Global rate hikes are putting downward pressure on asset prices. But Bitcoin and some altcoins are starting to outperform commodity and technology stocks. Bloomberg commodity analyst Mike McGlone agrees. The analyst says that crypto assets are poised to outperform the rest of the financial markets.

“Bitcoin and Ethereum and these coins will overshadow everything”

Analysts Mike McGlone and Jamie Douglas Coutts shared their views in the latest “Bloomberg Intelligence: Crypto Outlook” report. Accordingly, McGlone says that Bitcoin, Ethereum and altcoins will overshadow everything when the market turns bullish. These coins will make better profits than any other financial market when the market enters its bull cycle. McGlone claims that BTC will dominate tech stocks like Tesla and commodities like gold.

Meanwhile, Bloomberg analysts are giving a hint for the revival of the digital asset markets. To them, the narrative that Bitcoin has become a risk-free asset is gaining strength. This has the potential to revive the cryptocurrency market. Also, analysts are talking about the end of BTC being tightly associated with equity markets. According to them, BTC is evolving from a risk asset to a hedge asset.

“BTC will lead in the second half of 2022”

Mike McGlone added that October has historically been the best month for Bitcoin since 2014. The analyst says BTC averaged 20% gains for the month. He then states that commodities markets appearing at the top could signal that Bitcoin has bottomed out. cryptocoin.com As we reported, BTC experienced low volatility throughout September. We also saw a potential peak in commodity prices over the same period.

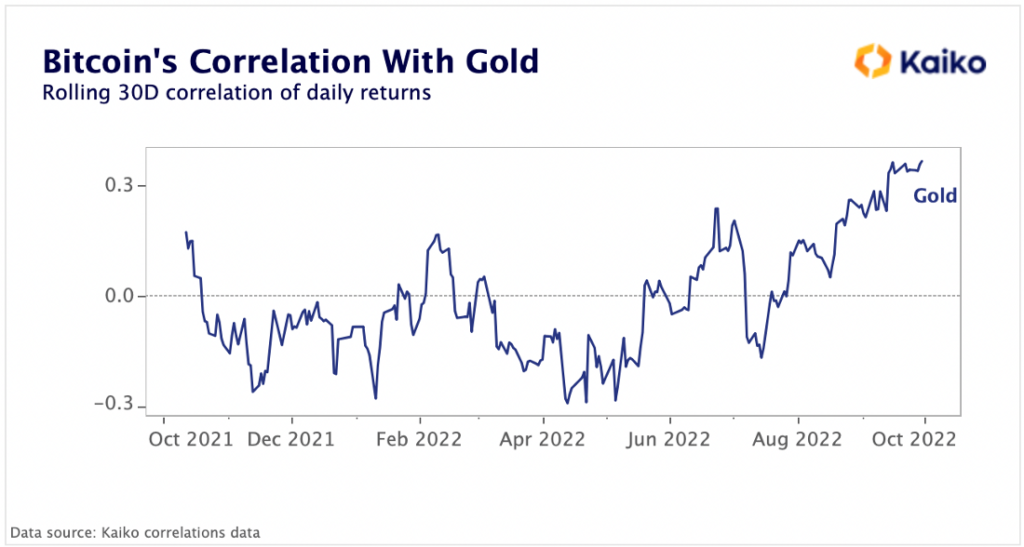

In this context, McGlone suggested that in the second half of 2022, we could see Bitcoin “starting to become a risk hedge asset like gold.” Kaiko Research data released on October 4 supports the idea that Bitcoin could switch to behaving like “digital gold.” Bitcoin’s correlation with gold has changed with the strengthening of the US dollar and rising interest rates. However, the BTC/gold correlation hit a one-year high. According to McGlone, these factors have the potential to trigger a rally in October.

“Ethereum gained price stability with its transition to PoS”

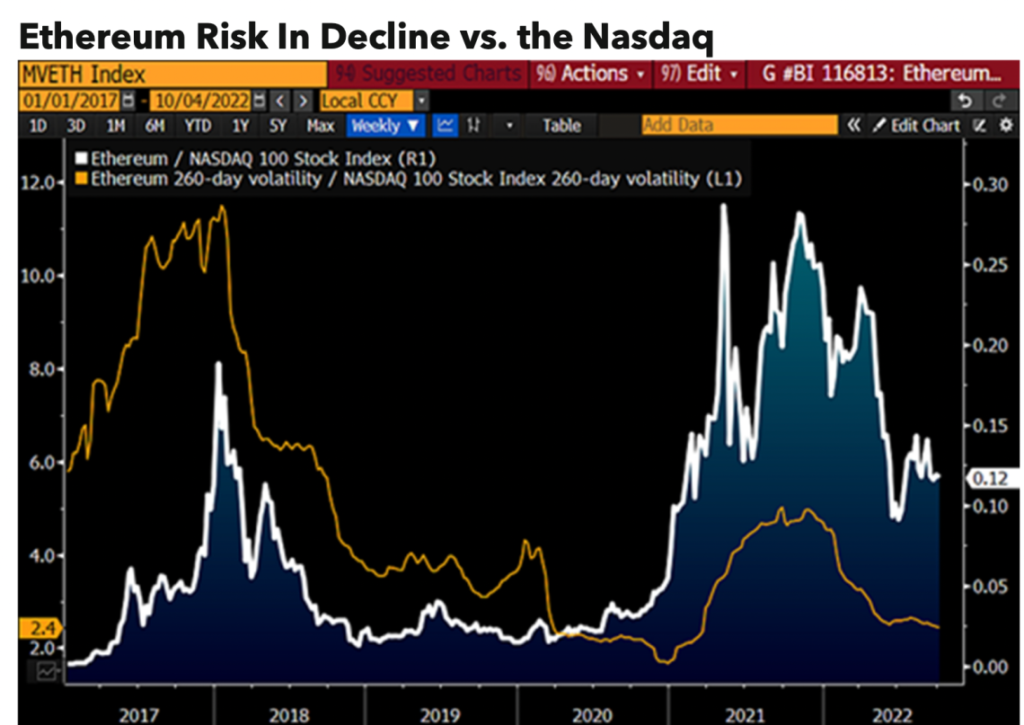

Bloomberg analysts also share some of their ideas for Ethereum. Analysts underline that the second largest blockchain has entered a new phase with its transition to PoS. Accordingly, ETH could become more stable in macro bear markets than traditional markets like the Nasdaq. McGlone attributes this expectation of stability to the altcoin being trapped between $1,000-2,000. According to him, $1,000 represents support and $2,000 represents resistance and the altcoin will see bigger gains in its bull cycle.

Previous Bitcoin predictions were out

Mike McGlone is known as a Bitcoin master and BTC guru in the crypto market. Because the cryptocurrency analyst has made a number of accurate predictions in the past. Accordingly, McGlone correctly predicted that in 2021 BTC would rise to $6,000, $12,000 and $50,000.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.