Popular crypto analyst InvestAnswersshared his views on why Bitcoin (BTC) has bounced back after weeks of bearish and sideways movements.

Speaking in a new video he posted on his YouTube channel, the channel host discussed the reasons for the bullish scenario from many different angles, ranging from geopolitical reasons to technical indicators.

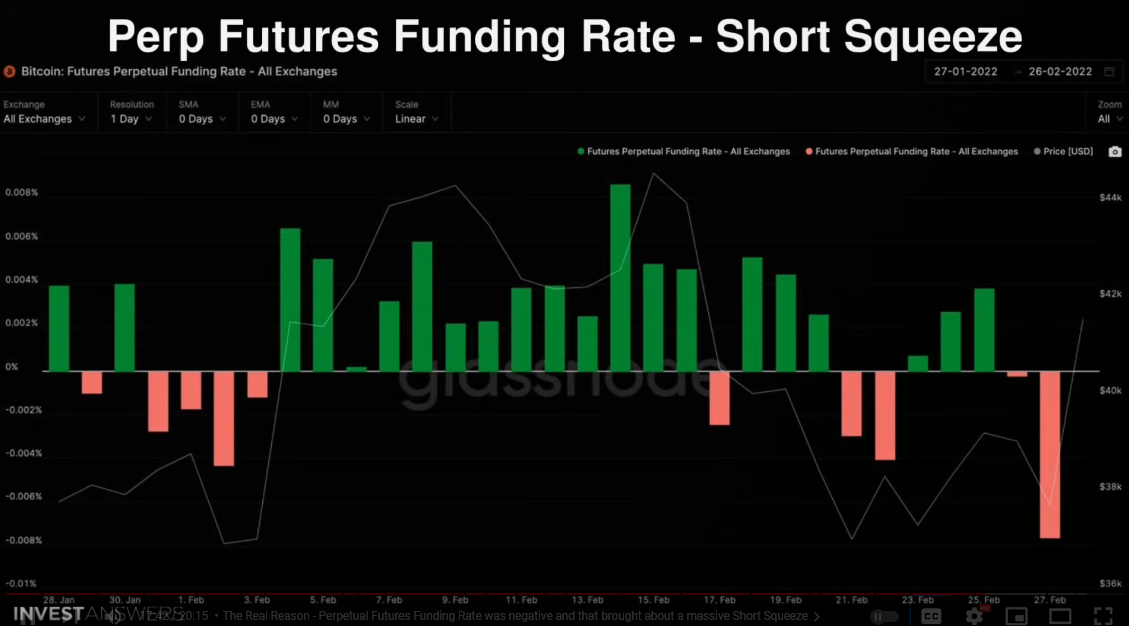

“Risk is back! Indeed, those who were oppressed before managed to return. There is not only a lack of trust in fiat regimes around the world, but also a general risk propensity. But if you ask me what I think the real reason is, my answer would be “perpetual funding rate.”

One of the tools available to crypto traders is the ability to take leveraged positions on futures contracts that never expire. Periodic payments are required for markets to maintain funding.

The analyst explained how funding rates affected BTC’s latest rally, saying:

“We saw a huge negative funding rate. This may cause a brief jam. When the rate turns positive, long positions pay out to short positions. When the reverse is negative, short positions pay out long positions.

When it is very negative, the situation is very worrying. It reminds me that all shorts go hard and invest in lots of investments. But I think those on the short side got stuck even harder in a big short squeeze.”

The presenter describes the large-scale conflicts of the ongoing military conflicts between Russia and Ukraine. Bitcoin (BTC) He thinks it contributes to his purchase.

“All it took to trigger this was a small purchase and maybe $254 million coming from somewhere like Russia, the Eurozone and Ukraine, maybe that was all it took to create this short squeeze and make it happen.”

The InvestAnswers host concludes by saying that he disagrees with traditional media’s interpretation of what’s causing BTC’s rise. He believes that Bitcoin’s sustained funding rates being so negative set the table for a possible squeeze, forcing investors’ hands in the wake of the ensuing military conflict.

“This is what I believe is the case. All the mainstream media gets it wrong. We did the numbers and we think it was triggered in the first place… The lighter that lit the fuse was the first money from Ukraine, Russia, oligarchs in London.

But that was because the perpetual funding rate was so negative, which caused a huge short-term contraction.”

At the time of writing, Bitcoin continues its rally, up another 2.5% and is trading at $44,128. BTC is up 15.9% since February 28 low of $38,072.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.