Basel Banking Supervisory Committee A report published by Globalpiyasa announced that the world’s largest financial institutions are exposed to approximately €9.4 billion worth of crypto assets. The research report by Renzo Corrias, secretary of the Basel Committee, estimates that, out of the total risk exposure of all banks, cryptocurrency exposure is approximately 0.01% of total risks.

Research, secretary Renzo Corrias called “Banks’ exposure to cryptoassets – a new dataset.” The research aims to establish a primary global standard on “banks’ prudent treatment of crypto-asset risks.”

“Total crypto-asset exposure reported by banks stands at around €9.4 billion. Relatively, these risks make up only 0.14% of the total exposures on a weighted average basis in the sample of banks reporting risks.

“Given all of the banks included in the Basel III monitoring study (i.e. those not reporting crypto-asset risks), the amount represents 0.01% of the total exposures.”

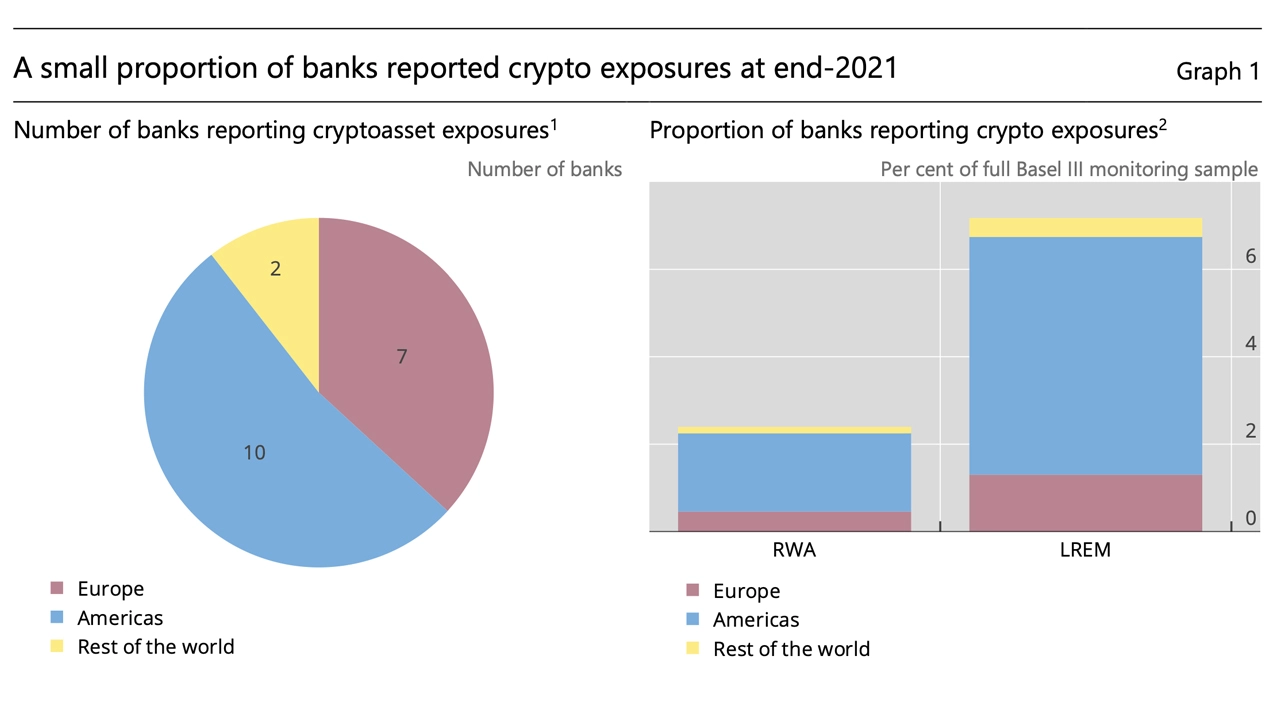

BCBS also announced that 19 banks worldwide have submitted data for research, and about ten US-derived financial institutions are involved. Seven banks operate in Europe and two banks operate in the rest of the world. Corrias also underlined that banks represent a small group of financial institutions out of the 182 collective banks that BCBS considered for its Basel III monitoring study.

