The electronics group now generates more than 4.5 billion euros a year – a quarter of the group’s sales.

(Photo: Würth Elektronik eiSos GmbH & Co. KG)

Stuttgart Reinhold Würth has always thought beyond the core business for his company. When the tool specialist known as the “Screw King” started building printed circuit boards decades ago, he dared to make a prediction: one day the electronics sector would be as big as the conventional business with screws and assembly materials.

It’s not quite there yet, but the foresight of the 87-year-old family entrepreneur is paying off. Today, the Würth Electronics Group consists of three units: CBT produces printed circuit boards, ICS manufactures power and control systems, and eiSos is a manufacturer of electronic and electromechanical components.

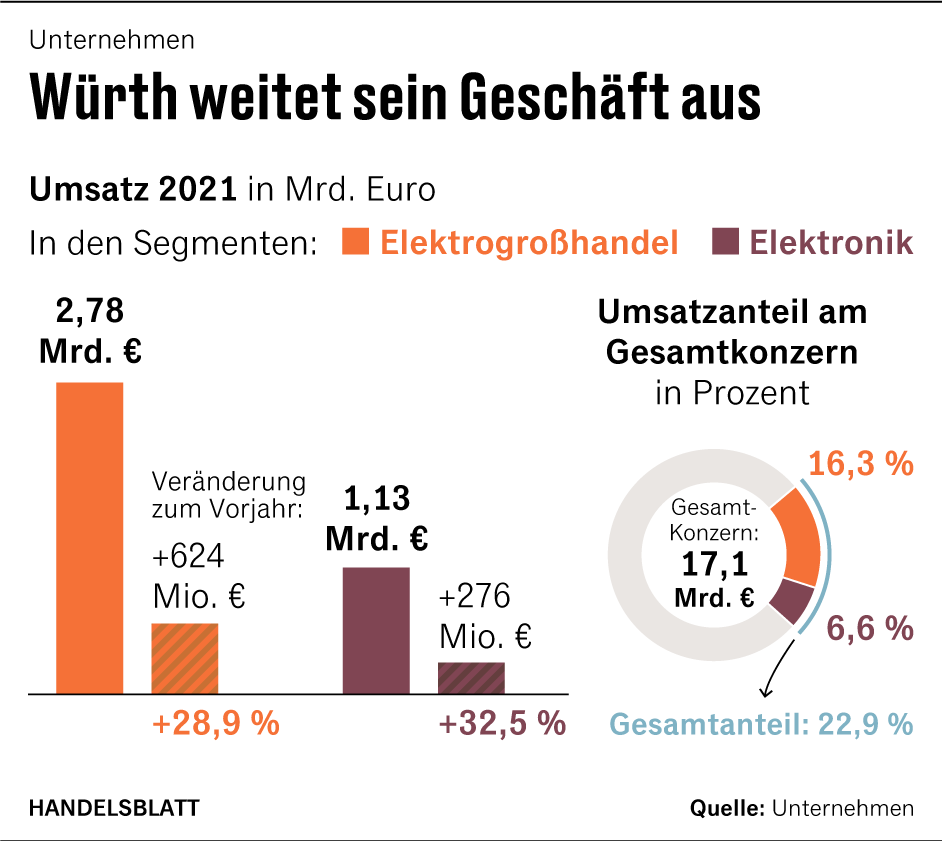

The electronics and electrical wholesale sectors, which receive little public attention compared to the assembly and fastening sector, now have sales of more than 4.5 billion euros – almost a quarter of the group’s sales. This makes them by far the fastest growing areas of the Würth Group.

With the eiSos components alone, external sales (sales proceeds) of one billion euros will be achieved this year. 600 million euros of this comes from in-house manufactured products from 14 plants worldwide. Würth is one of the leading manufacturers of passive components. “We will grow in double digits again next year,” says the head of Würth Elektronik, Thomas Schrott, to the Handelsblatt. The market, on the other hand, is currently only growing by eight percent.

Top jobs of the day

Find the best jobs now and

be notified by email.

Within two years, Würth Elektronik has grown purely organically by 65 percent. The medium-term sales target is two billion euros in 2030. “Small animals also make crap” is written in the current company brochure, alluding to the sometimes tiny electronic components.

200 million euros for the ability to deliver

One of the secrets of success is clever stock-keeping: “We deliberately built up a stock worth 200 million euros,” explains Schrott. “Our parts, for example for suppressing interference in micromotors and controls, are systemically relevant for industry and automotive construction.”

180 special patents secure the business. And in the meantime, Würth is also venturing into cooperation with chip manufacturers for so-called switching regulator modules, in which Würth’s passive components are installed together with the partners’ chips.

Würth has been building printed circuit boards since 1976, and fastenings were added in 1984. In the 1990s, products for electromagnetic compatibility, which counteract interference, were added. The components are sold in direct sales based on the model of the Würth parent company.

The project business is about winning developers who then put the eiSos components on the parts list. The focus is on industrial electronics and automotive applications for autonomous driving. According to Würth, it now has 100,000 customers. But that is only one percent in a gigantic market.

Electrical wholesalers benefit from the trend towards renewable energies, charging stations, energy storage and heat pumps

However, the passive components are only part of Würth’s transformation into an electronic future. The electrical wholesale trade is showing a similarly dynamic development. “Sales will increase this year by almost 24 percent to 3.4 billion euros,” says Uwe Schaffitzel, the division manager responsible for business in Germany.

Würth benefits from the strong trend towards renewable energies, charging stations, energy storage and heat pumps. Energy can be saved primarily with modern technology – it is connected with electrical installations. “We will also have double-digit growth in 2023,” says Schaffitzel. Despite the problems in the construction industry, he does not expect a real crisis in the electronics industry for the next year either. In Germany, Würth is now number two behind France’s Sonepar. The Rexel company is also performing even better across Europe.

The electrical wholesale business is atypical: no Würth products are sold. Products are sold by brand manufacturers under their own label. The focus is on components for distribution cabinets such as cables, small parts and switches. Because when it comes to electrics, people prefer to trust professionals than to do the work themselves – and to buy and connect the parts themselves. That is why the electrical trade is a very attractive clientele for Würth.

The dynamic growth was also possible due to fully stocked warehouses during the Corona years. But that caused high costs. The financial backing from the Würth Group helped a lot, explains Schaffitzel. And: “The supplies are rolling. By the end of the year, another 65 trucks will be delivered with ordered and therefore already sold photovoltaic modules and inverters, which the electricians are urgently waiting for.”

Half of the customers order online

Within the Würth Group, electrical wholesalers are also pioneers when it comes to online sales. Half of the turnover is made in the digital shop, group-wide the share is only one fifth. The international business has grown significantly over the past seven years, also through acquisitions totaling several hundred million euros. However, the business is tough, explains Ulrich Liedtke, who is responsible for the area: “You can’t differentiate yourself in the business with the products, but with the performance.”

If you order by 7.30 p.m., you will have your goods the next day. The company manages to do this 98 percent of the time with 45,000 articles. Due to the general delivery problems in the industry, the rate has slipped somewhat to 94 percent.

There is also competition from direct sales by manufacturers. The world market is worth 200 billion euros. “It is too difficult for us to get into the US and Chinese markets. But we still have many growth opportunities in Europe,” emphasizes Liedtke. The Würth trick consists of leaving the names and identities of the acquired companies: “We come without a blueprint. That helps us with takeovers.” The direct competitors in the market regulate things differently.

More: In the shadow of the patriarch: Würth CEO Robert Friedmann is in demand as a diplomat.