Negative developments in 2022 also helped trigger gossip in the crypto world. While the collapse of the leading FTX exchange and FTT Token continues to leave a question mark in mind, other coin that may suffer the same fate. Binance Coin (BNB) speculations have increased.

The domino effect, which started with the collapse of the Terra-LUNA ecosystem in May, took a much worse shape with the collapse of the FTX exchange. However, among all these problems, the name that suffered the least was undoubtedly Binance and CEO Changpeng Zhao. As a matter of fact, Binance Coin associated with these two names also protected itself. During all these developments, Binance CEO quarreled with many exchanges and names, including FTX, on Twitter.

Indeed, Binance and its native token, Binance Coin, continue to offer an impressive outlook since 2021. As such, many speculations arose about BNB. Some names on Twitter highlighted the anomalies related to BNB. So is Binance really speculating?

Binance Coin Price Action

According to CoinMarketCap, Binance Coin currently has a market cap of $46.3 billion. BNB; BTC is the 4th largest after ETH and USDT. cryptocurrency. Looking at the Binance Coin price action since the beginning of 2021, we see a huge spike from January to May 2021. During last year’s bull market, BNB rose nearly 100% from $32 to an all-time high of $704.6 (ATH).

Interestingly, six months later, in November 2021, the BNB price failed to surpass the ATH but peaked at $696.1. After forming a long-term double top formation, Binance Coin price started a bear market.

‘Exponential rises’ during the bull market and sharp falls during the ‘bear market’ are of course not an unfamiliar pattern in the market. However, unlike other altcoins, Binance Coin saw a lesser average drop of 73.5%. For example, Ethereum lost 82% value over the same period, while XRP lost 85%, DOGE 93%, ADA 90% and BTC 77%.

BNB Tops Against Bitcoin

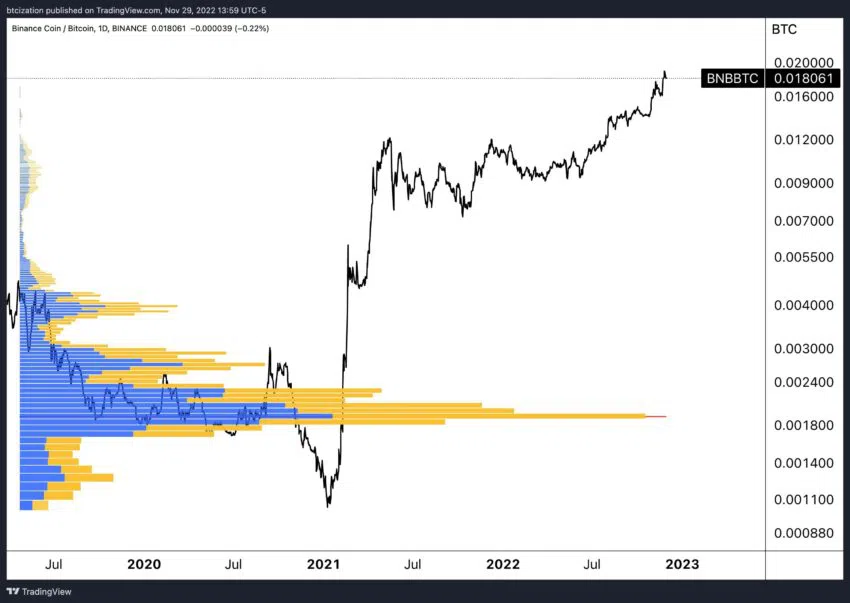

Binance Coin has recorded highs against Bitcoin since mid-2022. The BNB/BTC chart is far from a bear market outlook since 2021. Even if there was a decrease from time to time, this rate could not exceed 45% in general.

On the other hand, the increase in value of BNB compared to BTC is impressive. First, since the start of 2021, the price of BNB has skyrocketed from 0.00100 BTC to the top of 0.01235 BTC, recording a 1.075% gain over the top cryptocurrency for the pair.

The outlook remained good, although the bear market’s dominance resulted in a correction.

When Bitcoin peaked in November 2021, the BNB price was 0.00911 BTC. However, just one year later, in November 2022, Binance Coin hit an all-time high of 0.01970 BTC. BNB was up 117% compared to Bitcoin during a year-long bear market.

Will BNB Share the Same Fate as FTT Token?

Unnatural price action of Binance Coin, analyst @DylanLeClair_caught his attention. Commenting on BNB’s performance, the analyst did not neglect to be ironic and said the following:

“Tag me a pessimist, but all I see is a lot of hot weather. (…) There must be a ‘new paradigm’.”

In addition to the ironic comment, he compared the 2020-2021 charts, stating that the price of BNB and FTT experienced an exponential break at the beginning of 2021.

I’m sure it was retail that sent BNB 10x in two months. Same with FTT, right?

