In the cryptocurrency world, leveraged ETFs and leveraged tokens are popular products after futures. The daily trading volume of leveraged ETF products on crypto exchanges reached $52.81 billion. If investors are accustomed to opening positions with low leverage, they will find that leveraged ETFs have more advantages over margin trading and futures trading.

First, leveraged ETF positions have a higher rate of capital use. This is mainly because there is no need to pay margin when opening a leveraged ETF position. Opening and closing a position is like trading on the Spot, so there is no need to retain a portion of the position as margin to raise or lower the liquidation price.

Second, the rebalancing mechanism in leveraged ETF allows for the benefits of compound interest investment. After rebalancing, the profit of the position is automatically added to the newly opened position, which is suitable for trading in a bull market.

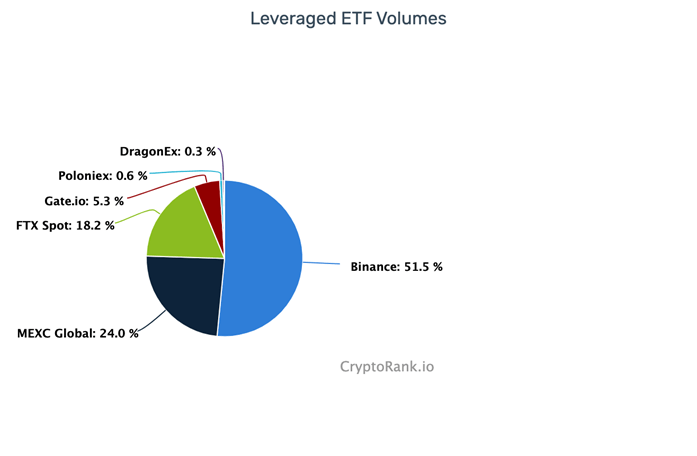

Among the main exchanges, Binance, MEXC, and FTX have three years of well-established experience in these products, with 24-hour user trading volumes in the top three.

However, many people are easily confused about leveraged ETF and leveraged tokens. This article will focus on introducing the two to understand the features of these products.

-

Similarities and differences between leveraged ETFs and leveraged tokens

A Leveraged ETF is a type of permanent leveraged product that increases the price volatility of Spot trading aimed at generating leveraged returns with benchmark indicators such as perpetual futures.

The name of the leveraged ETF is represented by “cryptocurrency + leverage + long/short direction”. For example, BTC3L/3S means 3x long/short transactions for Bitcoin. If BTC price goes up/down 1% on a given day, BTC3L will go up/down 3% and BTC3S will go up/down 3%.

The leveraged ETF of cryptocurrency is based on the principle of leveraged ETF in the traditional financial market. While leveraged tokens are similar to leveraged ETFs, leveraged ETFs are exchange-traded funds that are issued off-chain, which also yield a certain multiple (e.g. 3x) of the daily return on the underlying asset based on underlying asset (e.g. BTC) data. products that are traded.

