Cryptocurrency markets are leaving behind a rather unproductive year. Major cryptocurrencies such as SHIB, DOGE, BTC and ETH suffered massive drops in 2022. So what are the expectations in the last week of the year? Analysts shared their forecasts for SHIB, DOGE, BTC and ETH. Here are the analysts’ forecasts for the last week of the year…

Shiba INU (SHIB) and Dogecoin (DOGE)

SHIB price could be in its final stages before experiencing a serious drop. Also, the meme coin price is currently around 90% below ATH levels. However, the popular meme coin has been in a spiral range for several weeks. Now, the price is consolidating at the lower end of the range. Also, a difficult process awaits bull investors entering the market. On December 18 and 22, the bears rejected any bullish attempts. This failed attempt shows the bears are ready to push SHIB lower. However, the initial bearish target marks a 15 percent depreciation from current market cap. However, if there is a break, the decline thesis will be invalid. If the bulls block the decline, SHIB will move up to the $0.00001055 swing level on November 10.

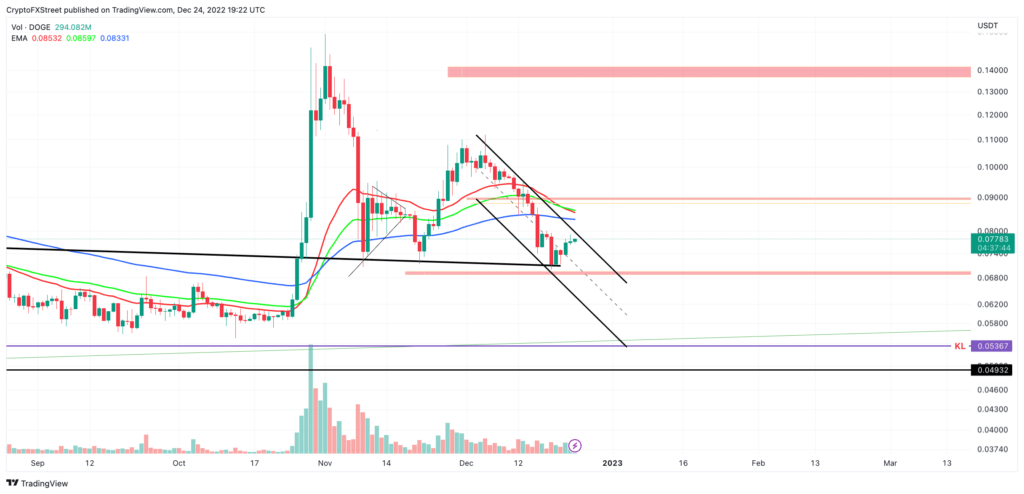

Dogecoin price has lost 28% in market cap for the month of December. DOGE continues to trend on a descending parallel channel as it has been for several weeks. The upper bounds of the parallel channel acted as resistance several times in December. The charts are currently pointing to a bearish trend for DOGE. The next collision with the descending parallel channel is likely to occur within 24 hours. If the bears are successful again, DOGE can mimic the strength of the previous drop and drop by 20%. They would need to retake the 50-day simple moving average at $0.08 for the bearish argument to be invalidated. If the bulls are successful, DOGE price could rally around $0.095. This means a 25% increase

Bitcoin (BTC) and Ripple (XRP)

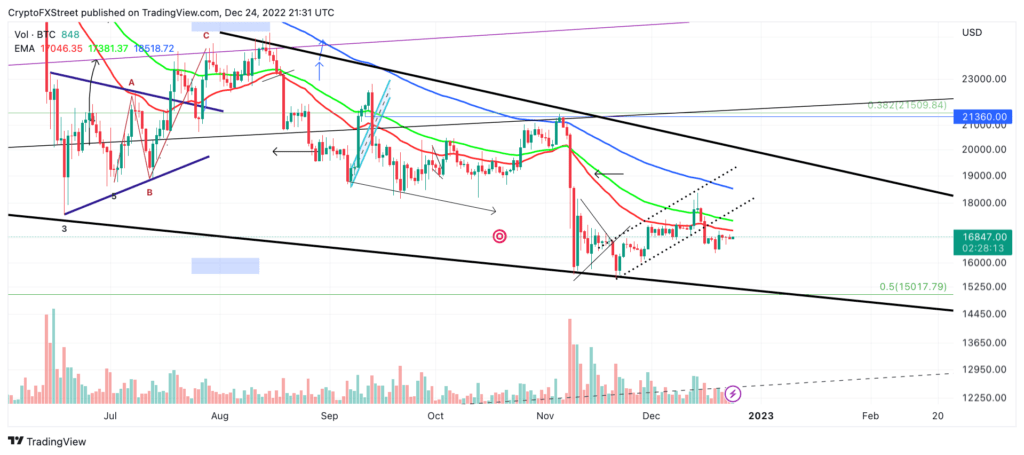

Bitcoin fell below the 50-day, 100-day and 200-day simple moving averages (SMA). This shows that Bitcoin is in a very strong downtrend. Ultimately, the safest confirmation that the bearish momentum is continuing will be the break of the previous week’s low of $16.293. If a breakout occurs, BTC could also slide down from its annual low of $15,479. On the contrary, if a break of the 50-day SMA at $17,200 occurs, extreme caution is required. If the bulls can consolidate above the indicator, there will be a chance for an additional rise towards the 200-day SMA at $18,600. Bitcoin price will increase by 12% as a result of the bullish scenario.

XRP price is trading at $0.35. The 50-day, 100-day and 200-day simple moving averages are hovering above XRP’s current trading range. If the market is indeed bearish, the next attempt at $0.33 weekly low could be the catalyst for a low event targeting $0.298. The bears could enter 2020 liquidity levels in the middle of the $0.20 region as the yearly low is broken. It is possible for the decline thesis to be invalidated. However, the bulls will need to clear the 50-day simple moving average above $0.40. The next bullish targets will be the 100-day and 200-day simple moving averages at $0.42 and $0.48. The bullish scenario creates a 40% bullish action potential if the bulls are successful.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.