Fees are collected every year from motor vehicles such as motorcycles, cars, pickup trucks and buses within the scope of Motor Vehicle Tax. Following the decision published in the Official Gazette today, 2024 Motor Vehicle Tax (MTV) fees were announced. Here are the details…

How much is the 2024 Motor Vehicle Tax (MTV)?

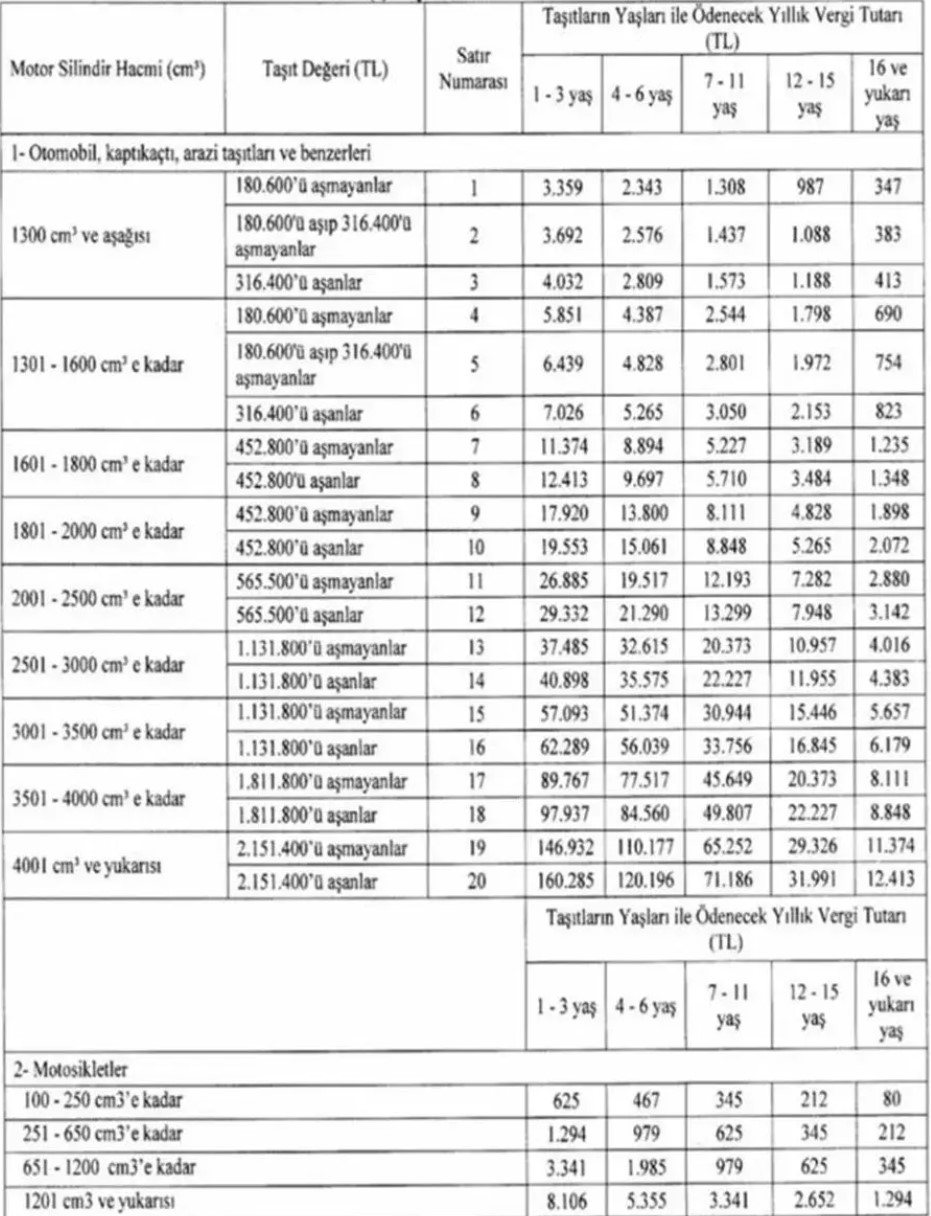

According to the information announced in the Official Gazette, the Motor Vehicle Tax to be collected for all vehicles in 2024 increased by 58.46 percent. For vehicles with an engine cylinder volume of 1,300 cm3 and below, MTV will be paid between 3,359 and 4,032 TL, depending on the age and price of the car.