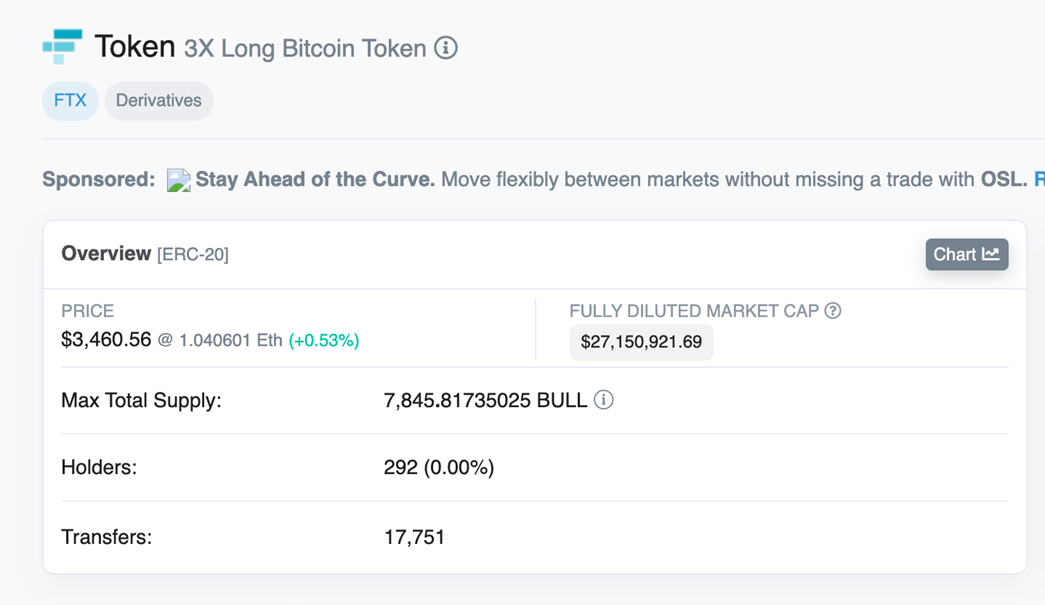

However, leveraged tokens reside on the blockchain. For every leveraged token purchased by a user, a token is produced or burned and destroyed on the Ethereum blockchain. This is the main difference between leveraged tokens and leveraged ETFs. Therefore, leveraged tokens can be thought of as “leveraged ETFs” issued on a blockchain.

Therefore, when trading activity on the Ethereum blockchain is high, the trading fee of leveraged tokens rises and there are bottlenecks in trading. This is not the case for leveraged ETFs.

Additionally, leveraged ETFs have a market price of $1, while leveraged tokens have a different market price. Data on the Ethereum blockchain shows that the leveraged 3x long BTC token price was $3460.56 on Jan. 16.

-

Advantages of Leveraged ETF products

Leveraged ETFs require no margin, no liquidation prices, and high use of capital; It has a compounding effect and it is easy to control risks.

No margin required, no liquidation price, high capital utilization: Let’s take BTC3L as an example, positions are opened as if trading Spot on leveraged ETFs, without users having to take a portion of their position as margin to raise or lower the liquidation price. Capital use is high and there are no liquidation rules.

Compound interest effect: Due to the rebalancing mechanism of leveraged ETFs, in a continuous up/down market, the daily profit portion is automatically transferred to the reinvest position to earn compound interest, so the profit will be higher than leveraged or futures products of the same leverage.

Risk control: The risk control and compounding effect of leveraged ETFs results from a unique rebalancing mechanism. Rebalancing is divided into periodic rebalancing and non-periodic rebalancing.

Periodic rebalancing is essentially what the platform does to maintain an ETF’s 3, 4, or 5x leverage. In addition, the platform needs to hedge on other derivatives platforms to avoid risks from sharp rises and falls in prices, and both experience a certain erosion of fee rate, maintaining leverage and hedging.

MEXC’s leveraged ETF products will be regularly rebalanced daily at 0:00 AM Singapore time and existing position accounts will be charged at a fee rate. For example, the current BTC3L fee rate is 0.2%.

Non-periodic rebalancing refers to scenarios where the target spot price rises or falls more than a certain range, where 3L or 3S position holders must pay transaction fees based on the fee rate.

For example, BTC3L and BTC3S are listed when the BTC spot price is 50,000 USDT. Hence, the fixed BTC spot price for non-periodic rebalancing of both BTC3L and BTC3S would be 50,000 USDT.

Periodic rebalancing is triggered when the BTC spot price rises or falls by more than 15%, that is, when the BTC spot price reaches 57,500 USDT or 42,500 USDT.

-

Variety of ETF products

ETF products of cryptocurrencies are not only popular in the crypto world, they are also sought after by traditional financial institutions and equity funds, and are suitable as investment vehicles by large equity funds.

In fact, in recent years, Bitcoin supporters in the United States have repeatedly appealed to regulators to launch Bitcoin ETFs. As of October 22, 2021, the US SEC has approved the first Bitcoin futures ETF, BITO (launched by ProShares). Eric Balchunas, a senior ETF analyst at Bloomberg, calculated that the trading volume of the product reached $280 million within 20 minutes of its listing. With the ensuing entries, it reached $1.2 billion in the next four days.

