bitcoinIt is known that fundamental analysis is just as important as technical analysis. In fact, the beginning of most bear or bull seasons is interpreted according to in-chain data.

In this article, we took a close look at whether there was a downside to major on-chain data…

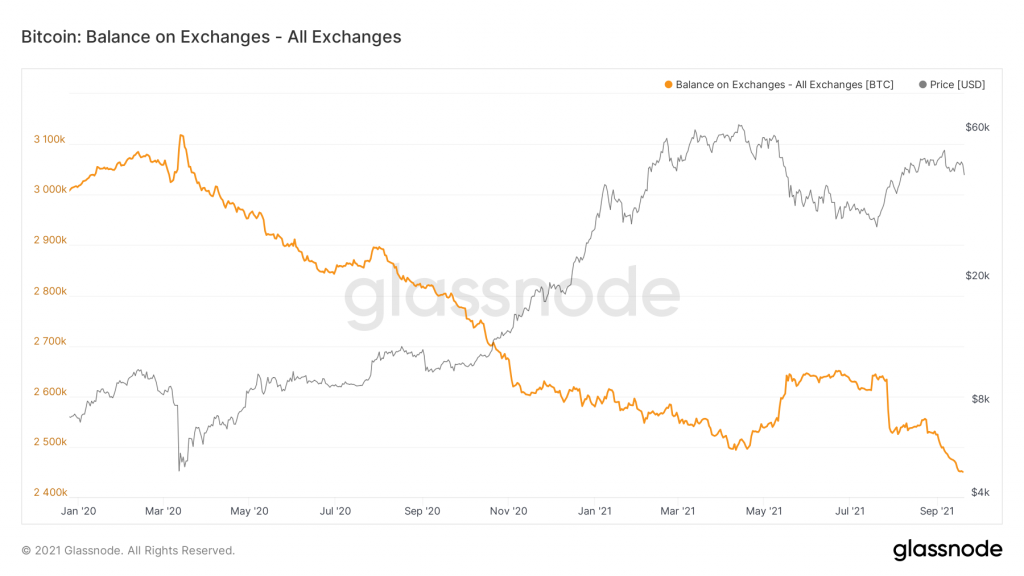

Amount of BTC on Exchanges

When we look at the amount of BTC waiting to be sold on the exchanges, that is, the BTC supply on the exchanges, it is seen that this value has decreased again with the last decrease. We mentioned that when there was a decrease of $ 10,000 in BTC, large investors transferred their BTCs to cold wallets in order not to sell them, and this situation was positive.

Again, the same situation showed itself in the last decline. In this context, it is possible to say that with this latest decline, large investors made moves not to sell but to buy and store BTC in their cold wallets.

On the other hand, it is seen that the miners do not sell and accumulate the BTCs they obtain.

