PEPE price is up 20% since the June 9 low as the move above the uptrend line continues. Meanwhile, the number of altcoin holders continues to increase. The number of holders has been steadily moving towards 20,000, accompanied by a price increase. Analyst Lockridge Okoth reviews PEPE’s latest appearance.

Altcoin price shows bullish momentum as new owners arrive

Pepe (PEPE) price showed some upward momentum despite the recent slowdown. It tested an important support level for almost a week. Subsequently, PEPE continued to consolidate with a promising trajectory. If the buyer momentum continues or a suitable catalyst emerges, this could bode well for the meme coin. But meanwhile, the pace is steady as the crypto markets take a breather.

Pepe (PEPE) price shows promising activity after a long wait. But a lot depends on the investors’ interest in the meme coin. PEPE rose almost 100% from its all-time low of $0.0000005 recorded on April 30. However, it is still down an astonishing 80% since its intraday high of $0.0000045 on May 5.

At the time of this writing, Pepe is priced at $0.0000009. It also showed a daily gain of 0.15%, supported by a 10% increase in 24-hour trading volume. This marks a growing interest in PEPE among traders. A sustained bullish momentum could help the meme coin continue above the uptrend line. This means more returns for investors.

However, the altcoin price will need to turn the 50-day Exponential Moving Average (EMA) to support for a significant breakout. Note that this level of supply congestion has suppressed PEPE for almost a month. So reversing this will clear the way north. This positive outlook is also supported by the Relative Strength Index (RSI), which points to sustained upward momentum.

On-chain metrics show increasing number of PEPE holders

Pepe price is on the rise as more crypto market participants enter the PEPE ecosystem. According to data from Etherscan, the number of token holders is increasing. Thus, it is slowly moving towards 20,000.

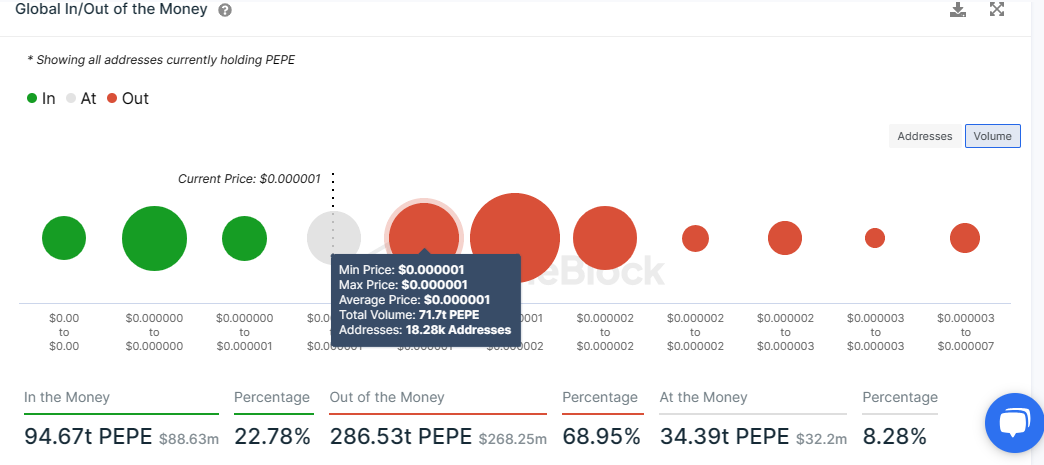

If the buying momentum intensifies, the market cap of the meme coin will also increase. Conversely, the selling pressure at $0.0000010 is forcing the altcoin price to move higher. Also, data from IntoTheBlock shows that this is a major supply congestion zone.

Therefore, efforts by the bulls to push the Pepe price above this level will be met with intense selling pressure from 18,280 addresses that purchased approximately 71.7 trillion PEPE tokens at an average price of $0.0000010. The increase in selling pressure could cause Pepe price to invalidate the current bullish view with a 12-hour candlestick close below the critical support of $0.0000008. The bearish thesis emerges with the RSI’s position below 50. This shows that Pepe price strength is in favor of the bears rather than the bulls.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.