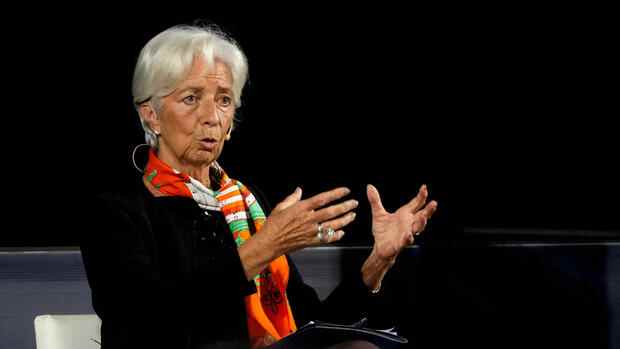

According to Lagarde, interest rates are the most important instrument of the ECB’s policy course.

(Photo: Reuters)

Frankfurt/Main ECB President Christine Lagarde has reaffirmed the central bank’s determination to fight record high inflation. “We assume that we will continue to raise interest rates,” Lagarde said on Friday at the Frankfurt European Banking Congress. “Ultimately, we will raise rates to a level that brings inflation back to our medium-term target in a timely manner.”

The European Central Bank is aiming for price stability in the euro area in the medium term with an inflation rate of two percent. In the euro area, consumer prices in October were 10.6 percent higher than in the same month last year. In Europe’s largest economy, Germany, the inflation rate rose to 10.4 percent in October.

“Inflation in the euro area is far too high,” Lagarde said in Frankfurt. In addition, the risk of a recession has increased, although the latest data on growth in gross domestic product have surprised on the upside.

After a long period of hesitation, the ECB has been trying to get the extremely high inflation under control by raising interest rates sharply since July. The key interest rate in the euro area, which was frozen at a record low of zero percent for years, is now 2.0 percent.

Top jobs of the day

Find the best jobs now and

be notified by email.

“Interest rates are and will remain the most important tool for adjusting our policy course. But we also need to normalize our other policy instruments, thereby increasing the momentum of our interest rate policy,” said Lagarde.

>> Read also: Top economist Olivier Blanchard sees a chance of falling inflation

The ECB’s balance sheet, which has swollen over the years as a result of billions in securities purchases, must be normalized “moderately” and “in a predictable manner”. “In December we will set out the main principles for reducing the bond holdings in our purchase program,” Lagarde announced. The Governing Council will meet again on December 15th.

Deutsche Bank boss Christian Sewing spoke at the banking congress about the financial challenges for the next few years. An efficient capital market is urgently needed for this. “We need a 2030 Agenda for Europe. And the very first step must be that we finally create a real European home market,” said Sewing. “Unfortunately, given the lack of political will or lack of unity in the EU, even at best, it will take many years to complete the Capital Markets Union.”

The capital markets union is essentially about removing bureaucratic hurdles between the individual EU countries in order to give companies more opportunities to raise money. The EU Commission’s plans for a capital markets union have been on the table since September 2015, but implementation is faltering.

“Europe’s strategic autonomy is not possible without strong banks that are fully capable of supporting the economy in all situations – and that are competitive on a global scale,” said Sewing.

(Photo: Reuters)

Without a significant increase in private sector investment, Europe cannot be competitive, Sewing warned. “We will neither master the sustainable transformation nor be able to keep up technologically,” said Sewing. “That’s why it’s so important to finally push ahead with the capital markets union in order to create a liquid and attractive market for domestic and foreign investors,” warned the Deutsche Bank boss.

“Europe’s strategic autonomy is not possible without strong banks that can support the economy in all situations with full force – and that are competitive on a global level,” affirmed Sewing, who is also President of the Association of German Banks. “It is becoming increasingly clear that the current regulatory framework is doing little to strengthen European banks.” Regulation in Europe must be readjusted.

More: It’s time for a real Capital Markets Union