The crypto market is holding near new monthly lows. Therefore, it is vital to take the time to evaluate altcoin projects. Layer-1 tokens Solana, Litecoin and Binance Coin show more earning potential, according to Tony M., an analyst. Here are the details…

Analyst: Popular altcoin Solana could hit $22

cryptocoin.com As we have reported, Solana price witnessed a devastating drop during this month. As Sam Bankman-Fried and the FTX scandal uncovered more information, SOL’s name became embroiled in controversy. According to sources, FTX was holding more than $982 million SOL before filing for bankruptcy. Investors are focusing on the situation, possibly contributing to the free fall of SOL. The volume indicator for Solana saw a huge spike in trading during the first break of the $13 barrier on Nov. 13. The indicator has since plummeted as the bulls have made several attempts to recoup losses.

Solana price will need to generate a lot more strength in the market to believe in a strong counter trend rally. A fractal wave used to project Solana to current price levels in July shows SOL targeting the $10.50 barrier. After marking this level, the potential for a rebound near $22 amid the 70% decline is highly likely. Therefore, traders can expect a drop in SOL price. Exceeding $17.50, on the other hand, may indicate a 60 percent rise to $22.

Litecoin price diverges from the market

Litecoin price stunned the market, with the cryptocurrency rallying 75% since November 9th. As the price consolidates near newly discovered monthly highs, traders are questioning what happens next. Litecoin price is currently at auction at $74.65. A stop candle was produced near the top of the rally as the bears sought to form a pullback from the 8-day exponential moving average hovering around $70. On the daily time frame, the Relative Strength Index (RSI) is clearly bearish between new highs of $83.66 and those formed near $68 on Nov.

According to the analyst, this pattern will encourage traders to sell short in the coming days. Still, the RSI is showing in the overbought zone. This means that LTC price has a higher chance to bounce. If the market is indeed in an uptrend, the next targets to target would be an increase to the $90 and $100 liquidity zones. Levels below $64.40 invalidate the bullish thesis. Next, lows to $49.57 can be seen. In other words, the decline may cause a 37 percent decline.

Binance Coin price has room to rise

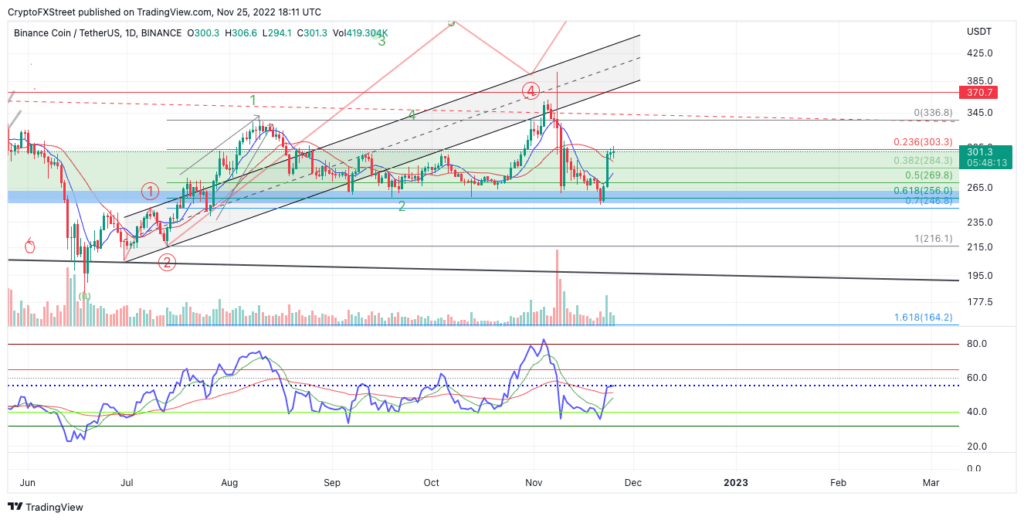

Binance Coin price produced a 20% countertrend increase this week. The bulls successfully surpassed the 8-day exponential and 21-day simple moving averages. With price hovering above the indicators, there are several factors to consider before entering the market. In BNB, there is a sharp downtrend between the first countertrend rally on November 9 and the current BNB price.

Given these factors, BNB may need to stay in more range to mitigate RSI imbalances. A Fibonacci retracement tool surrounding the strongest part of the summer rally shows the current range between 61.8 and 23.6 percent. BNB price spent its spare time filling the 38.2 percent zone near $284. BNB price may return to the border in the coming days before more bullish interest emerges. Loss of $284 invalidates the upside. On the upside, there are resistance levels at $310 and $398.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.