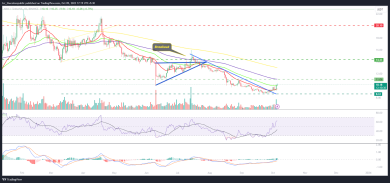

Avalanche (AVAX) coin price reversed the downtrend from the $8 demand zone, showing a reversal of buyers accumulating in previous trading sessions.

Moreover, price action shows that new reversal indicators are encouraging increased buying interest. Additionally, the structure of the chart highlights the trend line break.

altcoin is gaining momentum and maintaining its bullish outlook. However, AVAX coin price is near the primary hurdle of $11, which is close to the 100-day exponential moving average (EMA), which must be crossed for the buying momentum to continue. If the bulls escape the zone, it will extend the reversal to $14 in the coming sessions.

Following the collapse of the ascending triangle formation, Avalanche price continued to drag gains in the bearish market. In addition, the chart favors the bears and does not support a recovery.

However, due to the closure of short positions, AVAX gained new buying momentum. Moreover, it broke the $10 cluster by locking in short positions. Additionally, AVAX price found support in the 38.2% Fib zone and changed direction.

Avalanche Price Analysis

At press time, AVAX price is trading at $10.20 with an intraday gain of 4.79 percent, indicating yesterday’s buying momentum. Additionally, trading volume increased by 5.89% to $221.31 million and AVAX/BTC traded at 0.000368 BTC.

However, AVAX has a market valuation of $3.62 billion. Additionally, analysts maintained a neutral rating. Additionally, they hinted at a reversal based on the technical setup for the coming sessions.

On the daily charts, AVAX price is above the 50-day EMA, indicating a move back from the $8.00 demand zone. In addition, price action indicates that short positions have been captured.

Closing the gap signals a comeback of the bulls. To extend the buying momentum, bulls need to surpass the 100-day and 200-day exponential moving averages.

In addition, the bulls defended the lower zone against a continuation of the downtrend. In addition, he attempted a comeback.

The RSI curve was in the overbought territory and exhibited a bullish divergence, indicating that buyers are maintaining their strength and gaining momentum.

The MACD indicator displays a bullish divergence and green histogram bars, indicating a positive outlook for the upcoming trading sessions.