November was a devastating month for the cryptocurrency market. What’s going on around FTX has caused widespread grievances from affiliated companies to individual investors. In the wake of this crisis, demand for DEX platforms, which are decentralized exchanges, is increasing. In this article, let’s examine the top four altcoin projects from the list of analysts.

Best DeFi altcoin projects for long-term investments

Uniswap (UNI)

Uniswap is a DeFi ecosystem based on Ethereum, Polygon, Avalanche and Celo. Decentralized exchange (DEX) that makes it possible for people to buy and sell cryptocurrencies. It currently processes more than $1 billion in transactions daily.

Analysts believe Uniswap is a good investment because of its leading market share in the DEX market. While its ecosystem is also growing rapidly, the amount of fees it generates is the third largest in the industry after Ethereum and Lido. Its fees in the last 24 hours were $1.43 million compared to Ethereum’s $3.1 million. Also, it has doubled its reputation after FTX.

Lido DAO (LDO)

Lido is one of the largest DeFi platforms in the liquid staking industry. Its total locked value (TVL) is more than $33 billion. Thus, it becomes the third largest player in the DeFi market. Lido has over $5.7 billion in equity funds. It has paid over $212 million in fees so far.

Most of these projects are in Ethereum’s over $5 billion network. This is followed by Polygon, Solana, and Polkadot. According to analysts, LIDO will likely yield good results in the long run.

PancakeSwap (CAKE)

PancakeSwap is the world’s third largest DEX by volume, after Uniswap and dYdX. It is a DEX that makes it possible for people to buy and sell cryptocurrencies. It also has features that enable NFT trading. Like FTX, PancakeSwap provides investors with a platform for perpetual futures trading.

PancakeSwap has a TVL of over $3.8 billion and processes over $600 million daily. As more investors and users move to DEXs, analysts expect Binance-backed PancakeSwap to come to the fore.

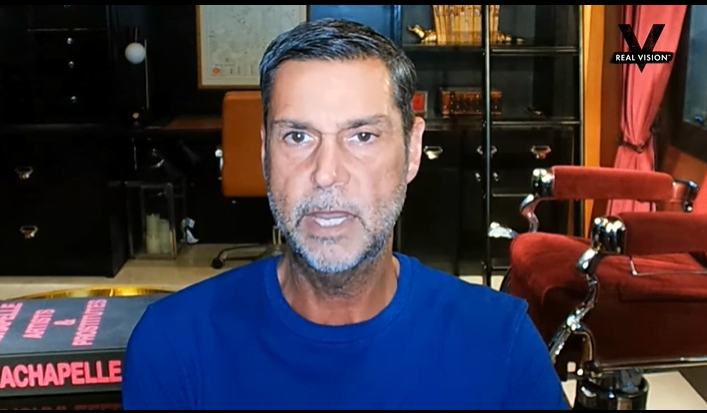

Famous economist Raoul Pal pointed to historical data about the collapsed Solana

The former Goldman Sachs executive says Solana presents a huge opportunity for investors after the price drop. In his new analysis, he noted that Solana did a lot in his favor to ignite an eventual bull run. Pal says that despite some Blockchain disruptions and the effects of the FTX collapse, Solana looks strong because of its use-case potential for brands and consumers:

…One of the things that brought Solana down was its concentration of ownership due to FTX. Now they can liquidate so you get rid of one of the problems. Solana herself, I think, is doing something very clever. What matters in the cryptocurrency market is perception. For example, Bitcoin; digital gold. Ethereum is the distributed internet for Web3…Solana has and is building a narrative that is to be the consumer Blockchain.

Raoul Pal also said that another altcoin project that does this is FLOW. He stated that NFTs are the main reason that glorifies networks like Solana and Flow:

There are others who do this. FLOW, I think is another example, much smaller… I believe the use of NFTs and other crypto products will only explode in the next few years. We’ve just seen Nike develop more. We saw Adidas. We saw fashion brands. We saw Ticketmaster.

Raoul Pal says Ethereum also fell 97% in 2018

Pal says that Solana currently operates like Ethereum, with the price of the smart contract platform dropping more than 90% in 2018. Solana was trading at $38.74, this month’s high, but dropped to $12.21 after FTX crashed. It is currently trading above $13.5. cryptocoin.com It recovered somewhat after the Binance announcement, which we quoted as.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.