozone inflation weighs on the European Central Bank’s rhetoric that it won’t raise interest rates this year.

Gold is considered a hedge against inflation, but tight monetary policy increases the opportunity cost of holding the unproductive metal. Carlo Alberto De Casa, market analyst at Kinesis, said that expected global rate hikes this year, starting with the Bank of England on Thursday, are likely to blunt the surge in the search for safe-haven stemming from the Russia-Ukraine crisis.

The precious metal was bolstered by US Federal Reserve officials’ statements on Wednesday that they oppose potentially aggressive rate hikes this year. The comments weakened the dollar, making gold more attractive to other currency holders. Also, ongoing tensions over Ukraine have helped safe-haven demand for the yellow metal. Russia has deployed more than 100,000 troops on the Ukrainian border, and Western countries say they fear they will plan to invade. Moscow denies this, but declares that it may take indefinite military action unless its security demands are met.

TD Securities: Precious metals will struggle to attract capital

Fed policymakers said they would raise interest rates in March, but on Monday they spoke cautiously about what might happen in the face of an uncertain inflation outlook and an ongoing epidemic. David Meger, director of metals trading at High Ridge Futures, evaluates the Fed speeches and their impact as follows:

The Fed felt much more dovish on Monday than last week, and as a result, we’ve seen the dollar pull back and asset prices rally almost especially because of yesterday’s Fed speech.

In addition, David Meger notes that Russia-Ukraine tensions continue to drive gold’s pricing for safe-haven demand.

Meanwhile, holdings of SPDR Gold Trust, the world’s largest gold-linked exchange-traded fund, rose to the highest levels since mid-August on Monday, reflecting investor appetite. Investors are now focused on US nonfarm payroll data, which will be released later this week. In a note, TD Securities analysts highlight:

The weak labor data we’ve come to expect is unlikely to return the Fed from its absolutely hawkish tone. Instead, we think the central bank will address the past weakness in relation to Omicron’s impact. In this context, we expect the precious metals complex to struggle to attract capital.

“Gold seems to be supported at $1,800”

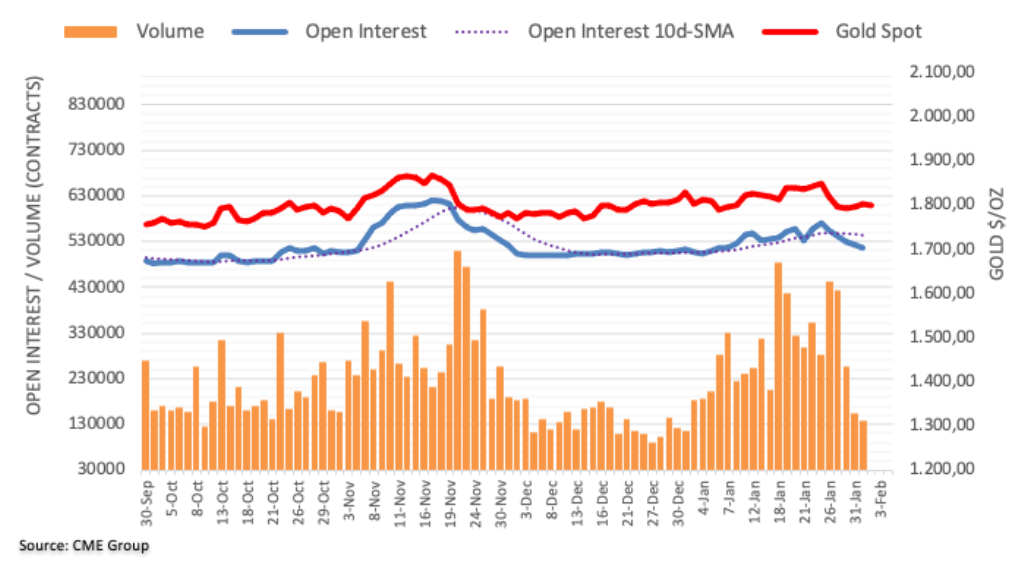

Preliminary data from CME Group for the gold futures markets showed that traders recorded their open interest on Tuesday at around 7,000 contracts, the fifth consecutive daily pullback. Volume followed suit, extending the downtrend this time to around 14.7k contracts.

Market analyst Pablo Piovano says Tuesday’s rise in gold prices came amid declining open interest and volume, indicating that extra losses are not preferred, at least in the very near term. However, $1,800 is emerging as the main magnet for the bulls for now.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.