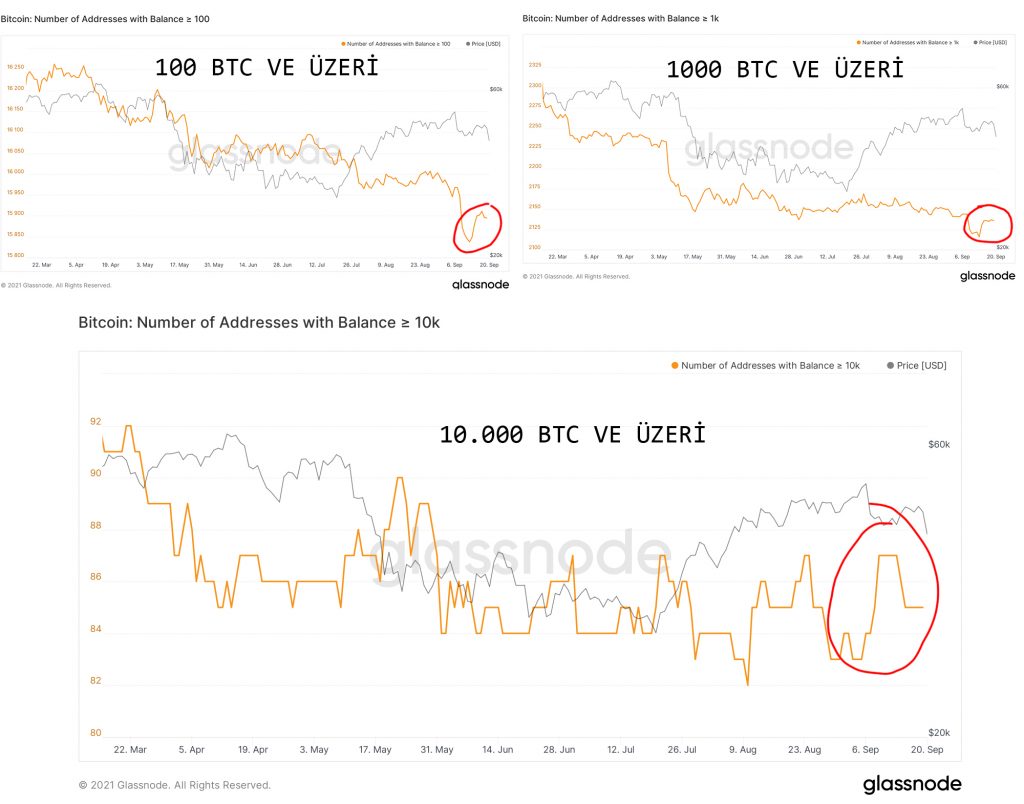

What’s the Situation with Whales?

Knowing which position the whale, namely the “big investor”, trades, can often give serious ideas about the price direction.

When the movements of large investors holding assets over 100, 1,000 and 10,000 BTC are examined, positive results for BTC emerge. It can be seen from the charts below that especially investors who hold large amounts of BTC are buying with an average of $ 46,000.

Exchange of Wallets on the Exchange

When the data showing the wallet change of not only Bitcoin but also Bitcoin and major altcoins in the last 30 days are examined, a positive picture welcomes us again. The coin outflow rate on the exchanges has come to the point where BTC was at the level of 17,000 dollars.

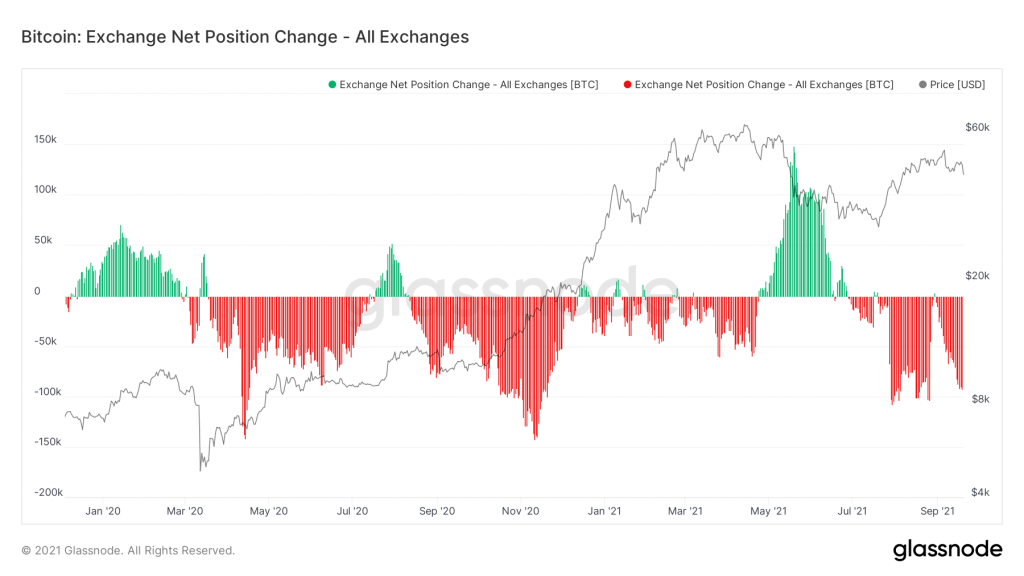

As can be seen from the chart, when the amount flowing to the stock markets is high (shown in green), the price decreases, while when the amount outflows is large (shown in red), the price increases. Currently, when this data is analyzed, it is understood that bullish signals are still continuing and institutional or large investors are moving in the direction of buying.

News Feed

When the news flow is also examined, it is seen that the negative news has increased a little recently. Uncertainty in the USA, in particular, directly affects not only Bitcoin, but also many other products. In this context, although there is no hard news that will directly affect the price, developments such as the crypto money report expected from the FED should be closely followed and news flows should be evaluated while trading.

In addition, CME futures expire on September 24, the last Friday of the month. Generally, some decrease is observed on the expiry date of the contracts. While many experts think that this is the factor that triggered today’s decline, it is still necessary to pay attention to September 24.

*No data on its own provides certainty about direction. A common conclusion should be drawn by blending the data in the form of technical and fundamental analysis and the investment should be shaped accordingly.