Berlin, Dusseldorf, Espoo The federal government nationalizes Germany’s largest gas importer Uniper. The company, its Finnish parent company Fortum and the Federal Ministry of Economics published corresponding statements on Wednesday morning.

The federal government is granting the ailing company a capital injection of eight billion euros, which increases the federal stake to 93 percent. The federal government is buying the remaining share of the Finnish state-owned company Fortum of around six percent for 480 million euros.

Investors were startled by the news: Uniper shares fell by up to 20 percent at the start of trading. The papers of the previous majority owner Fortum, on the other hand, are up almost 18 percent on the Helsinki stock exchange.

Federal Minister of Economics Robert Habeck (Greens) said at a press conference on Wednesday morning that the situation had “deteriorated significantly for Uniper” since the first rescue operation. The country is in a dynamic situation, is constantly being confronted with new challenges and has to continuously sharpen the measures.

Top jobs of the day

Find the best jobs now and

be notified by email.

With the first rescue package in July, the federal government had already approved a capital increase that gave it a 30 percent stake. In view of the Russian gas supply freeze via the Nord Stream 1 pipeline, Uniper received less gas than expected at the time, and prices continued to rise.

At these high prices, Uniper has to buy gas on the world market in order to meet its own delivery obligations. It was therefore necessary to adjust the rescue package.

KfW grants further loans to Uniper

As a further pillar of the support shares, the state-owned KfW Bank grants Uniper four billion euros each in loans and guarantees. Part of this is to be used to replace a line of credit from Fortum. According to Habeck, the federal government will offset a total of EUR 7.5 billion in credit lines from Fortum to Uniper.

If necessary, KfW will provide Uniper with additional liquidity to bridge the gap until the completion of this capital increase, according to a Fortum stock exchange release. Nationalization allows the federal government to take further rescue steps if these become necessary. At an extraordinary general meeting in the fourth quarter, the rescue plan is to be presented to shareholders for a vote.

>> Read here: Why a Uniper nationalization could mean the end of the gas surcharge

The service union Verdi welcomed the nationalization of Uniper. “The takeover by the federal government is necessary to ensure security of supply and it is in the interests of the employees,” explained federal board member Christoph Schmitz.

According to him, insolvency would be an incalculable risk for the gas market in Germany and for the entire energy and heat supply. “Germany needs Uniper and Uniper needs Germany,” emphasized Uniper Group Works Council Chairman Harald Seegatz.

Energy company Uniper is nationalized

The takeover is the right step to stabilize the company. With around 5,000 employees in Germany alone, Uniper is systemically important for the energy supply and needs permanent support. “The federal government must see its stake in Uniper as a long-term commitment,” said Seegatz.

Robert Habeck: Gas surcharge is coming

Habeck emphasized that the gas surcharge will come despite the nationalization of Uniper. At the same time, he announced changes to the levy: “Today we are initiating the departmental vote,” said the minister. He found a legally secure way to shake off free riders.

In principle, the gas allocation is a done deal. However, Habeck had to take heavy criticism for technical errors. According to the current regulation, it is possible for companies to benefit from the gas levy that have recently made high so-called random profits. Habeck wants to correct that now.

The Economics Minister wants to introduce the gas surcharge, but is also waiting for a financial constitutional review of this.

(Photo: dpa)

The minister emphasized that the question of whether the levying of the surcharge for a state-owned company, such as Uniper will be in the future, is constitutional is justified and must be answered. “The financial constitutional tests are running in the relevant departments,” said Habeck.

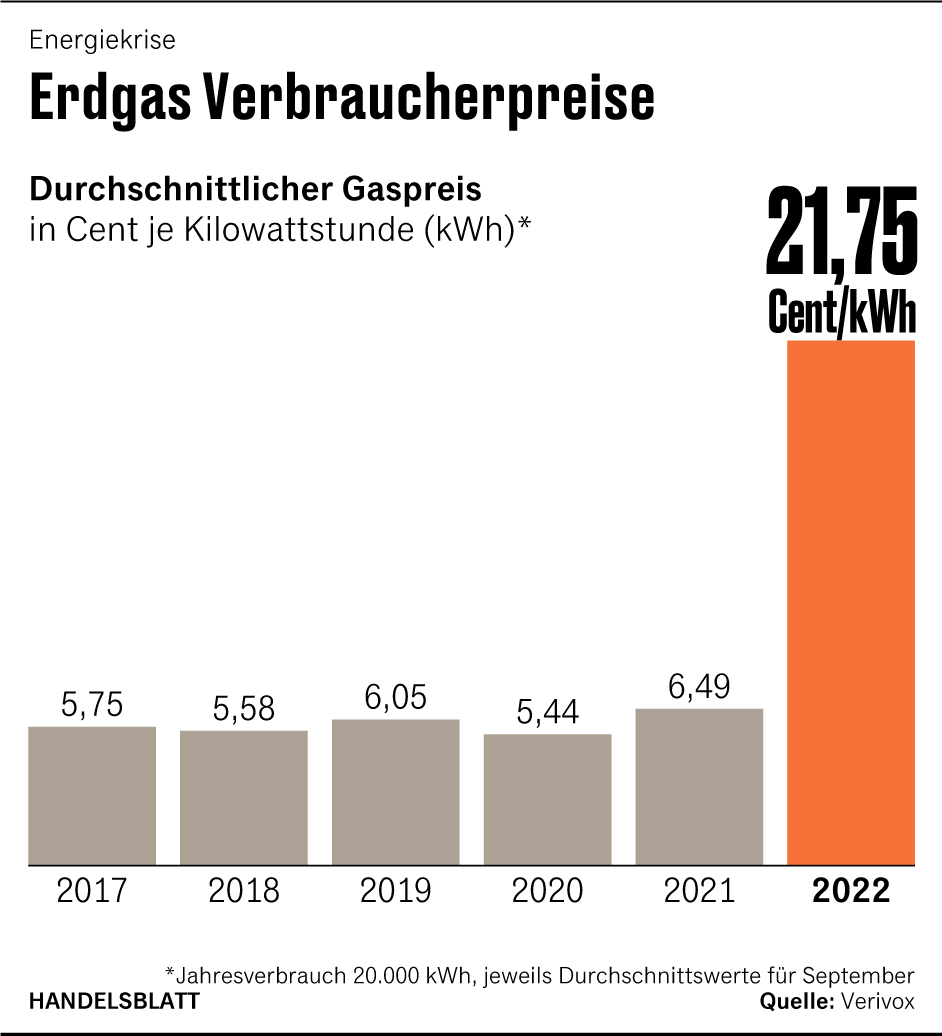

Irrespective of this, the gas surcharge will be levied on all gas consumers from October 1st, the minister explained. The proceeds go to gas companies, whose procurement costs have risen because Russia has stopped supplying gas. About 90 percent of the procurement costs are to be offset by the levy. The surcharge is a bridge to ensure Uniper’s financial solidity.

>> Read here: That’s how expensive gas is at the moment and how expensive it could be in the near future

Could the other two major gas importers – VNG and Sefe (formerly Gazprom Germania), which is under federal trust – also be nationalised? Habeck said the state “will do everything necessary to keep the company stable on the market.” One way to achieve this goal is the gas levy.

The surcharge for all gas users is currently set at around 2.4 cents per kilowatt hour. According to the current status, the first advance payments should be due at the end of October.

More: Cold withdrawal of Russian gas – Germany is threatened with an emergency winter