One of the well-known on-chain analysts in the crypto world. Willy Woonoted that a not-so-talked-about group of Bitcoin (BTC) investors could generate a new wave of strong demand.

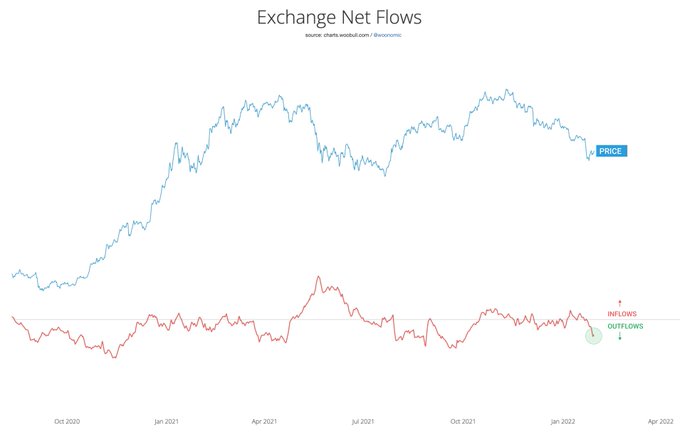

on his Twitter account Sharing his analysis, Woo stated that he closely monitors the ‘stock market net flows metric’, which monitors the amount of Bitcoin entering and leaving crypto exchanges, and shared his views.

According to Woo, the metric currently shows the dominance of ‘currency’ outlets. According to this metric, there is an increase in demand, and while investors wait for Bitcoin to rally, they have Bitcoin (BTC) It appears to continue to hold.

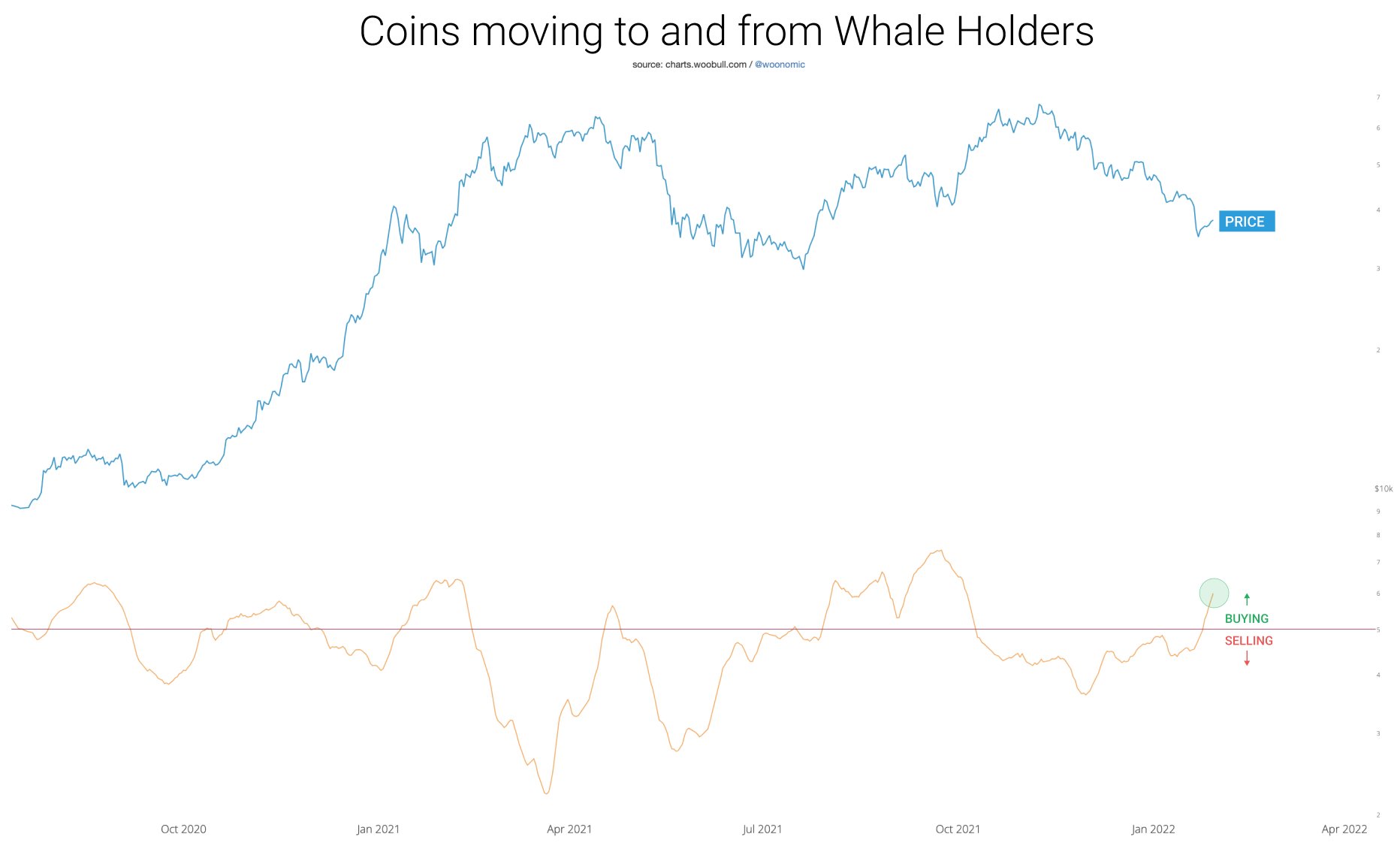

Woo also added that he thinks institutions are behind the purchasing power, based on the amount of money that whales or assets holding 1,000 to 10,000 BTC get their hands on.

