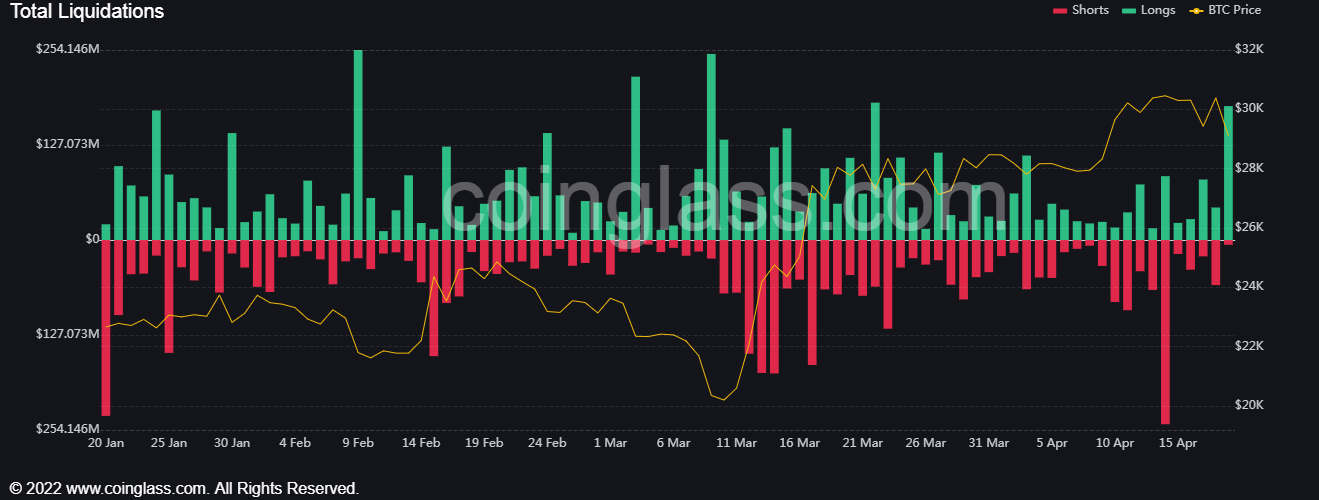

Today crypto- A larger sale began in the market. Over $160 million worth of crypto assets were liquidated in one hour and $250 million in the last 24 hours.

bitcoin The price fell 5% to $29,000 and is currently trading at $29,281. Over the past 24 hours, BTC price recorded lows and highs of $29,012 and $30,470, respectively.

Ethereum prices also fell sharply below the $2,000 level. ETH price has dropped over 6% in the last 24 hours. The price is currently trading at $1,988. The lowest and highest prices in 24 hours are $1,980 and $2,121, respectively.

While other altcoins such as BNB, XRP, Cardano, Dogecoin, Polygon (MATIC) and Solana lost around 5%, the global crypto market fell 3% in the last 24 hours to $1.23 trillion.

Data from Coinglass revealed that there is over $175 million in long-term liquidation today. Nearly 75,000 traders have been liquidated in the last 24 hours, with Binance’s largest single liquidation order on the BTCUSDT pair worth $3.02 million.

UK and European Central Banks Create New Inflation Fears

Global stock markets fell after the Bank of England and the European Central Bank considered raising interest rates further to push inflation below target rates. Investors are cautious as Federal Reserve officials James Bullard and Raphael Bostic favor a higher final interest rate of between 5.50% and 5.75% and a 25 basis point hike in May.

In the UK, annual consumer price index (CPI) inflation came in at 10.1%, against the 9.8% expectation. Core Eurozone inflation, on the other hand, rose in March, while the annual inflation rate fell to 6.9%.

As Koinfinans.com reported, the US Dollar Index (DXY) rose to 102, causing Bitcoin and Ethereum prices to fall sharply.

Popular crypto analyst Michael van de Poppe said there was a deep correction in the markets as Bitcoin failed to hold the $29,700-29,800 levels and fell with a series of liquidations. stated.