As it is known, the most important feature of Bitcoin that makes Bitcoin is that it has a limited supply. With this feature, it is issued against inflation. BTCis a technology invented against virtually all fiat currencies, with a total supply of 21 million.

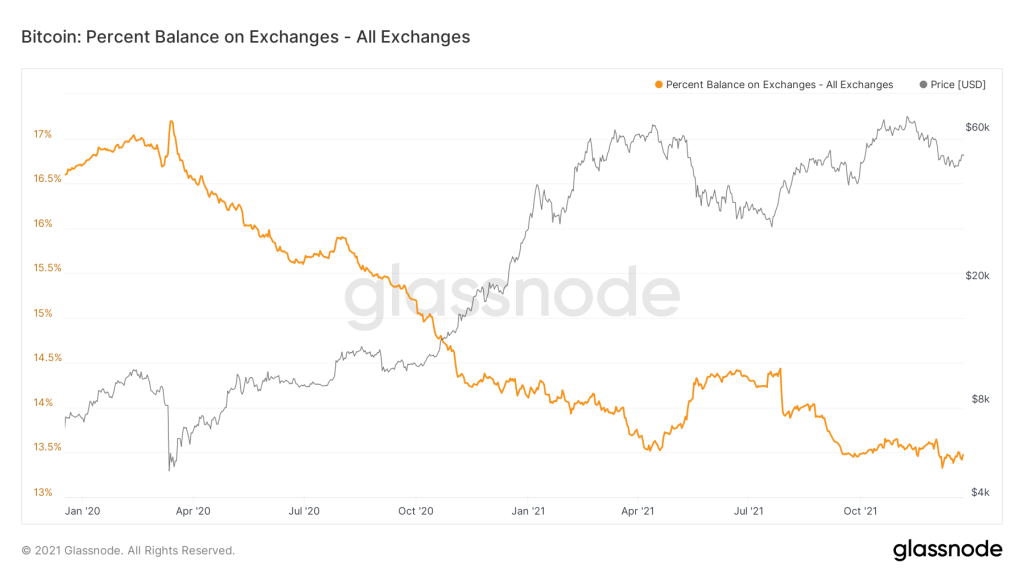

In this limited supply, the total amount of BTC waiting to be sold on the exchanges is undoubtedly very decisive for the price. When we look at the supply graph in the stock markets; When the amount of BTC available for sale on exchanges is low, the price rises, and when the opposite happens, the price falls.

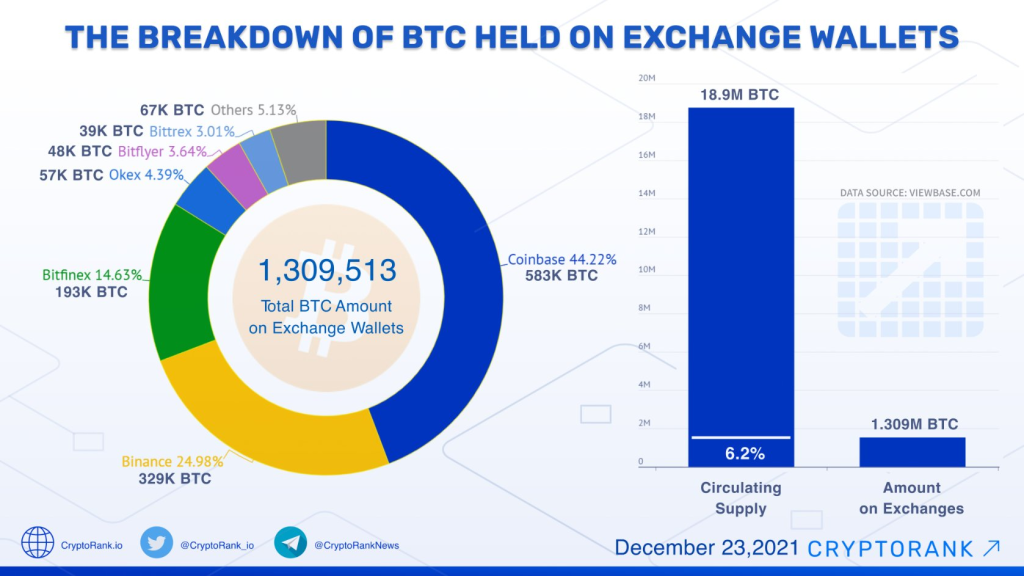

According to the research conducted by CryptoRank, the amount of BTC on the exchanges has been decreasing continuously in the last period. In other words, especially large investors transfer the BTCs they receive to cold wallets in order not to sell them and to keep them for a long time.

According to the research, in the second half of 2020, only 9.5 percent of the total BTC amount was available on exchanges. This rate decreased to 7.3 percent in July 2021 and to 6.3 percent in the current month.

This reveals that the amount in the exchanges is decreasing day by day and that approximately 1.3 million of the 19.6 million BTC amount as of the moment are kept in the exchanges.

Looking at the Glassnode data, it is revealed that the amount of BTC is decreasing day by day in the stock markets.

It is seen that the price graph shown in black increases as the supply quantity shown in yellow decreases. Based on these data, experts state that it is highly possible for BTC to rise in the coming days.

*Not investment advice.