Cryptocurrency investors stablecoin It tries to determine positions by tracking their movements. According to the latest data, the total value of stablecoins is worth $130.8 billion, with a 24-hour trading volume of around $28 billion. So what does that mean, here are the details.

With the increasing global regulatory pressure on cryptocurrencies, the need for stablecoins has also started to increase. These assets, which are pegged to the fiat currency, are generally pegged to assets such as the US dollar, the Euro and the Japanese Yen. With this fixed, investors can hold any fiat money they wish via crypto money and make transactions.

Whales Accumulate Stablecoins

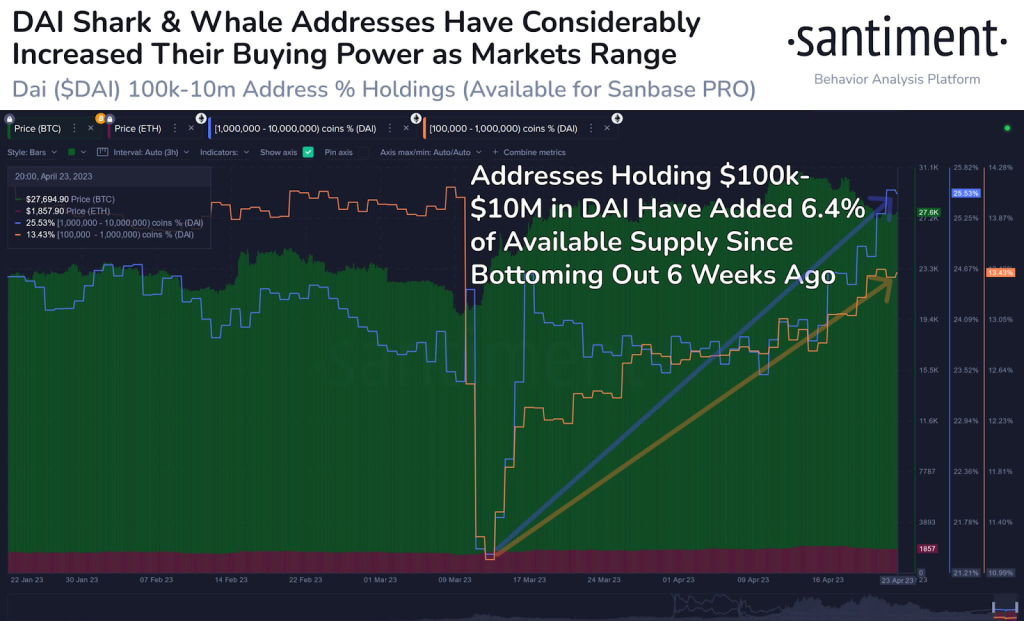

Crypto whales belong to MakerDAO, according to Santiment data DAI It accumulates stablecoins such as With Bitcoin hovering just below $28,000, Santiment noted that large crypto investors have increased their stablecoin accumulation rates. In particular, DAI stands out as the remarkable asset in this regard.

Even with the ups and downs of the crypto markets in April, the trend of accumulation in top stablecoins like $DAI was noticeable. Since $DAI was traded in mid-March to pump $BTC and $ETH, $100k – $10 million DAI addresses have added back 6.4% of the supply.

NEWS CONTINUES BELOW

Koinfinans.com As we reported, a community of MKR token holders also manages the Maker protocol and smart contracts powering the DAI stablecoin. This decentralized governance model allows token holders to vote on changes to the protocol, including setting the stabilization fee and setting the collateralization rate.

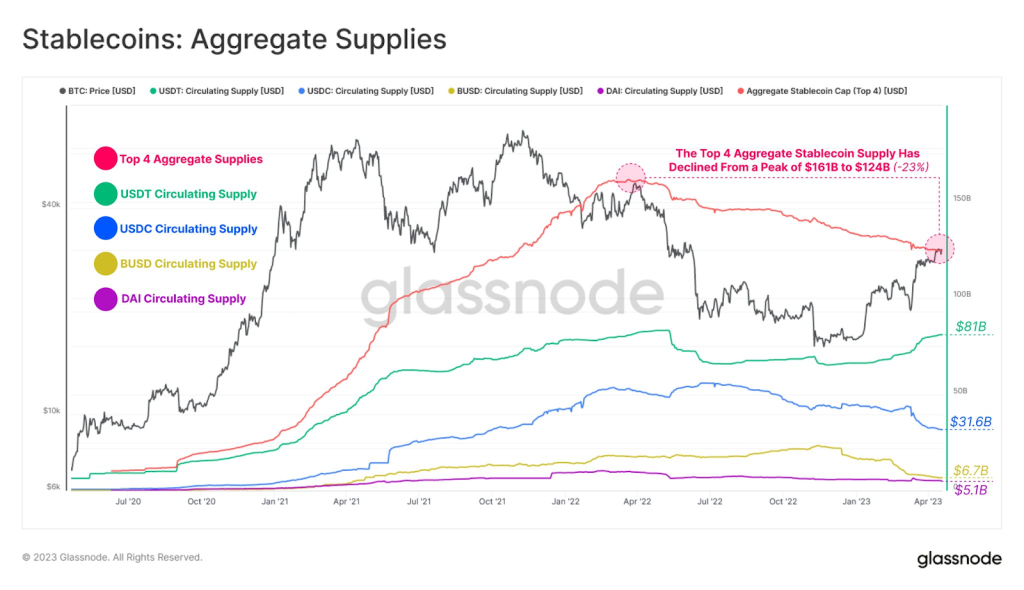

However, a recent report by Glassnode showed that the stablecoin market continues to shrink from its peak of around $161 Billion. The drop can be partly attributed to the decline of Binance-backed BUSD earlier this year. However, it remains important in the overall market and is essential for the stability of the cryptocurrency market.

As a result, analysts may imply investor behavior seeking to move the holdings of this accumulation to a safer position. This is interpreted by some analysts as a bearish risk.

You can follow the current price action here.