- bitcoin According to the data, traders who open leveraged trades are expecting an increase in these days when the asset is separated from the stock markets.

- Supporters underline that despite the recent drop in price, 55% of Bitcoin supply is still profitable.

- Analysts have identified a descending channel that represents a drop in price.

bitcoin price It had a dip and fell below new support levels. The asset is expected to end the week around $29,000 as Bitcoin splits from stocks.

Bitcoin Price Keeps Falling

In the recent crash, the Bitcoin price has lost value for about eight weeks. Analysts fear that the BTC price will drop below the support levels. Volume has come to the fore as a major factor in the price trend, while trading volume has dropped significantly.

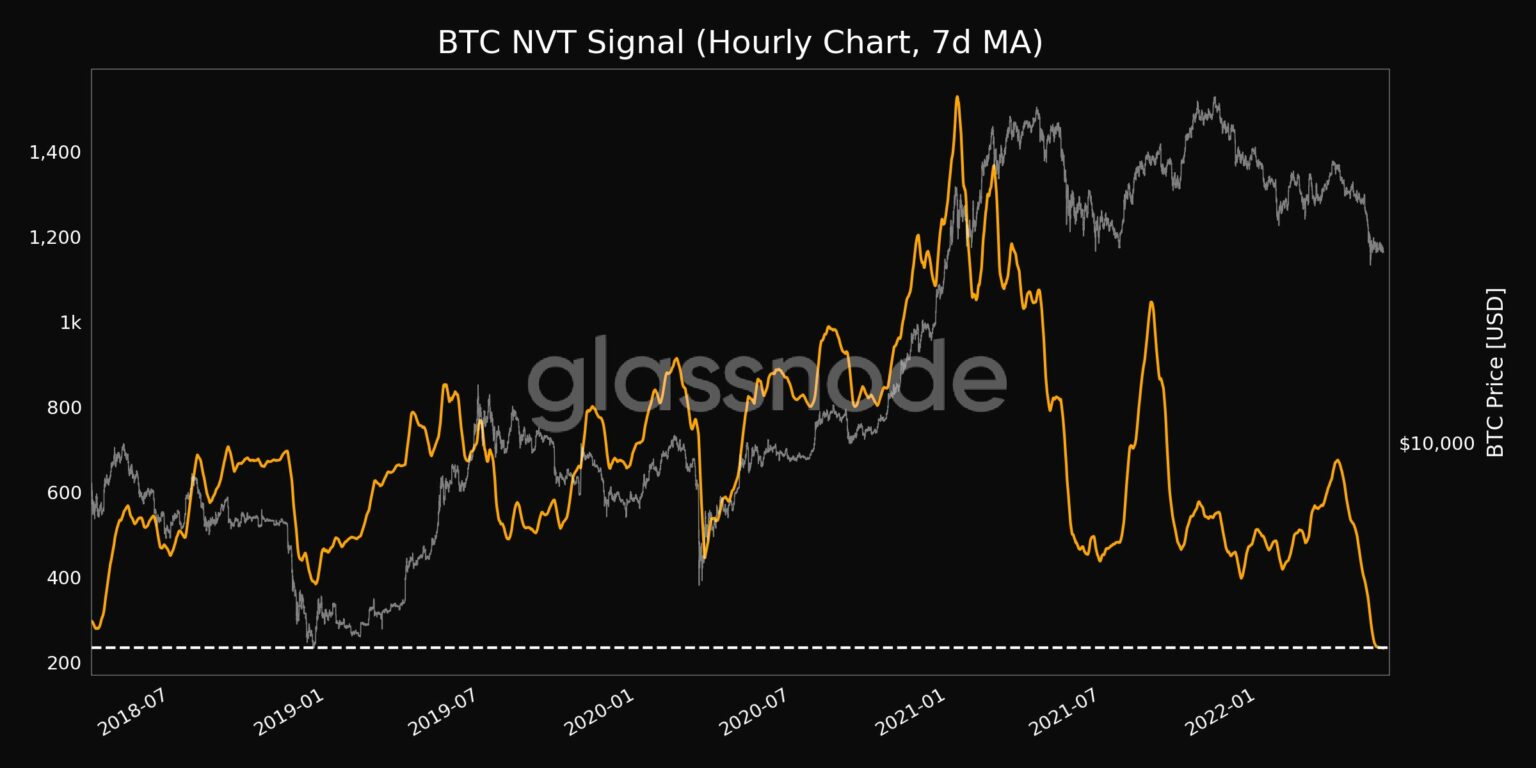

While the bitcoin price is consolidating in the region of $29,000 to $30,000, the metrics suggest a bearish phase is coming. Crypto data intelligence platform Glassnode reveals that it uses the 90-day moving average of daily trading volume in the denominator of the NVT signal, which is a variation of the NVT Ratio. Signal, BTC priceIt is used to predict peaks in

The signal recorded a four-year low of 233.9. This is a sign of a bearish phase in BTC price.

55% of Investors Still Profit

Despite the Bitcoin price dropping below $30,000, 55% of current investors (of the current supply) are still profitable. Glassnode’s leading crypto analyst Crypto Season has compared BTC price cycles from 2017 to 2018.

We would have to wait 151-184 days for 55% of the current supply to become profitable. Bitcoin price seems to have capitulated to a dip right now, with profits down by about 58% in about 213 days in the 2021-2022 cycle.

Analysts evaluated the Bitcoin price trend and identified a falling wedge pattern. CryptoVizArt, a prominent analyst, has identified a clear Wyckoff accumulation phase and thinks the price will consolidate in a demand zone.

Bitcoin has continued its downtrend over the past few months after falling below its all-time high of $69,000. The recent drop below the key psychological barrier of $30,000 has created an extreme bearish sentiment among investors.

Despite the BTC price leaving the exchanges, analysts fear further declines in BTC.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.