Cryptocurrency investors and traders are trying to navigate through a cloud of fog. Because the systemic risk created by the collapse of FTX, the increase in regulatory pressures, and the weariness caused by the long winter market make market players despair. However, an on-chain analytics firm says that three altcoin projects are giving bullish signals. The firm attributes the reason for this to the extreme bearish trend of the traders in the market.

Traders are betting on the fall of three altcoin projects!

cryptocoin.comAs you follow, the crypto market was hit hard by the collapse of Terra in the bear market. The market was going to heal the wounds of this just when it was knocked down with FTX this time. In this environment, altcoin prices are seeing sharp drops, while traders are betting on further declines. So is there no limit to this? Santiment, a leading on-chain analytics firm, reveals that traders are betting heavily on the continued decline of Polkadot (DOT), Stellar (XLM), and Monero (XMR). That’s why analytics firm draws attention to a ‘short squeeze’ situation. In this context, Santiment makes the following statement:

Since the weekend started, traders have been betting against several altcoin projects to profit from their declines. Polkadot, Monero and Stellar have large short positions on exchanges. Typically, this increases the chances of liquidation and price increases.

At press time, DOT is trading at $5.29 and XLM at $0.08. Also, the two altcoin projects are trending sideways with a slight decline on the day. XMR is changing hands at $151.48, up 1% on a daily basis.

“This increases the likelihood of an altcoin price bottoming out”

According to Santiment, market participants are showing notable signs of capitulation and negativity. In such an environment, traders are largely shorting three altcoin projects. Based on this, the analytics firm makes the following assessment:

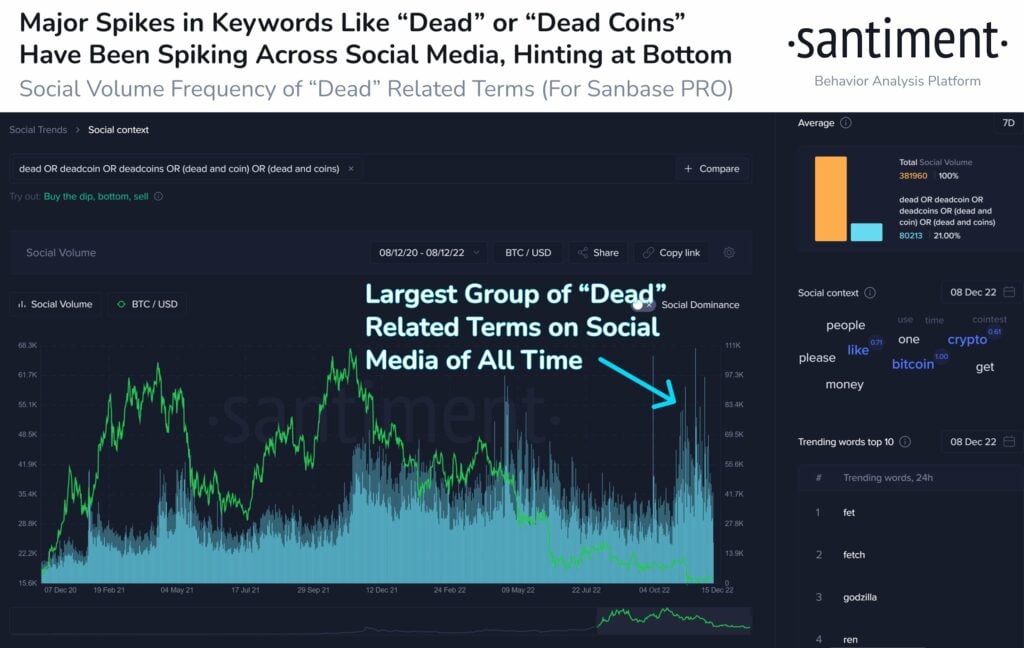

Mentions of ‘dead’ and ‘dead cryptocurrency’ jumped to all-time highs in late November. Also, this is still high historically. This traditionally increases the likelihood of a crypto price bottoming out.

BTC and ETH supply on exchanges is at the bottom!

The analytics firm is also looking at leading crypto Bitcoin (BTC) and leading altcoin Ethereum (ETH). Santiment notes that the supply of BTC and ETH on crypto exchanges is at a four-year low. He explains the effect of this situation as follows:

BTC and ETH continue to see their current respective supplies dwindle. Now both have broken their lowest levels in four years. This means a lower risk of selling. Meanwhile, Tether has a high stock market supply, which means higher real-time purchasing power.

At press time, Bitcoin was trading at $17,179 on a daily basis, unchanged. Ethereum, on the other hand, is slightly up at $1,274.67.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.