Ripple (XRP) The price started to rise after the optimistic news from the stock market and managed to maintain this rise. The general bullish sentiment in the cryptocurrency markets represents an important move for 2022 that has been expected for some time, and it has finally started, albeit belatedly, after geopolitical tensions. With this upward movement, Ripple wants to reach its long-awaited $1 price target.

XRP Price Preparing for 15% Rise

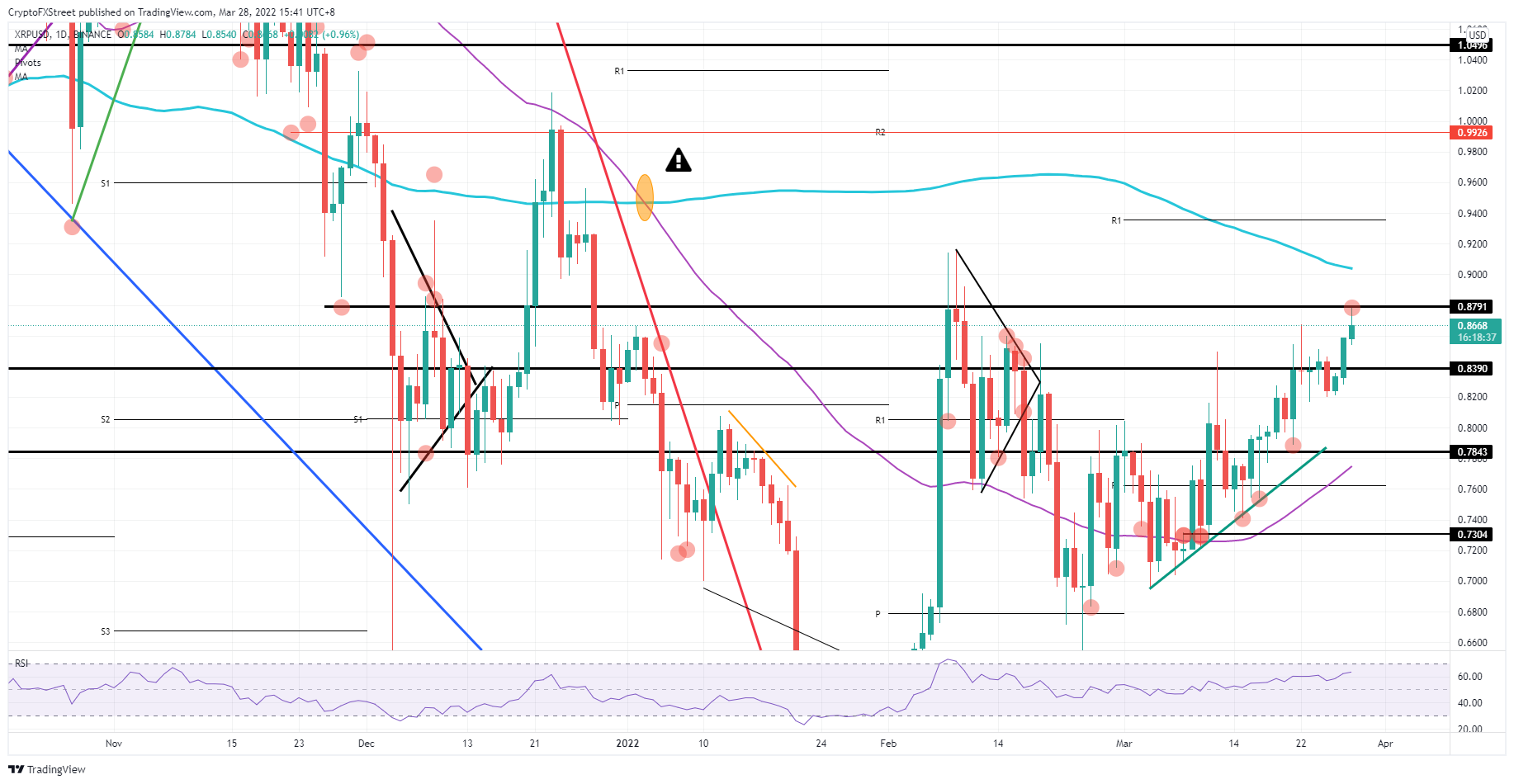

XRP pricerallied Monday morning along with ASIA PAC, showing a flat top at Sunday close. This is highly bullish as traders and market participants are in the market to buy at any available price. With the huge demand coming in, the ASIA PAC has already risen to some important highs and is on the upside of $0.8784 (almost exactly $0.8791), a very important level.

Ripple price unfortunately received a rejection after this level. However, the bulls have to continue without getting discouraged as the European session is likely to show some sideways trading. The US session will likely act as the catalyst to push the price above $0.8791 as the most significant volume will weigh on the bears trying to defend $0.8791 but they will eventually get stuck. The 200-day Simple Moving Average will rest at $0.90 today as it will set a price cap before reaching $1 this week.

While the predictions that triggered this rally seem to have increased, there are also a small number of analysts who state that geopolitical news is still important. But the risk here is that Russia will remain silent again, will not compromise on anything and will want to control every area and capital it has. This would mean a pullback in the peace talks, causing the price action in XRP to retrace to $0.8390 in the first phase and continue lower to $0.7843, which would mean an 8% correction on the downside.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.