After the December 15 Fed rate statement and comment on its forecasts for the next year, crypto markets experienced a slight pullback after a quick reaction. However, there was another important thing to watch, and that was the stablecoin on the exchanges. Tether (USDT) was the price.

This is evident when looking at how the crypto markets are correcting and liquidations are taking place. Numerous traders have liquidated their positions and are currently holding large amounts of USDT.

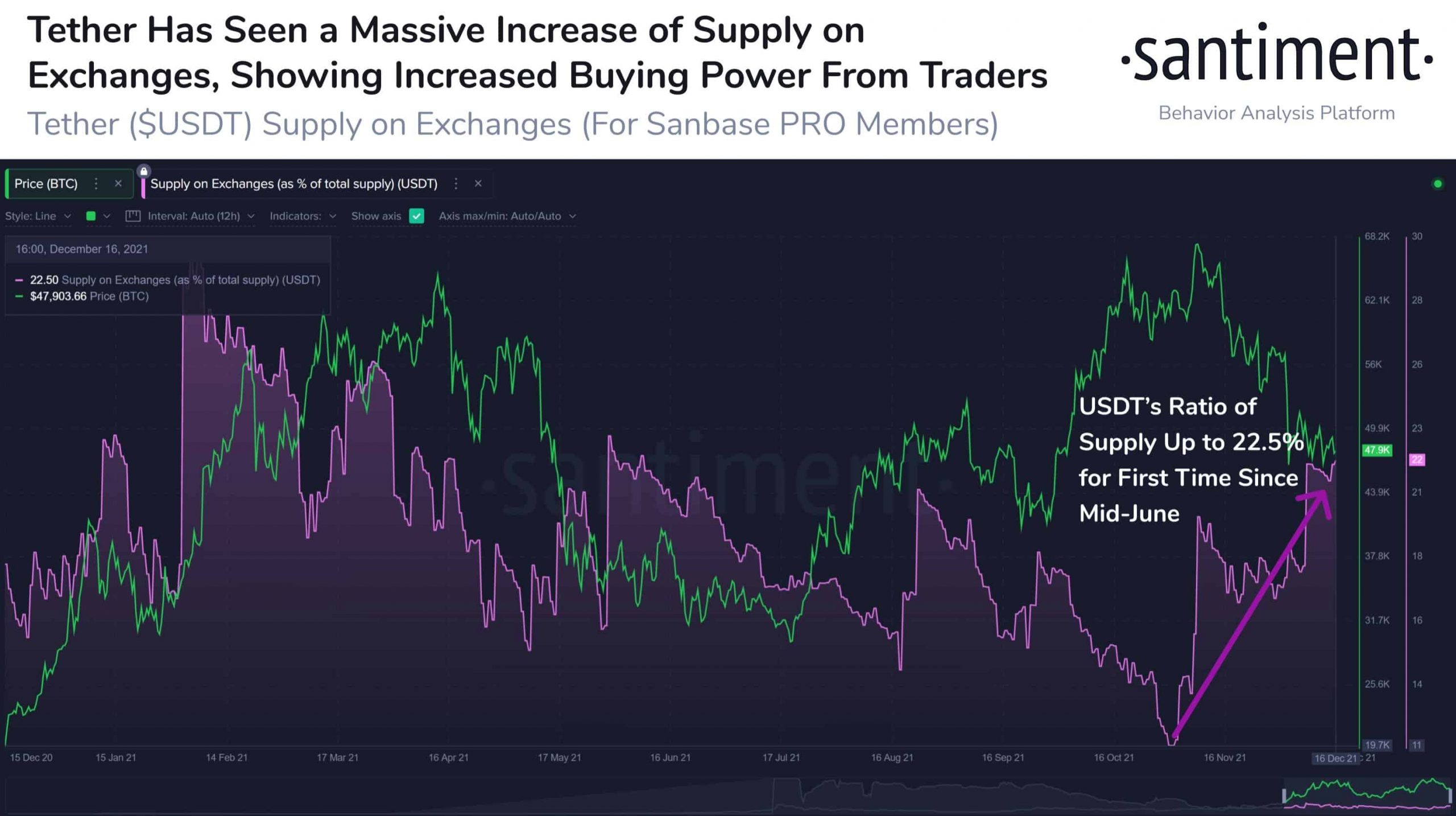

According to on-chain data provider Santiment, the exchange USDT stablecoin The supply has reached the highest level in 6 months. The data provider noted:

“The share of Tether stablecoins on exchanges has risen to 22.5%, a 6-month high. This amount of supply turns into $ 8.99 billion, showing that the purchasing power accumulated in the exchanges has increased.”

Tether Issues 4 Billion Dollars of New USDT in a Month

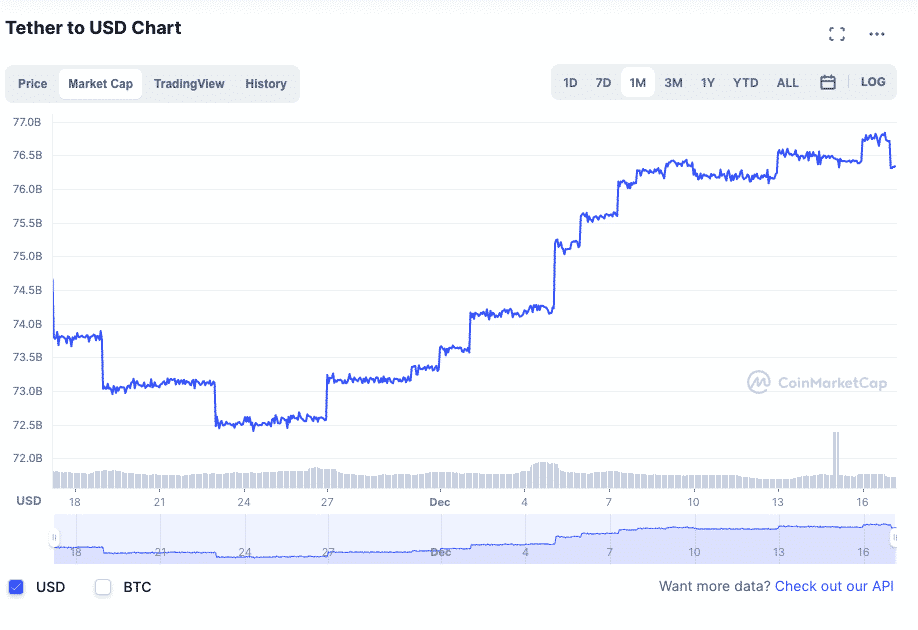

stablecoin issuer Tether has been quite aggressive in issuing USDT this year. Shortly last month, Tether issued an additional $4 billion USDT with a market cap of over $76.5 billion.

The supply of Tether (USDT) to the crypto market has grown tremendously this year in 2021. If we look at the year-to-date chart, the supply of USDT has quadrupled from $20 billion to nearly $80 billion.

We would also like to remind you of the discussion that there are many reports of Tether printing USDT over the air without backing it 1:1 with the US Dollar. However, Tether denied all these claims, stating that all its reserves are in place. He noted on his website:

“100 percent backed by reserves that include traditional currency and cash equivalents, and may occasionally include other assets and receivables.”

Tether has even been adopted by some political parties. Recently, Myanmar’s parallel government, NUG, announced Tether’s USDT as its official currency. Tether responded by calling it a bold move.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.