Inflation is declining in the US. According to the CPI, this rate decreased to 6.5% on an annual basis in December. In general, inflation was 7.1% in November and 9.1% in June 2022. So all the developments bitcoin How will it affect the price?

Moody’s Analytics Chief Economist Mark Zandi commented on the CPI data for the month of January. Zandi thinks people won’t be talking about inflation this time next year. With the economy slowly getting back on track, the Federal Reserve is likely to slow the rate of rate hikes.

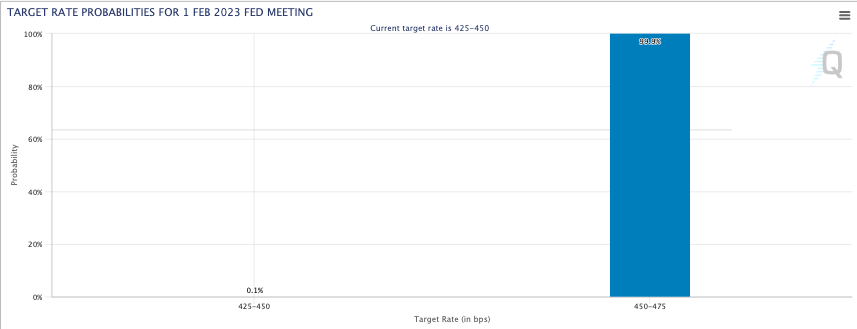

The new interest rate will be announced on Wednesday, February 1. According to the CME, there is a 99.9% chance of increasing interest rates by 25 basis points (4.5% to 4.75%). Also, interest rate futures indicate that the Fed’s current rate hike cycle could end in June.

In a recent speech, Philadelphia Fed President Patrick Harker stressed that 25 basis points increases would be “appropriate” going forward. He also added:

I predict we will raise interest rates a few more times this year, but to me, the days of increasing 75 basis points each time are definitely gone.

NEWS CONTINUES BELOW

How Will Bitcoin React to the Interest Rate Decision from the USA?

Currently, Bitcoin is trading around $23,000. In addition to the rate hike, investors are skeptical of President Powell’s interest in the soundness of the economy, the job market, macro recovery, etc. Follows his comments on the subject. A short-term rally is possible if Powell hints at easing forward measures.

Besides, if the Fed takes a decision as expected, the immediate surge could help Bitcoin surpass $25,400. However, if the increase is perceived as a hawkish stance by investors, a drop to around $20,700 is possible.

If the macro outlook remains positive, a slope towards $32,000 is still possible in the medium term.