As the crypto winter deepens, on-chain data bitcoin revealed that trust among whales is far from diminishing. The leading cryptocurrency is currently trading below $20,000, down 71% from its all-time high of around $69,000 in November last year.

Normally, many traders liquidate their positions during big sales like this. However, this does not seem to be the case when it comes to those holding more than 1,000 BTC.

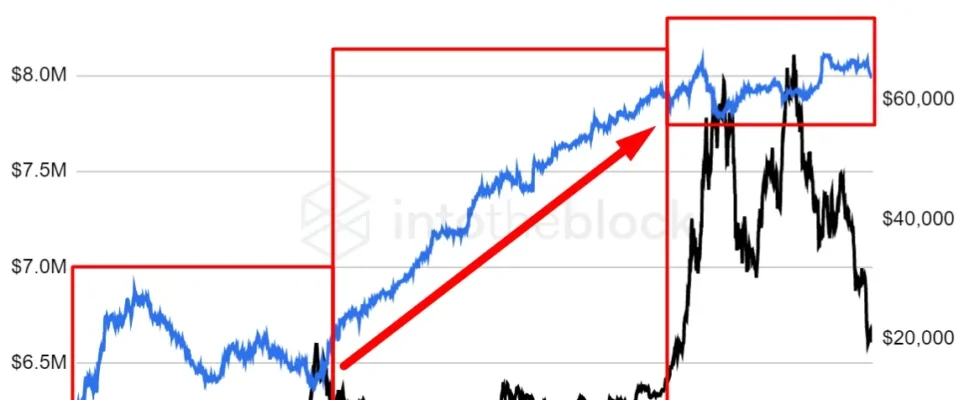

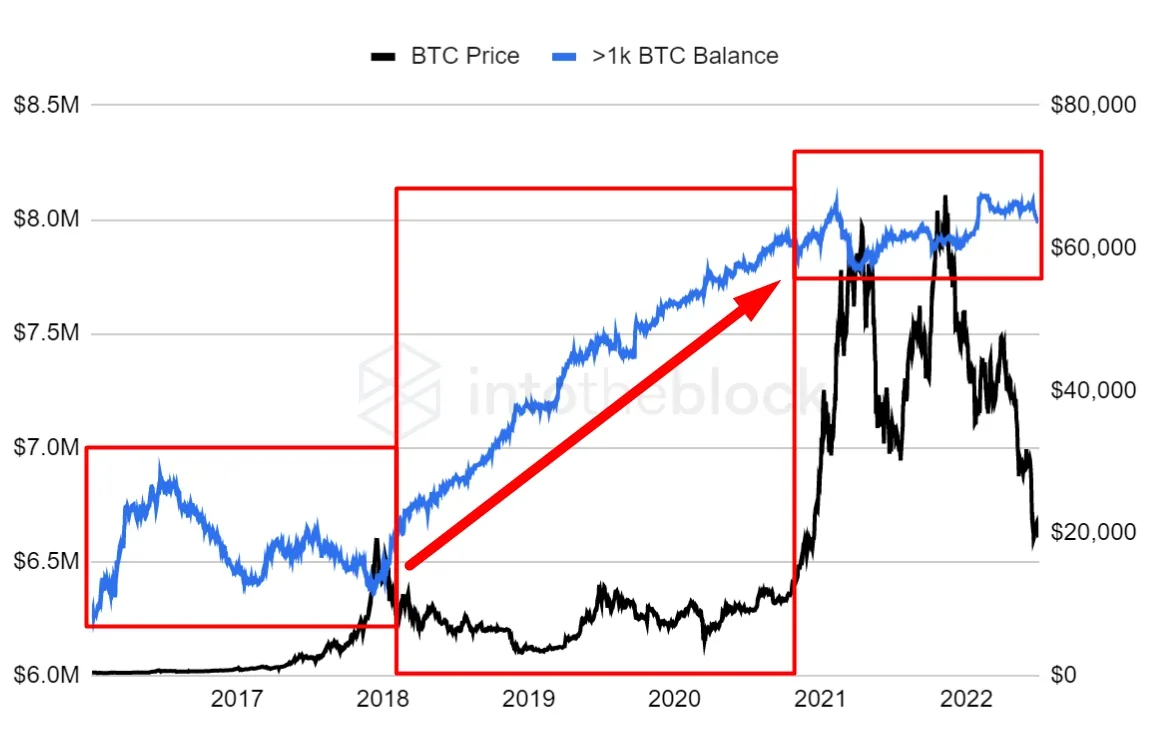

New data from IntoTheBlock shows that this demographic continues to accumulate cheap money, despite falling prices.

Blockchain analytics firm IntoTheBlock“In the last multi-year long bear market, Bitcoin whales took advantage of high-speed accumulation, as indicated by the red arrow on the chart,” Juan Pellicer, research analyst at Decrypt told Decrypt.

But Pellicer pointed out the fact that although the whales’ balance continues to grow, “so far we don’t see them doing it with the same intensity as in the last bear cycle.”

Earlier this week, blockchain analytics Glassnode also said that whales are aggressively increasing their balance, receiving 140,000 Bitcoins per month directly from exchanges.

According to Glassnode, whales currently hold 8.69 million BTC, or 45.6% of Bitcoin’s total supply of 21 million.

Whales (>1k $BTC) typically go through accumulation / distribution cycles, often aligned with #Bitcoin market structure.

These entities are also adding to their balance aggressively, acquiring 140k $BTC/month directly from exchanges

Whales now own 8.69M $BTC (45.6% Supply)

3/4 pic.twitter.com/zPaehTYqgO

— glassnode (@glassnode) June 29, 2022

Bitcoin Bull Market Appearing?

Whales who buy Bitcoin at a cheap price could theoretically signal a return to a new bull cycle. Still, when asked about the possibility of such a scenario, Pellicer said there was “no clear on-chain structures that point to a very rapid market recovery.”

There are some positive aspects, though, Pellicer adds, pointing to the enduring confidence that retail Bitcoin investors (those with balances between 0.1 and 1 BTC) “take advantage of the market drop to accumulate at a greater-than-normal rate.”

“This rapid pace of accumulation by retail investors has only been seen in the last two years right after the Covid crash, and the price at that time jumped drastically a few weeks later,” Pellicer told Decrypt.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.