The biggest whales in the Ethereum (ETH) network are saving from this altcoin apart from DOGE or SHIB. The prices of cryptocurrencies have dropped significantly. However, crypto whales continue their savings at a “fast pace”. As stated, over $1 billion was traded in a single day based on market capitalization. As Kriptokoin.com, we are transferring the altcoin that ETH whales are after.

Santiment explained, not DOGE or SHIB!

On-chain analytics firm Santiment shared on its Twitter account. In the shared posts, it is seen that whales with 10 thousand dollars to 1 million dollars of ETH added a total of 947,940 tokens to their wallets in a single day. In general, the savings of whales have exceeded 1 billion dollars in the last 24 hours.

Mobility comes from whale and shark addresses with $100 and $100,000 ETH in their wallets. In the last 12 days, they have increased their holdings by over 3.5 percent, according to the data. They also currently hold the largest percentage of the crypto market supply.

CryptoCompare data shows that Ethereum was trading at $1,160, roughly the $1,200 level Santiment was talking about at the time of this writing, as the entity behind the FTX hack sold all of its ETH in the market to buy a tokenized renBTC. The version of BTC on other blockchains.

Investors withdraw their holdings after FTX crash

Ethereum was trading at $1,250 a week ago and is falling steadily near its all-time high of $5,000 during the bear market. At the beginning of the year, the cryptocurrency was trading close to $4,000 per token. Cryptocurrency investors are pulling their funds from exchanges following the collapse of FTX, which occurred after the trading platform was unable to invest user funds and process withdrawals during a bank run.

October has been a constructive and lucrative month for many altcoins in a challenging macroeconomic environment. Also, DOGE price rallied with Elon Musk’s acquisition of Twitter. SHIB continued to partner. According to CryptoCompare’s latest Asset Report, Ethereum price rose by 18.4 percent during the month of October, while Bitcoin rose 5.49 percent. The S&P 500 index rose 5.26 percent, while the NASDAQ rose 1.56 percent.

Awaiting DOGE, is LTC a hotspot of the crypto winter?

The bear market has seriously affected other altcoins, especially DOGE. However, Litecoin (LTC) price increases have performed well despite the problems with FTX.

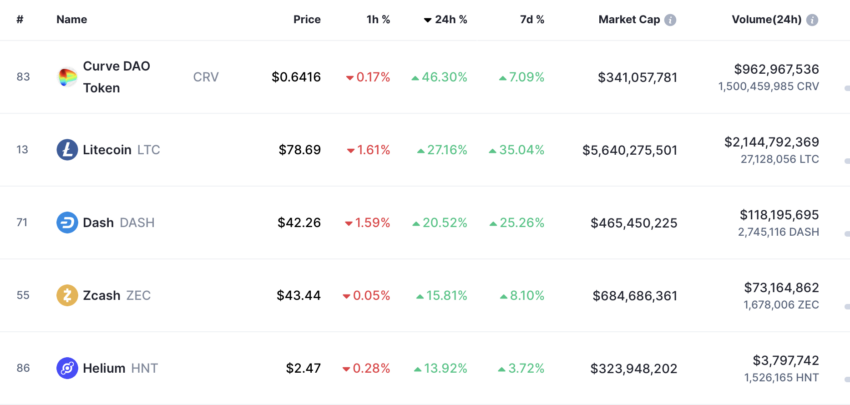

Litecoin ranked second on the CoinMarketCap winners list, up 27.16 percent. In the first place was CRV with a daily gain of over 45 percent. The fact that LTC is on the rise again seems to make its investors happy. As a result of the gains, according to analysts, a decrease can be observed in Litecoin.

Litecoin surpasses other cryptocurrencies

The top cryptocurrencies have only managed to gain short-term price momentum. LTC price tested its highest level since November 14, 2021. Litecoin gained 188.80 percent in 24-hour trading volumes. It rose above $2.18 billion, showing a boost on newly acquired retail sentiment.

LTC’s recent rise is likely due in part to the mining reward halving planned in eight months. This will be the third halving event for LTC. As a result, it is stated that crypto money will lead to a positive change in the supply dynamics.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.