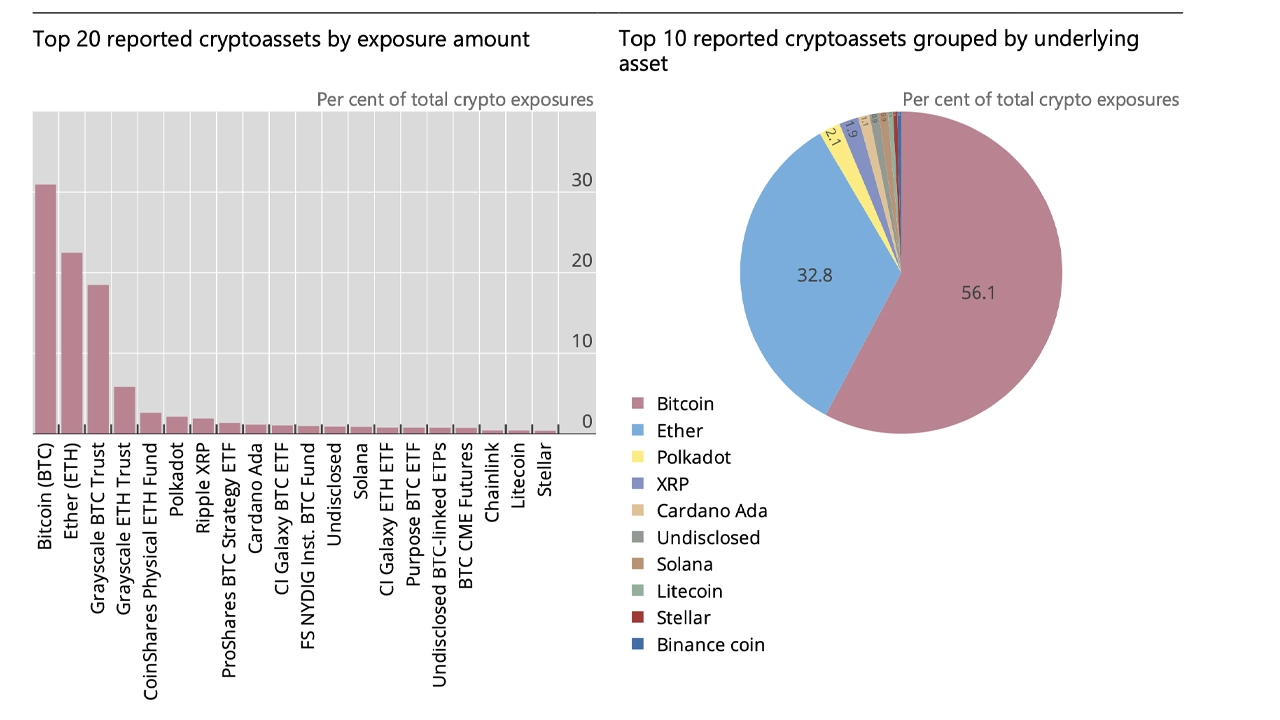

Bank-reported crypto assets are mostly about 31% of risks. bitcoin (BTC) and Ethereum (ETH), which accounts for 22% of assets. In addition to exposure to USD-backed stablecoins, banks are also associated with crypto assets such as Ripple (XRP), Cardano (ADA), Solana (SOL), Litecoin (LTC), and Stellar (XLM).

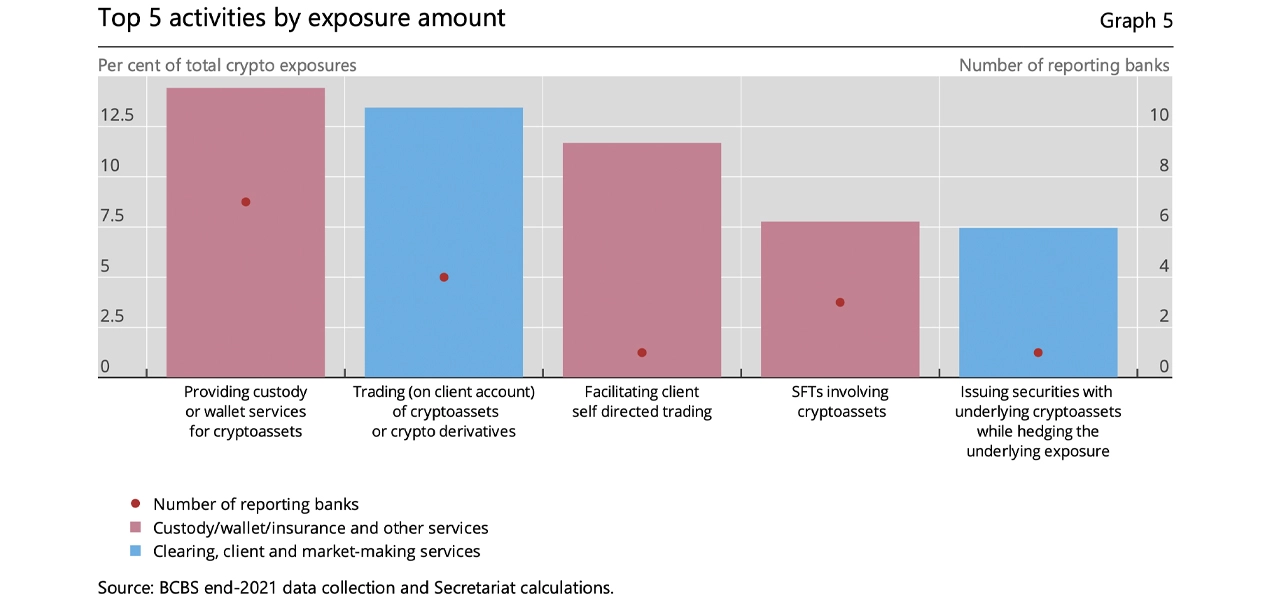

Corrias explains that banks’ exposure to crypto consists of three distinct categories, which include crypto assets and lending, clearing and market-making services, and custody/wallet/insurance services. The top service of the top five activities contributing to banks’ crypto risk is “[kripto varlıkları] to provide custody or wallet services”.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.