For vehicles between 1,300 and 1,600 cm3, which are the most preferred in our country, the MTV fee will start from 5,851 TL and go up to 7,026 TL. MTV fees for other cars, motorcycles and heavy vehicles are as follows:

Automobiles, pickup trucks, off-road vehicles and similar for Motor Vehicle Tax (MTV) –2023

| Engine cylinder volume (cm3) | Vehicle value (X TL) |

1-3 years old (X TL) |

4-6 years old (X TL) |

7-11 years old (X TL) |

12-15 years old (X TL) |

16 years and over (X TL) |

|---|---|---|---|---|---|---|

| 1300 and six |

Not exceeding 114,000 | 2,120 | 1,479 | 826 | 623 | 219 |

| 1300 and six |

Those exceeding 114,000 but not exceeding 199,700 | 2,330 | 1,626 | 907 | 687 | 242 |

| 1300 and six |

Over 199,700 | 2,545 | 1,773 | 993 | 750 | 261 |

| Between 1301-1600 | Not exceeding 114,000 | 3,693 | 2,769 | 1,606 | 1,135 | 436 |

| Between 1301-1600 | Those exceeding 114,000 but not exceeding 199,700 | 4,064 | 3,047 | 1,768 | 1,245 | 476 |

| Between 1301-1600 | Over 199,700 | 4,434 | 3,323 | 1,925 | 1,359 | 520 |

| Between 1601-1800 | Not exceeding 285,800 | 7,178 | 5,613 | 3,299 | 2,013 | 780 |

| Between 1601-1800 | Those exceeding 285,800 | 7,834 | 6,120 | 3,604 | 2,199 | 851 |

| Between 1801-2000 | Not exceeding 285,800 | 11,309 | 8,709 | 5,119 | 3,047 | 1,198 |

| Between 1801-2000 | Those exceeding 285,800 | 12,340 | 9,505 | 5,584 | 3,323 | 1,308 |

| Between 2001-2500 | Not exceeding 356,900 | 16,967 | 12,317 | 7,695 | 4,596 | 1,818 |

| Between 2001-2500 | Over 356,900 | 18,511 | 13,436 | 8,393 | 5,016 | 1,983 |

| Between 2501-3000 | Not exceeding 714,300 | 23,656 | 20,583 | 12,857 | 6,915 | 2,535 |

| Between 2501-3000 | Those exceeding 714,300 | 25,810 | 22,451 | 14,027 | 7,545 | 2,766 |

| Between 3001-3500 | Not exceeding 714,300 | 36,030 | 32,421 | 19,528 | 9,748 | 3,570 |

| Between 3001-3500 | Those exceeding 714,300 | 39,309 | 35,365 | 21,303 | 10,631 | 3,900 |

| Between 3501-4000 | Not exceeding 1,143,400 | 56,650 | 48,919 | 28,808 | 12,857 | 5,119 |

| Between 3501-4000 | Those exceeding 1,143,400 | 61,806 | 53,364 | 31,432 | 14,027 | 5,584 |

| 4001 and over |

Those not exceeding 1,357,700 | 92,725 | 69,530 | 41,179 | 18,507 | 7,178 |

| 4001 and over |

Those exceeding 1,357,700 | 101,152 | 75,853 | 44,924 | 20,189 | 7,834 |

Automobiles, pickup trucks, off-road vehicles and similar vehicles registered and registered before 31/12/2017 are taxed according to the tariff numbered (I/A) regulated in the provisional article 8 of Law No. 197. Accordingly, MTV rates are as follows:

| Engine Cylinder Displacement (cm³) | 1-3 years old (X TL) |

4-6 years old (X TL) |

7-11 years old (X TL) |

12-15 years old (X TL) |

ages 16 and up (X TL) |

|---|---|---|---|---|---|

| 1300 cm³ and below | 2,120 | 1,479 | 826 | 623 | 219 |

| up to 1301-1600 cm³ | 3,693 | 2,769 | 1,606 | 1,135 | 436 |

| up to 1601-1800 cm³ | 6,527 | 5,098 | 3,003 | 1,828 | 707 |

| up to 1801-2000 cm³ | 10,284 | 7,918 | 4,654 | 2,769 | 1,091 |

| 2001-up to 2500 cm³ | 15,423 | 11,196 | 6,996 | 4,178 | 1,652 |

| up to 2501-3000 cm³ | 21,508 | 18,709 | 11,687 | 6,283 | 2,306 |

| up to 3001-3500 cm³ | 32,755 | 29,473 | 17,752 | 8,859 | 3,249 |

| up to 3501-4000 cm³ | 51,503 | 44,472 | 26,190 | 11,687 | 4,654 |

| 4001 cm³ and above | 84,294 | 63,211 | 37,435 | 16,821 | 6,527 |

Motor Vehicle Tax (MTV) for motorcycles –2023

| Engine cylinder volume (cm3) | 1 – 3 years old (X TL) |

4 – 6 years old (X TL) |

7 – 11 years (X TL) |

12 – 15 years old (X TL) |

ages 16 and up (X TL) |

|---|---|---|---|---|---|

| up to 100 – 250 cm3 | 395 | 295 | 218 | 134 | 51 |

| up to 251 – 650 cm3 | 817 | 618 | 395 | 218 | 134 |

| up to 651 – 1200 cm3 | 2,109 | 1,253 | 618 | 395 | 218 |

| 1201 cm3 and above | 5,116 | 3,380 | 2,109 | 1,674 | 817 |

Note: You can click here to learn the MTV rates for vehicles such as minibuses, buses, trucks, planes and helicopters.

What do you think about this issue? Don’t forget to share your opinions with us in the comments!