Although the ProShares product was the first Bitcoin ETF in the US, many Bitcoin ETFs in Canada are traded on the Toronto Stock Exchange, including the Purpose Bitcoin ETF and the 3iQ Bitcoin ETF.

Simultaneously with the launch of the ETF BITO, Grayscale filed with the SEC to convert the Grayscale Bitcoin Trust (GBTC) into a Bitcoin spot ETF.

Pressure on cryptocurrency ETFs by traditional institutions has helped increase market risk and allow for more traditional funds to flow, which is certainly a good thing. However, it mainly targets ETF products of BTC and ETH, specifically ETF futures.

Meanwhile, the leveraged ETF launched by crypto exchanges has incomparable advantages over the above ETF products.

Modeled on MEXC’s leveraged ETF, its tradable products have reached more than 360 trading pairs of 180+ cryptocurrencies. MEXC is currently the trading platform with the highest leveraged ETF trading category on the network. ETF products not only include Bitcoin leveraged ETFs and Ethereum leveraged ETFs (like BTC 3L/3S, ETH3L/3S), but also BNB3L/3S, DOT3L/3S, LTC3L/3S etc. and also ATOM3L/3S, FTM3L/3S, LUNA3L/3S, SOL3L/3S etc. It includes leveraged ETF trading pairs of popular tokens such as

Given that cryptocurrencies follow the BTC market trend, there is a huge gap between price changes and they often resonate with popular sectors. This gives investors more options considering the expected returns.

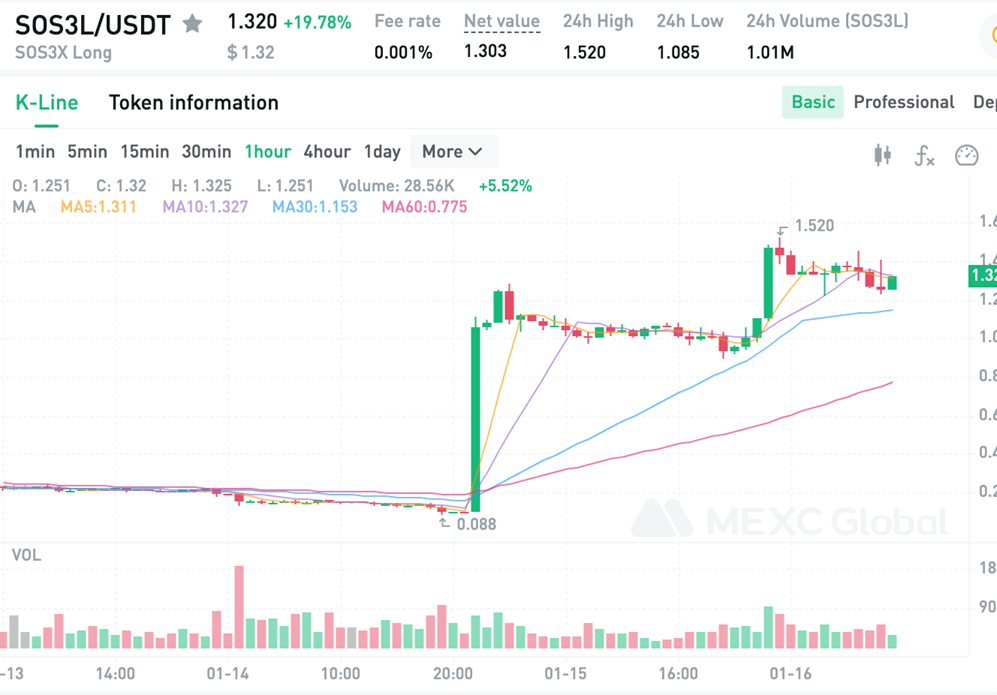

For example, in the range where BTC3L dropped 3.67% in 24 hours on January 16, a 19.78% gain in trading SOL3L is possible.

Disclaimer: This is a sponsored promotional post. KoinFinans.com cannot guarantee the accuracy of the content on this page provided by the relevant company and cannot be held responsible for any damages that may arise regarding the products and services on this page. Readers should do their own research before taking any action.