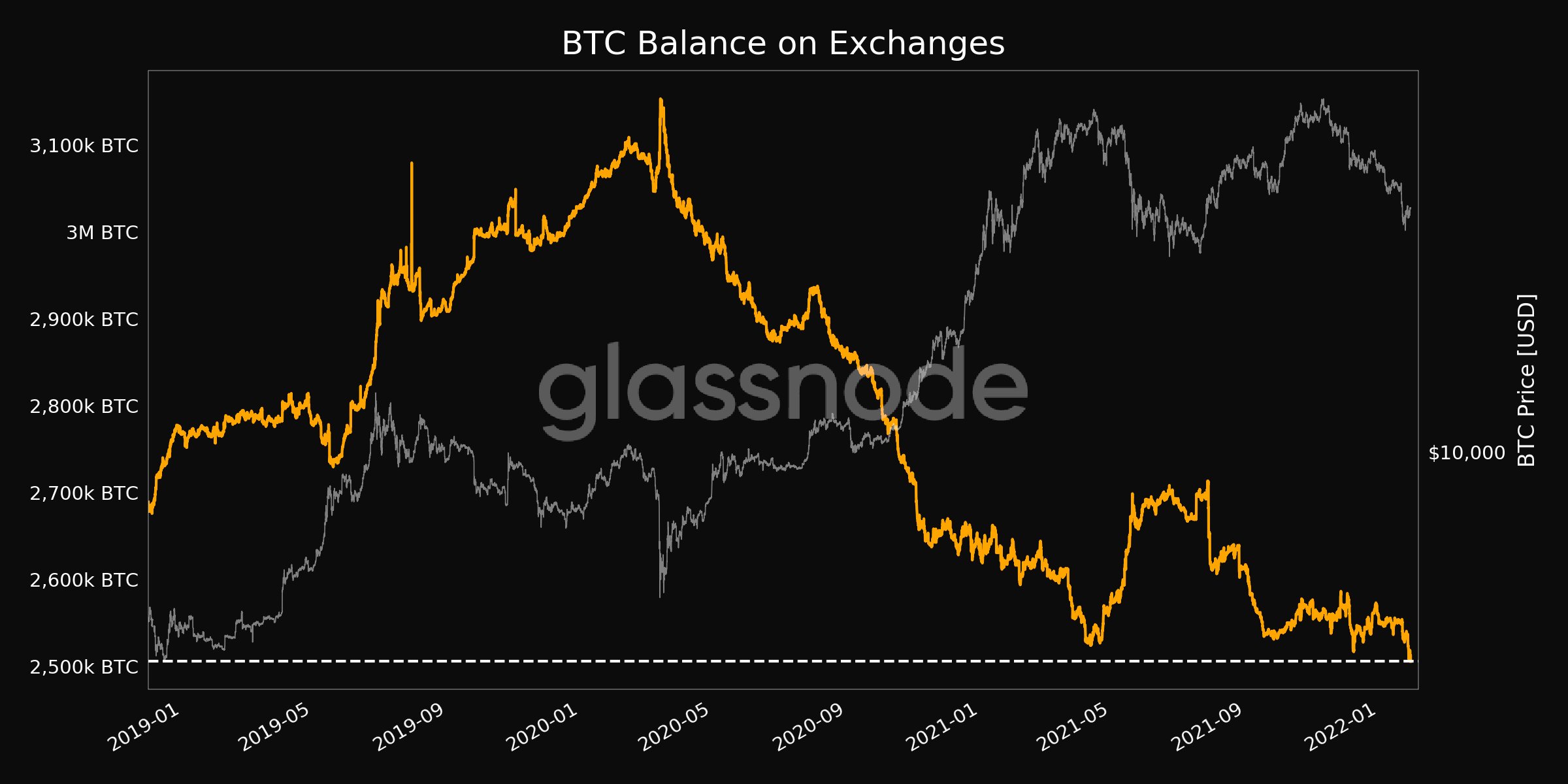

The popular analyst also noted that he used data from blockchain tracking platform Glassnode to house factors such as exchanges and exchange-traded funds (ETFs) to get a more accurate picture.

According to Glassnode, Bitcoin balance on exchanges is currently at its lowest point in three years, indicating that selling pressure for BTC has eased.

“BTC balance on exchanges hit a three-year low of 2,505,972,824 BTC. On January 27, 2022, 2,508,534,211 BTC was observed, the lowest level of the previous three years.”

In addition, Glassnode, bitcoin He argues that the vast majority of all transfer volume on its network is dominated by institutional-sized flows, and major players are starting to take control of BTC.

“Bitcoin transfer volumes continue to be dominated by institutional-sized flows, with over 65% of all transactions being greater than $1 million. The upward trend in institutional dominance in on-chain volumes started around October 2020 when prices were between $10,000 and $11,000.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.