At the beginning of the year, the crypto market continues its bearish momentum. In the NFT coin industry, it is extremely difficult to understand what is going on. The year 2022 has been the perfect mix of collectibles, new markets and incentives for fraudulent activities. It was claimed that the OpenSea data did not reflect the truth and was built on completely fake activities. So when you look at the NFT collection leaderboards, not everything is as it seems. This article has key statistics for the past year. So you can create your own analysis.

Market value and trading volume of NFT coin projects rose

Total sales of NFT coin projects in 2022 were $55.5 billion. That’s a 175% increase from $20.2 billion in 2021. When you compare total sales for 2020 and 2022, it’s 390 times more. When we look at the market value of the industry; NFT industry market cap of 41.5 on April 4

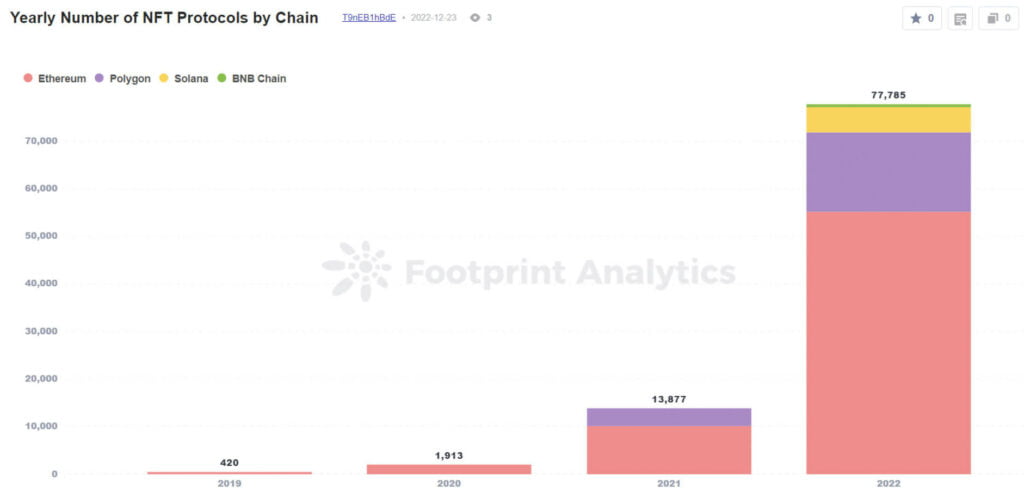

reached its peak with billions of dollars. However, about 85,000 NFT collections were released last year. While there were approximately 14.5 thousand collections in 2021, this number reached almost 99 thousand by the end of 2022. It is worth noting that Opensea continued to be the leader in both years.

About 7,700 collections had traded volumes of over $100,000. Note that the majority of this activity did not come from legitimate and organic interest in the project. Also, only 2,623 collections had more than 1000 unique buyers. However, NFT trading volume reached its 2022 peak in January with a valuation of $17.4 billion. This represents a jump of more than 4 times compared to the previous month (December 2021). This was also the month when Google’s searches for the keyword “NFT” reached an all-time high.

Statistics on these NFT collections stand out

By the end of the year, CryptoPunks was the collection with the largest market capitalization, worth $ 1.1 billion. Launched by Larva Labs in 2017, Crypto Punks became the first NFT collection with the highest floor price in the industry. Yuga Labs acquired the IP of the collection in March 2022. However, the transaction volume of major collections in the Yugaverse – Yuga Labs’ product portfolio – was $3.1 billion. This amount includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside and CryptoPunks. It excludes Meebits, which has the greater trading volume of all of them.

The Yuga Labs portfolio accounts for approximately 20% of the total market value of the entire NFT industry. This amount includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, CryptoPunks and Meebits. Without any filters, Terraforms by Mathcastles had a staggering $12 billion in transaction volume at 11,341 transactions, more than any other collection. However, 99.8% of the volume and 46.3% of the transactions were identified as suspicious transactions. CryptoPunks had the highest volume ($2.9 billion). Then came the Bored Ape Yacht Club ($2.3 billion).

Statistics on chains and markets for NFT coin projects

As cryptokoin.com reported, Ethereum had 95% of nft coins volume, 47% of transactions and 71% of protocols. These figures are almost the same as those in 2021. Based on the data, Ethereum is still the most widely used for NFT. Solana currently ranks third globally. However, OpenSea hosted 53% of all total collections. OpenSea continued to be the preferred marketplace for Ethereum and Polygon. Also, Solana had 392K more active users than Ethereum with 411K in October.

While most of the blue chip collectors and collectors trade on OpenSea and Ethereum, Solana built a large community of NFT enthusiasts in 2022. Solana’s active users hovered between 20-45% of the total market share. Over $903 million in platform fees were generated at OpenSea and went to market and creators alike. This has made OpenSea the most profitable marketplace in terms of trading fees.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.