At the end of November, fears of Thanksgiving in the USA and the Omicron variant gripped the markets, and the Bitcoin (BTC) price was quite flexible at that time. However, fears regarding the COVID-19 Omicron variant continued to affect markets even more strongly the following week. BTC, which could not escape the worries in the markets, experienced a very sharp decline on December 5th.

Of course, the sharp drops in BTC had a very hard and negative impact on almost the entire cryptocurrency market that weekend. Of course, contrary to the expectations of rising prices, the unstable price and sharp declines have caused many retail investors and even institutional investors to BTCkept away from.

According to many analytics firms, in the period when sharp declines and rises occurred, retail investors preferred to invest with high risk factors such as leveraged transactions and wide stops instead of spot transactions. However, managing these risks seems to be much more difficult than expected.

BTC and VIX

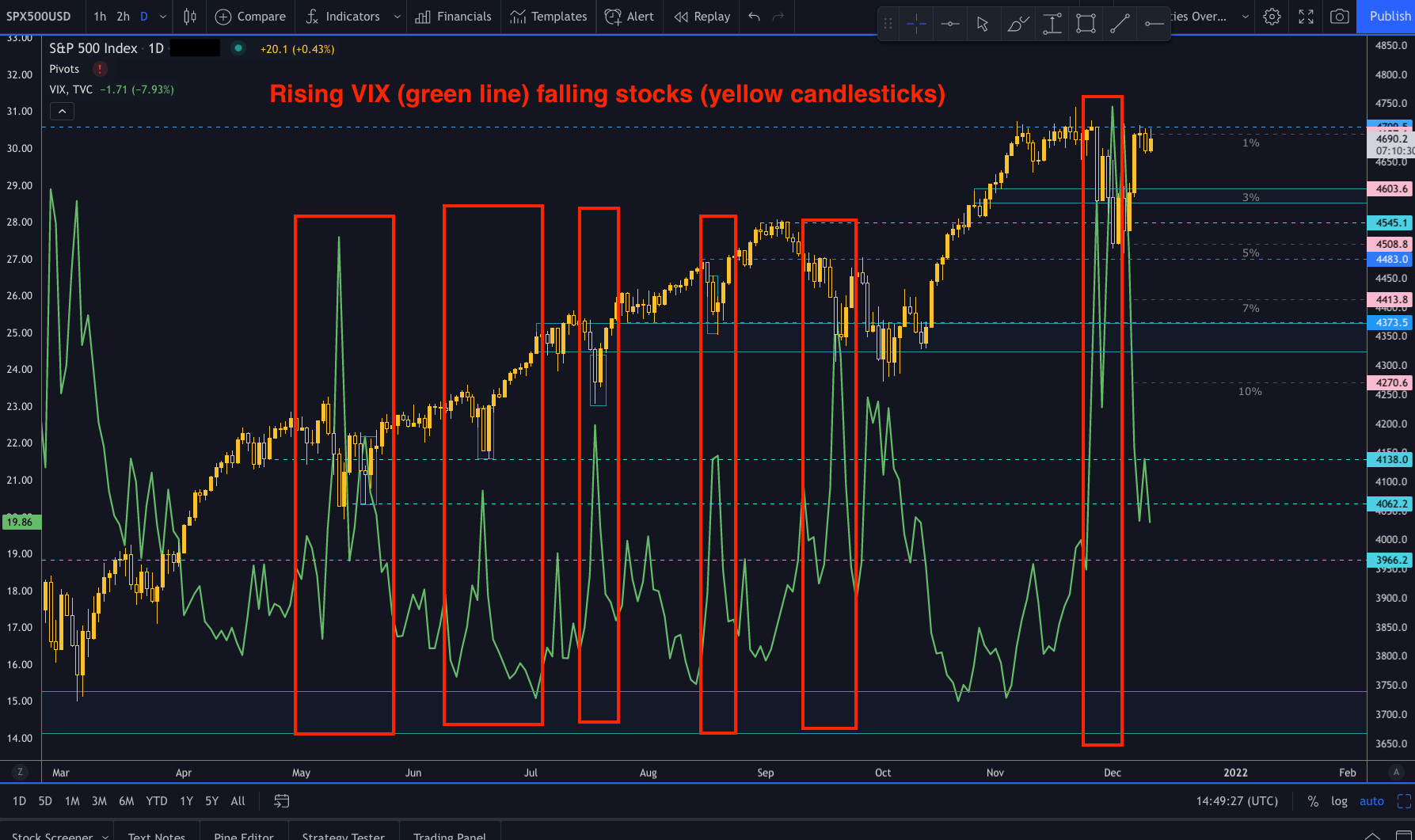

VIX, S&P 500 It is a variable index that reflects options in the market. Stock investors, as everyone knows, prefer to avoid risk. As a result, when S&P 500 traders fear a drop in stocks, they will buy S&P 500 options. As these sales numbers increase, the VIX rises, giving a clue as to how engaged stock investors are.