It definitely wasn’t the exchange operator with an incentive to drive up the price of their own token to create a feedback loop of attention, hype, and more users…

Definitely not. pic.twitter.com/j2Z49SEuLA

— Dylan LeClair 🟠 (@DylanLeClair_) November 29, 2022

The analyst also underlined that he is aware of the increase in value of altcoins against Bitcoin. In the same period, he shared the winners such as SOL, AVAX, LUNA. Accused Solana of Alameda leveraged transactions and fraud. He also did not neglect to associate AVAX with Three Arrows Capital. LUNA represents a story whose outcome is clear.

According to the analyst, these increases are nothing more than a free token creation chain. According to the analyst, the method is clear. A token is created, capital and marketing are used in an illiquid market. Of course, this marketing is embellished with a stylish presentation.

Analysts Worried About Binance Coin

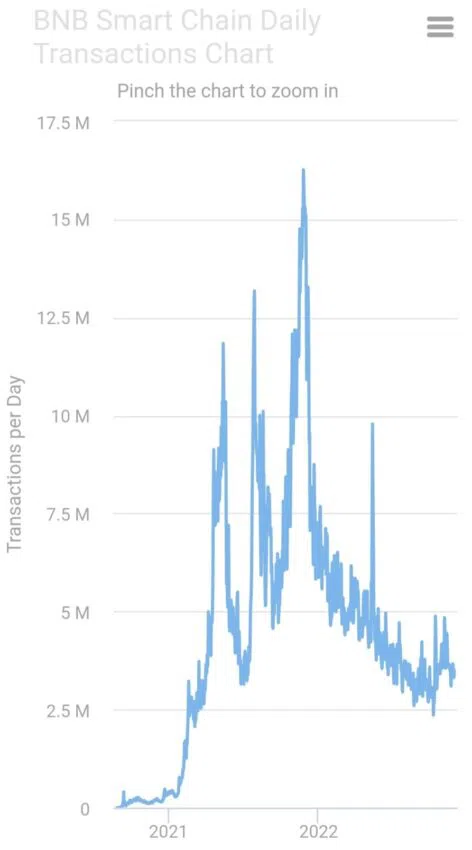

@MatthewHyland_, on the other hand, drew attention to the trading activities and gave the Binance Coin forecast. Looking at the charts, indeed, the trading activity of BNB Smart Chain has declined since November 2021. It is now near its lowest level and has dropped almost 80% in a year.

But of course, these details do not relieve the concerns. BNB continues to influence the choices of traders and investors. @DylanLeClair_ ‘compared’ his two charts of BNB price by trading volumes. In the BNB/BTC spot market, the chart has major support levels close to 2020 prices (before exponential breakout).

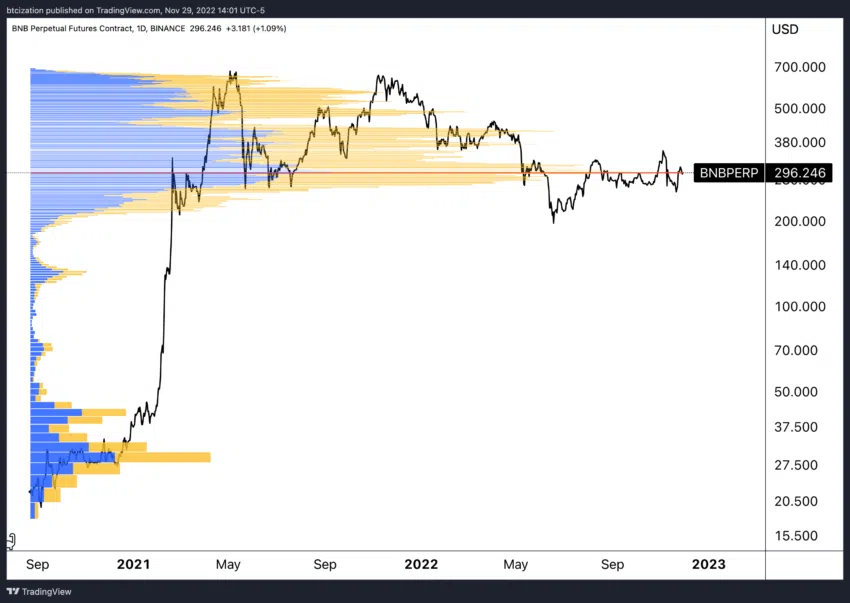

However, when looking at perpetual futures contracts for BNB, the opposite seems to be the case. Leveraged traders created large volumes in the high price areas reached from mid-2021 to date.

According to the analyst, this is proof that the BNB/USDT pair is overvalued. Binance Coin may face problems after a while. If that happens and the price of Binance Coin drops, the entire cryptocurrency market will be affected as well. BNB is currently the fourth largest cryptocurrency, while stablecoin BUSD ranks sixth with a market cap of $22 billion.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.