A survey conducted with the participation of the US public after the FTX bankruptcy revealed that the public’s expectation of Bitcoin (BTC) price in the coming period has decreased, but hopes for the future of Bitcoin remain.

by Morning Consult 15-17 November A survey conducted between . 11,500 showed that they expected it to have a price of just over $. According to the survey, the expectations of the general public after FTX bankruptcy are about $27,066 from January’s estimate. 15,500, From the estimate of 17,159 dollars made in October, 5,600 dollar lower. Although the forecasts of crypto money investors participating in the survey were more optimistic, it was seen that the decline in the forecasts was sharper over time. On the other hand, a significant portion of the US population is in cryptocurrencies. they want regulation among the surprising results of the survey.

The expectations of crypto money investors are in January. 49,779 from dollars 17,503 falling to the dollar 32,276 dollar lower. The effect of the FTX bankruptcy on the expectations of cryptocurrency investors is approximately 5,769 became dollars. Investors’ forecasts for October 30,272 While this price is filling up as of November 17,503 withdrawn to dollars. Also, crypto investors 74% of He stated that they believe that cryptocurrencies will continue to be in the market for the next 10 years. next 10 years Cryptocurrency investors who believe that cryptocurrencies will disappear from the market 16% had such a low rate.

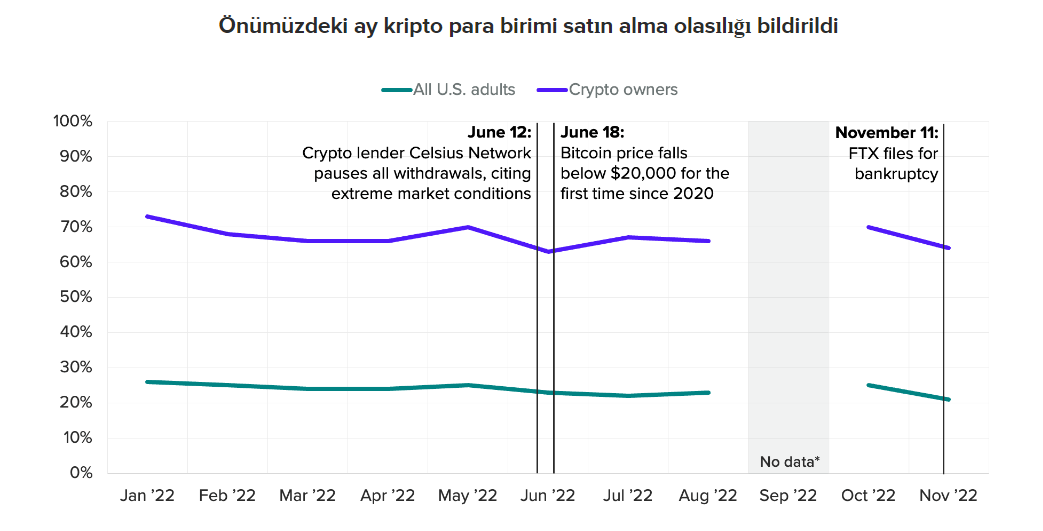

Among citizens without cryptocurrency investment after FTX bankruptcy I can invest in cryptocurrencies Percentage of those who say from 26% to 21% fell. Among investors with cryptocurrencies, this rate was 73% in October, while it increased in November after FTX bankruptcy. to 64% descending 9 points disappeared.

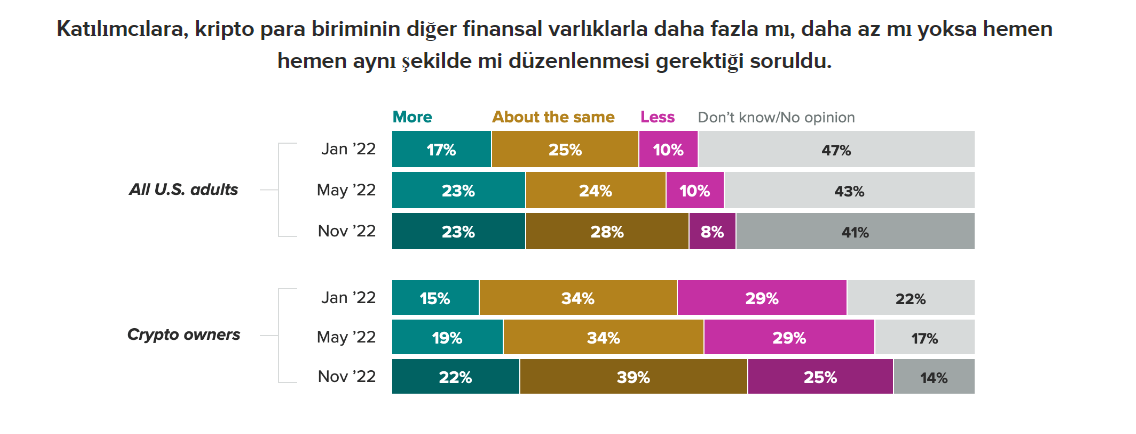

Citizens who do not invest in cryptocurrencies 28% of While arguing that cryptocurrencies should be regulated similarly to other financial assets, 23% of stated that more regulation is needed. While the percentage of participants who desired stricter regulations was 17% in January, the participants who thought that a similar regulation should be made constituted 25% of the total participants.

Citizens with cryptocurrency investments 39% suggested that standard regulations should be applied. Share of participants advocating standard regulations among total participants in June 34% were at their level. Those who say that more liberal regulation should be applied than other financial assets have been on the agenda since the beginning of the year. from 29% to 25% descending 4 points declined.