Obviously, the higher the VIX level, the greater the concern, resulting in larger S&P 500 declines. So the rule of thumb is, as the VIX goes up, the stocks go down.

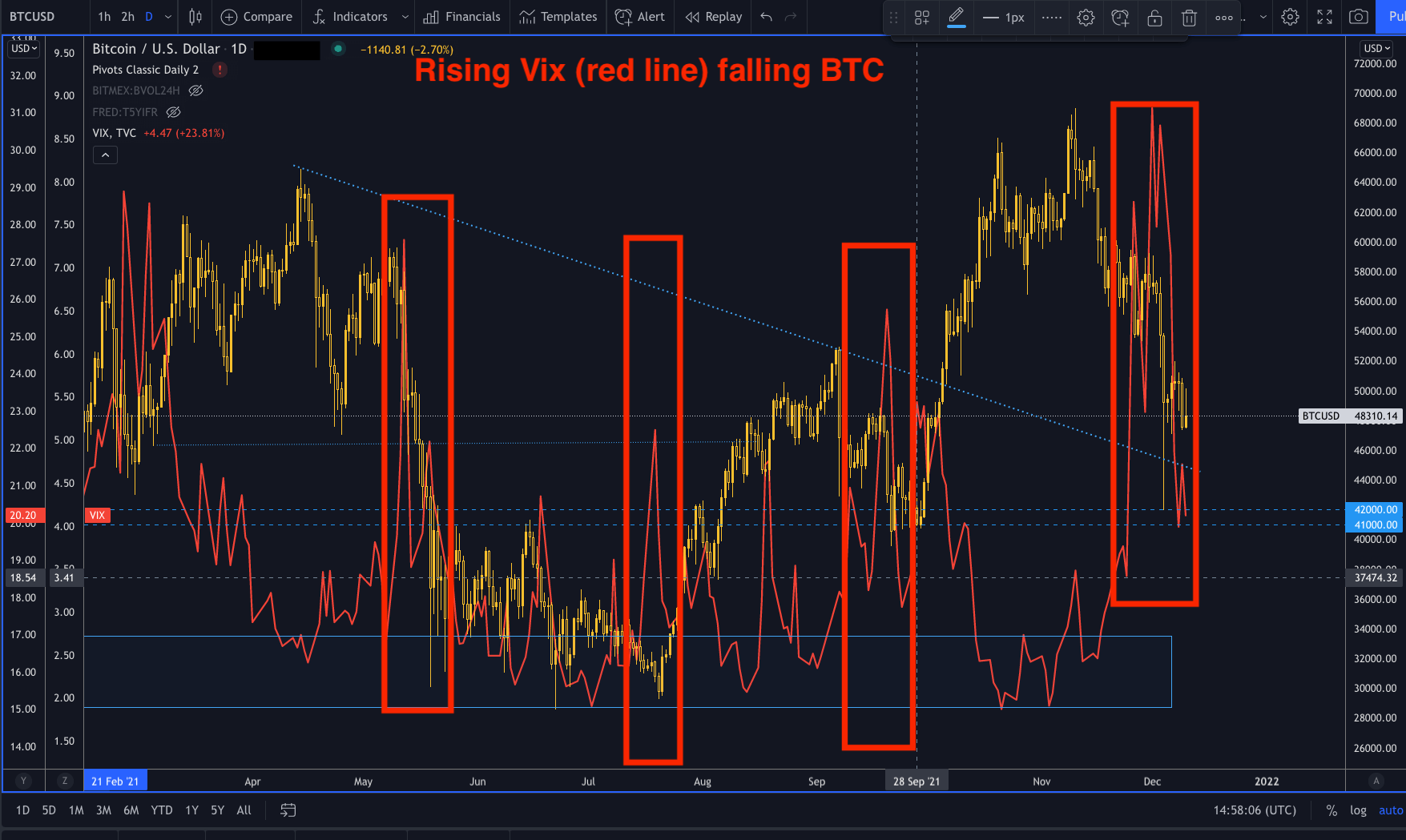

It is also noteworthy that BTC also shows similar patterns. When the VIX is trading higher and the markets are risk-averse, this also presents as selling pressure for BTC. Could traders be liquidating positions in BTC to offset other losses?

In some cases, yes. However, the fact that BTC is traded as a speculative risk asset still stands out. Therefore, the next time the markets may obviously be risk-off (risk-off), it is not unreasonable to expect BTC to drop while BTC holds it.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.