Ark Invest, one of the biggest Bitcoin whales in the market, and its founder, Cathie Wood, went after a new stock market token.

Institutional Bitcoin whale grows its share in this stock market

Ark Invest’s ETF product, founded by Cathie Wood, adds Coinbase to its list of investments. ARK’s Fintech Innovation Fund (ARKF) added 10,880 Coinbase shares, bringing its total investments to $60.5 million. Thus, Coinbase’s share reached about 8% of the fund’s weight.

According to the SEC, this represents ARK’s first purchase of Coinbase stock since June. In August, ARK’s Chief Investment Officer, Cathie Wood, said that the fund had reduced its funds on Coinbase due to an SEC investigation into the crypto exchange.

Wood described the investigation as a “thesis risk” for Coinbase at the time. He also said that ARK will sell 1.1 million shares of COIN, which he says are “too few”. Both Wood and ARK remain quite optimistic about Coinbase and crypto in general. 13F filings show that ARK owns 7.7 million COIN shares. However, the company has added nearly 2 million shares to its portfolio over the past year. The filings show that ARK pays an estimated average of $218.45 over all COIN purchases.

Cathie Wood hasn’t given up on Bitcoin for years

While expanding the ARK portfolio with Coinbase, Cathie Wood has never given up on Bitcoin. The ARK founder and CEO says he made the purchase after reading the Satoshi whitepaper. Wood said in a new podcast that he bought $100,000 while BTC was trading at $250. She also stated that she has never downsized this investment so far. As a result, Wood’s initial $100,000 investment now amounts to $7.6 million.

ARK also invests in Bitcoin products through the Grayscale Bitcoin Trust (GBTC). The Next Generation Internet Fund (ARKW) currently owns approximately 5.9 million GBTC shares valued at approximately $67.4 million. Wood remains bullish about Bitcoin.

GBTC down

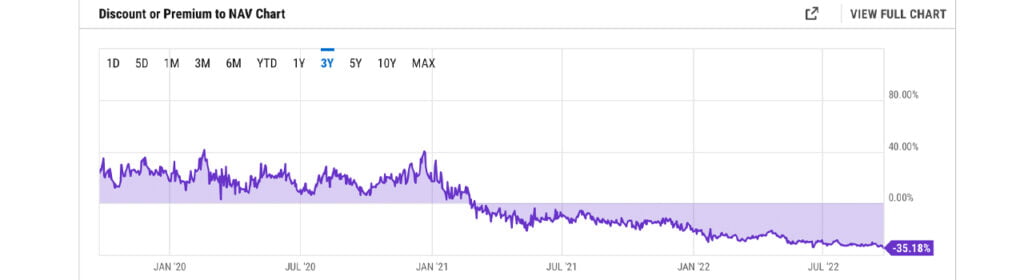

Grayscale’s Bitcoin Trust product GBTC has sought new bottoms throughout the month as the Bitcoin fund suffered a record 35.18% drop against spot prices. GBTC’s spot discount has been on the ground for a total of 577 consecutive days.

Grayscale Bitcoin Trust is one of the oldest and most popular Bitcoin funds on the market today. However, recently GBTC has suffered from a discount compared to BTC’s spot market caps. Unfortunately GBTC has been trading at a discount instead of a premium since February 26, 2021, or about 577 days. cryptocoin.comAs you follow, the Grayscale Bitcoin Trust (GBTC) price has dropped to $11,000 in the past few weeks.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.