More than 70,000 BTC worth about $1.5 billion was withdrawn from exchanges on Wednesday, making it the largest stock market outflow in 6 months. Details are here.

Bitcoin (BTC) recently witnessed major stock market breakouts. Crypto market analysis platform IntoTheBlock reported that more than 70,000 BTC worth $1.52 billion were withdrawn from exchanges on October 26. announced. IntoTheBlock said in a tweet on Friday:

“Bitcoin has recorded the largest net outflow from exchanges in the last 6 months. On October 26, over $70,000 worth of BTC worth $1.52 billion left the exchanges.”

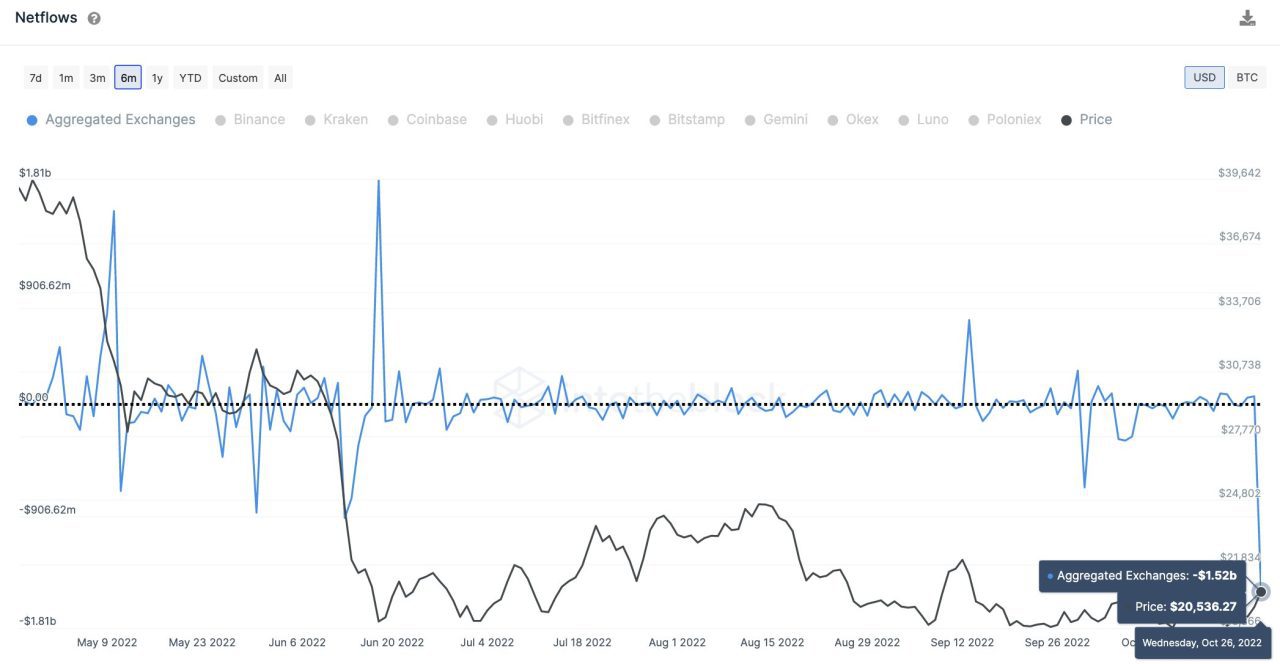

Koinfinans.com As we reported, the platform shared a Bitcoin Exchange Netflow chart to support its claims. Data from the chart shows that the $1.52 billion BTC outflow coincided with the period when the asset broke out above the $20,500 price mark.

Bitcoin Records Exits From September to Today

Additionally, BTC has recorded periodic exits from exchanges since mid-September despite the current bear market. In late September, whales moved over $850 million in BTC from exchanges.

As a testament to the massive exit wave, CryptoQuant’s Bitcoin Exchange Reserve chart reveals some promising metrics. The data in the chart shows that BTC reserves on exchanges are decreasing. The trend began in late September, reducing the BTC Exchange Reserve to 2.1 million, the lowest level seen this year.

Also, the Coinbase Premium Index provides some improved metrics as the data reveals an increase in buying pressure from US investors. In addition, there was a slight improvement in expectations as the funding rate showed the dominance of long position traders.

Despite these favorable indications, whales have been on a selling spree lately as BTC price struggles to stay above the $20,000 level. lives. On Tuesday, BTC broke above $20,000 for the first time since the first week of October. The price hike led to a surge in whale sales, threatening the asset’s goal of consolidating its position above $20,000.

Finally, Bitcoin is trading at $20,390, down 1.02% in the last 24 hours.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.