A Real Vision Bot, known for accurately predicting trends in the markets, shared its new portfolio as the cryptocurrency market is trying to break out of a downtrend.

Real Vision Botpublishes a number of surveys each trading week to share their algorithmic portfolio assessments created using a consensus called the hive mind.

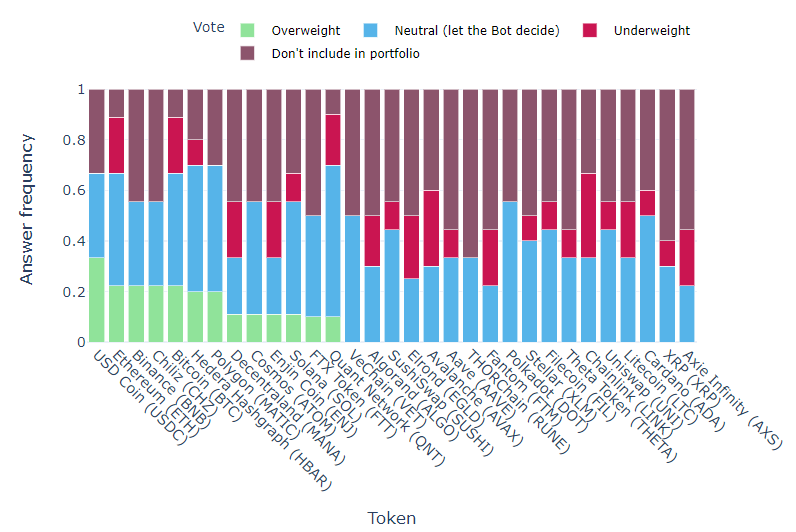

In the latest data shared by the Trade bot, it is seen that the risk taking rate of traders has decreased significantly compared to the previous week. Many investors in the market also shared that they focus on 11 different altcoins, especially Bitcoin and Ethereum.

The top crypto asset in the portfolio would be the stablecoins, US Dollar Coin (USDC), increasing its share from 20% last week to 33%.

Four crypto assets occupy the second place of the list with a share of 22%. Alongside these cryptoassets are Ethereum and Bitcoin, Binance’s native token BNB, and fan token network Chiliz (CHZ).

“The recent results of the crypto survey conducted by Real Vision Bot clearly revealed that the risk aversion mode is active. The data that shows this most clearly is that the share of risky assets has decreased and the share of stablecoin USDC has been increased.”

In sixth place is the decentralized application creation protocol, up 20%. Hedera Hashgraph (HBAR) and Layer-2 scaling solution Polygon (MATIC).

Decentraland (MANA), Cosmos (ATOM), Enjin Coin (ENJ) and Solana (SOL) formed an important area in the list with 11% shares and managed to maintain a certain share despite the current risks.

The last altcoins with 10% share were FTX Token (FTT) and Quant Network (QNT). While this altcoin pair continued to hold its share to a certain extent, it showed the tendency of investors to avoid risk.

According to the survey, portfolio distribution on crypto exchanges is managed by USDC with 23.4%, followed by Polygon with 18.8%, Binance and Chiliz with 15.6%, Cosmos, Hedera Hashgraph with 9.38% and finally 7.81%. FTX Token is following.

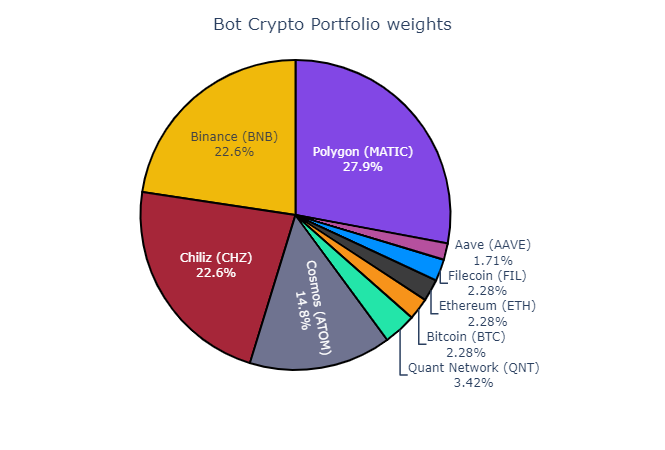

The trade bot, which also shares a portfolio based on the data, allocated a 27.9% share to MATIC, placing it at the top, while BNB and CHZ with 22.6% and ATOM with 14.8% were included in its portfolio. Five more digital assets managed to occupy between 1.5% and 3.5%, including QNT, BTC, ETH, decentralized storage network Filecoin (FIL) and lending and borrowing protocol Aave (AAVE).

Real Vision Bot is a trading bot jointly developed by quantitative analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macroeconomics expert Raoul Pal described the bot’s historic performance as “astonishing” and said it outperformed the top 20 cryptoassets in the market combined, by 20%.

Current price action from here you can follow.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.