According to the new proposal from the IMF, there is a new resource to be used in determining our credit rating in the future: our internet search history.

Would you like your credit score to be determined based on your internet search history? How does the probability of determining whether you can get a loan or not based on the searches you make and the sites you visit sound like? International Monetary Fund (IMF)indicates that just this method can be tried.

Credit score from internet history?

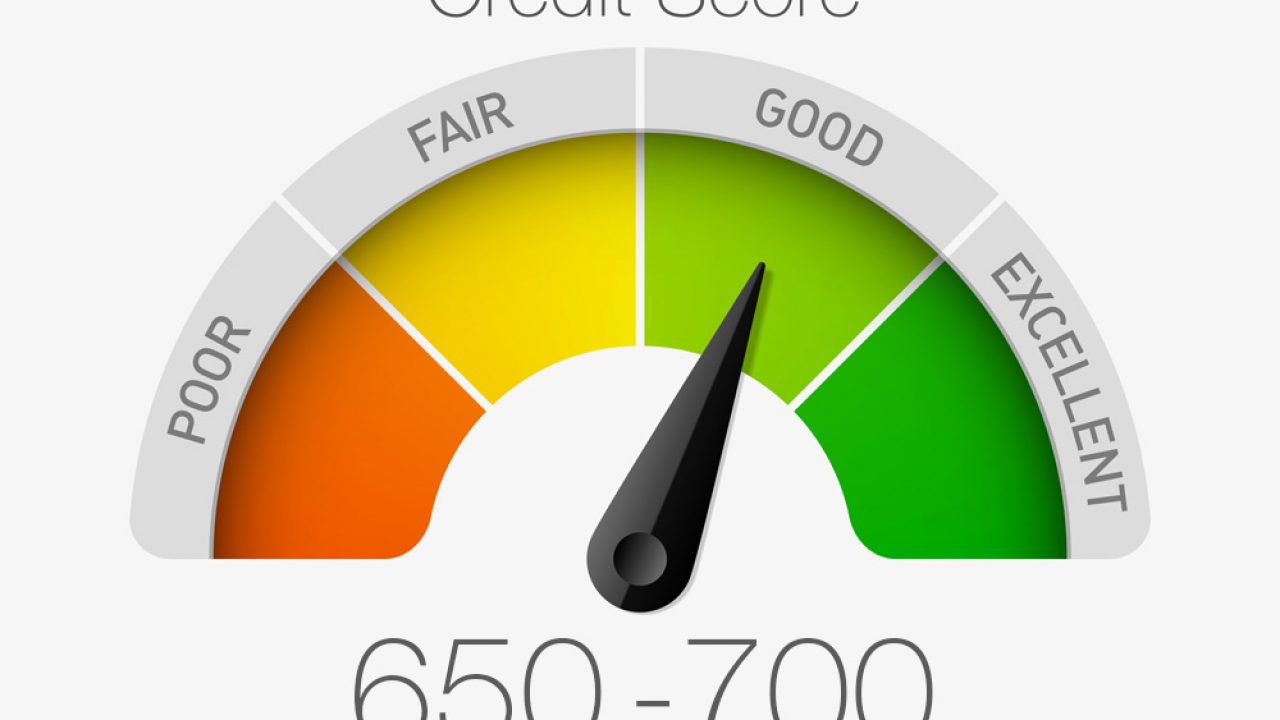

Normally, every citizen has a credit rating has. For this, things like your total debt amount, monthly earnings, total number of accounts, whether you have delayed payments are taken into account. IMF researchers are working to make more than that possible.

International Monetary Fund According to researchers, it is very difficult to evaluate people who do not have a credit history in traditional methods. In addition, it is stated that people become more risky customers even with good credit history during bad economic periods.

RELATED NEWS

Prepare Credits(!): iPhone 13 Series Prices Revealed

According to researchers, people do internet searches, the tools they use and the methods of accessing the internet, their past searches and online purchases can yield more accurate results than traditional credit evaluation methods.

Credit is not decided by grade alone

Credit score determination systems are what most people know and understand. is more complexis a system in which the evaluation grade is constantly changing. Depending on the loan you apply for, you also have different credit ratings, consumer loans and automobile loans are not evaluated in the same way.

RELATED NEWS

Closing the Debt with Debt May Be a Date: The Number of Maturities in Consumer Loans Has Been Decreased

Although the data is the same the banks themselves they can use their own evaluation systems using different algorithms. The new system is actually used to understand whether people are eligible for credit. the idea of using artificial intelligence is focusing. Still, it’s not realistic to expect people to go with their browser history when they go to get a loan.

The main purpose of the researchers is to evaluate internet habits rather than using internet history to give credit scores. That is, using an entry-level model when accessing the Internet. Between using iPhone 13 there will be difference. The final decision will still be made by human bankers.

Source :

https://www.howtogeek.com/756015/will-your-credit-score-be-based-on-your-web-history/