Leading cryptocurrency Bitcoin (BTC) is struggling just below $17,000. After a bad 2022, it is a matter of curiosity what 2023 will bring for crypto. Analysts share their price predictions for Bitcoin from different time perspectives.

“Bitcoin is more than 100% ready to explode”

Popular analyst Michaël van de Poppe talks about the bullish trend regarding Bitcoin as 2023 approaches. According to the analyst, if Bitcoin’s ‘falling wedge’ pattern removes the diagonal resistance, it is possible to rise by about 108% from current levels. The analyst makes the following statement:

We are looking at a falling wedge structure for BTC, which you will clearly want to see burst in 2023. And once we get out of that, it’s possible we could rally towards $35,000.

In the short term, Van de Poppe says that if BTC breaks below the $16,600 support level, it will likely fall slightly below the current bear market low it reached in November. He explains his predictions on this matter as follows:

Looking at the retest of $15,700, you can conclude that we have broken this low. And I think if we’re going to get to that stage where such a correction is going to happen, we’re looking at scanning this low ($15,700). If we lose $16,600, I think the probability of clearing $15,500 will be significant. And once we see that drop below $15,500, I think there will be some serious liquidity-seeking cleanup and buyers will step into the markets as well.

Is Bitcoin bottoming out?

Crypto analyst Jason Pizzino says that Bitcoin’s current bear market aligns with the two previous downtrends in terms of time. In this context, the analyst notes:

For the day count, we’re getting very close again to what we’ve seen in previous cycles. The first loop here is 2014, we have 411 days. Look, 411 days from top to bottom. The next cycle was in 2018, and 363 days, basically almost exactly a year. And right now, the current low is mid-November, 376 days, while the peak is early November. So this could still go all the way to January, maybe for another bottom as well. And this would still be within the timing of all previous cycles. This means that it fits very well with previous cycles and of course the halving event that will take place in 2024.

Pizzino also says that traders should be on the lookout for sharp Bitcoin rallies even amid negative market sentiment. Big gains marked the end of the 2014 and 2018 bear markets, according to the analyst. Based on this, he comments:

In the last two bear market cycles for BTC, the volatility marked the end of the bear market. When these fluctuations break upwards, that is the end of the bear market. But the news will still be very, very negative. So don’t let that put you off.

Will there be a Santa Claus rally for BTC?

According to a popular analyst nicknamed Kaleo, the upcoming Christmas holiday will cause a spike in Bitcoin. The analyst claims he is about to see a wave of celebration that no one has seen given the consistently high hashrate. Since most people expect a crash, they claim the opposite is likely.

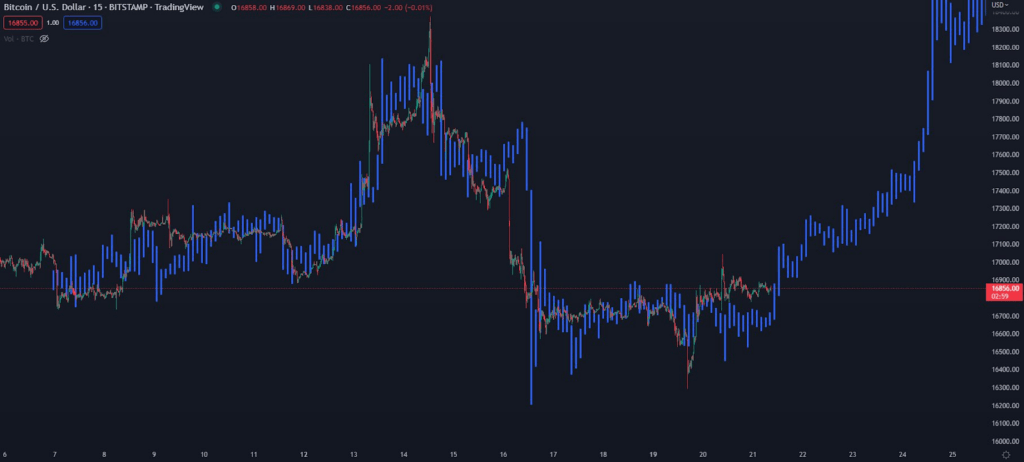

However, he claims his long time chart is set for a disastrous bearish spiral. According to the analyst, a common rule of chronological consensus is that everyone is wrong when they agree on anything. Kaleo said, “Bitcoin will continue to grind up to $ 17,500. Then it will accelerate and start ‘short squeeze’ towards $18,500,” he predicts.

By hash rate, a frequently watched metric, Kaleo claims that Bitcoin is showing strength. He says that even though Bitcoin has been below $20,000 since the collapse of FTX, the hash rate remains high. He makes the following statement about it:

When you look at the chart below, Bitcoin’s hash rate is one of the most remarkable you can find. Although Bitcoin has been trading under $20,000 for about a month, the miners have not given up yet.

What does the hash rate suggest?

The analyst states that the hash rate is a measure of the processing capacity of the Bitcoin network. Because a more robust and secure network is indicative of a higher hash rate. By the way, let’s remind you that the hash rate is the rate at which a Bitcoin miner solves an algorithm. Still, Kaleo wonders how much longer the current hash rate can hold up. The analyst shares the following assessment:

The chart below compares BTC price to miner production costs. There are many factors. Also, some miners may have lower average prices. But this leaves you wondering when someone will give up.

How will BTC perform in the coming days?

However, other analysts predict that the Bitcoin price will almost certainly drop. cryptocoin.com As we reported, analyst nicknamed Crypto Capo, who successfully predicted the next major market crash, predicts that the BTC price will drop to roughly $12,000.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.