The US is getting closer and closer to regulating the cryptocurrency space. According to some, the country is late to cryptocurrency regulations. However, the US has emphasized several times that it is more important to do a good job in this regard. In this post, we’ll talk about the comments on the White House’s latest cryptocurrency executive order.

Cryptocurrency regulations still a hot topic in the US

Journalist Nikhilesh De spoke with Carole House, one of the authors of the White House cryptocurrency executive order, and offered an answer on what to expect now for cryptocurrencies. It is worth noting in advance that many important questions remain in the air about how the US will regulate cryptocurrencies. The battle for territory between the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission is not nearly as close to a conclusion as when the order was first issued.

It is also unclear whether and how the federal government will adopt policies that support blockchain development. cryptocoin.com As we reported, the White House and various executive branch departments have released the first few sets of reports that address a range of topics, including a central bank digital currency, how crypto-related crimes can be prosecuted, and how the United States sees itself on the world stage.

Several more reports are expected, one focused on whether the Fed has the authority to issue digital dollars, and one examining what regulatory loopholes still exist in crypto oversight. One of the White House documents, released in September, proposed a “comprehensive framework for the responsible development of cryptocurrencies,” proposing a federal regulatory regime for non-bank payment providers. This is something crypto companies would want to get a money transfer license given the current system.

Responses to the executive order came from many institutions

To date, the Treasury, Commerce, and Justice departments, as well as the White House Office of Science and Technology Policy, have issued responses to the executive order. The Justice Department may have taken the most concrete action with two reports, by creating a network of prosecutors specializing in cryptocurrency crimes and proposing a set of laws to both better track cryptocurrency crimes and share more information about these crimes with the department’s international partners.

The Commerce Department took a slightly different approach, reflecting the organization’s mission. In a report published in September, the department recommended greater engagement with both private companies and international regulators “to encourage the development of cryptoasset policies … consistent with US values and standards.” This could include supporting education initiatives and developing a workforce, the report said. The Treasury Department released the most reports and initiated a request for comment process asking the public to weigh in on specific illicit finance concerns. Saray emphasized the importance of the “responsible development” aspect of the reports.

Broader influence in the cryptocurrency space

Much of the executive order focuses on assessing and mitigating risks, whether they are money laundering risks, terrorist financing risks or financial stability risks. The administration willingly requested more public information when answering questions about the role of cryptocurrencies in illicit finance. This seems to bolster the US’ current research on central bank digital currencies (CBDC) and in particular whether the Fed should issue digital dollars.

The idea remains controversial, as CBDC opponents generally dislike the concept of U.S. central bank involvement, and others doubt that a token-based digital currency as proposed could meet the needs of this ambitious goal. But the White House said that to that end, one of the reports was “trying to assess what the future of money looks like from a very holistic picture.”

Noting the broad scope of the executive order, the administration cited concerns about climate risks as an example of one of the wide range of issues addressed. Emir wasn’t just looking at companies, he was looking at broader ecological issues, namely climate change. Things are different now than when this order was drafted and published. 2022 in the crypto space; marked by failures, bankruptcies, and millions of dollars worth of lost crypto. The crashes led to a host of issues that regulators were paying attention to, ranging from stablecoins to lenders to exchanges.

New laws could focus on Terra, Celsius and DeFi coins

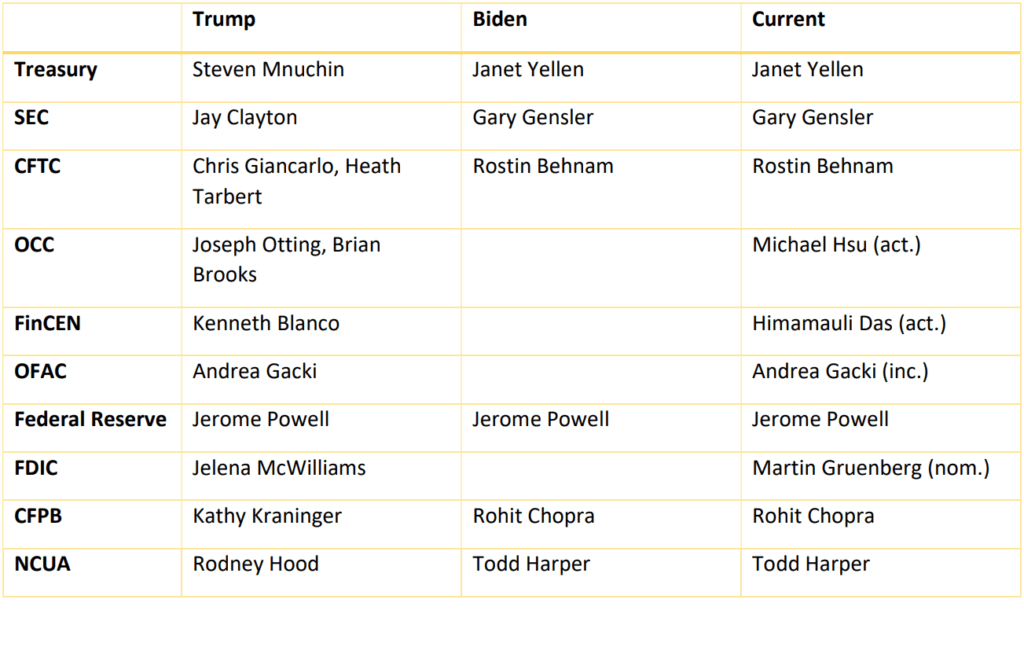

Regulators are assessing whether existing or new laws will prevent the next Terra or Celsius. The White House said the extent of the problems cryptocurrency has seen this year should demonstrate the need for transparent communication about the industry. This ranges from decentralized finance (DeFi) to more centralized projects. “Most of this was predictable, and it is extremely unfortunate that so many people were injured in these circumstances,” the White House said. Meanwhile, you can see the list of corporate executives that have changed under Biden’s management, as follows:

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.