Frankfurt The European Central Bank (ECB) continues to raise interest rates in the euro area. It raises the key interest rate by 0.5 percentage points to 3.0 percent. The currently even more important interest rate that banks receive for their deposits at the ECB will rise from 2.0 to 2.5 percent. The central bank announced this on Thursday afternoon. The ECB also announced that it intends to raise interest rates by 0.5 percentage points in March.

Experts and investors had expected an increase of this magnitude. The interest rate hike is thus as strong as it was in December. After the decision at the time, the head of the central bank, Christine Lagarde, promised several rate hikes of this magnitude.

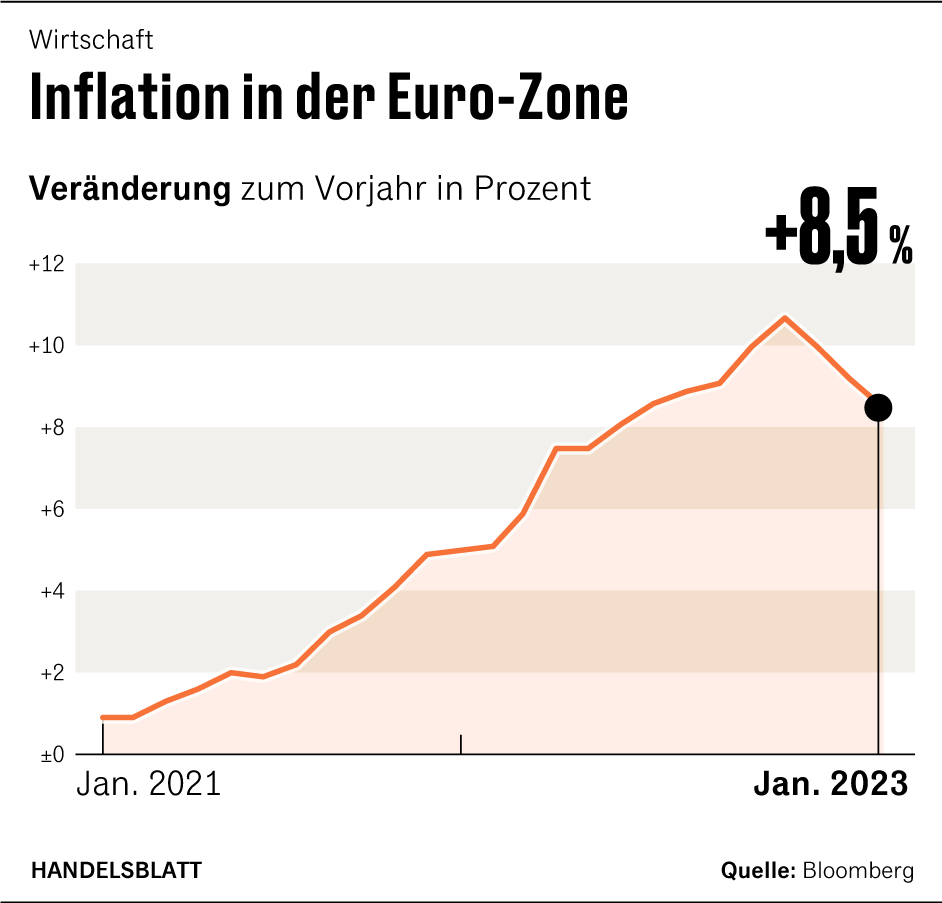

With its decisions, the central bank is reacting to the high inflation in the euro area. In October, this had reached its previous high of 10.6 percent. Recently, the price increase has weakened somewhat. On Wednesday, the European statistics office Eurostat reported an inflation rate of 8.5 percent for the euro area in January. Inflation remains well above the ECB’s medium-term target of two percent.

From 2:45 p.m., ECB President Christine Lagarde will give a press conference on the new decisions.

>> Read here: Follow the ECB live blog

The ECB also announced that it would start reducing its balance sheet as planned. From March to the end of June, the central bank no longer intends to replace expiring securities from its portfolio of EUR 15 billion per month from the older APP program.

Investors should pay particular attention to how Lagarde comments on further interest rate developments beyond February. In the run-up to the February meeting, various Council members took different positions on this.

In an interview with the Handelsblatt, ECB Director Fabio Panetta spoke out in favor of keeping further steps open. He stressed that there has been some good news on the inflation side since December. For example, the prices for oil, gas and electricity have fallen significantly. Some economists expect a recession in Europe and the US. Critics therefore fear that the central banks could overreact.

>> Read also: ECB Director Fabio Panetta against committing to rate hikes beyond February

On the other hand, advocates of a tighter monetary policy, such as the head of the Dutch central bank Klaas Knot, are pushing for a further interest rate hike in March by half a percentage point – as the ECB also communicated on Thursday. Bundesbank President Joachim Nagel also pointed out that the central bank had already announced that it would also raise interest rates sharply in March after February.

In the run-up to the meeting, the markets priced in further interest rate hikes in the euro area for this year, up to a peak of 3.5 percent for interest on deposits. The expectations of economists are also similar.

The chief European economist at the US bank Goldman Sachs, Jari Stehn, expects an increase of a quarter percentage point in May after two 50-point steps in February and March. This would increase the deposit rate to 3.25 percent. Bankhaus Berenberg also expects this level.

More: Inflation in the euro area is falling surprisingly sharply