Dusseldorf For many years, the steel industry was considered the problem child of German industry. But in 2022, German steel manufacturers can unexpectedly look back on an extremely profitable year. Thanks to unusually high steel prices, producers such as Thyssen-Krupp and Salzgitter have not only been able to increase their profits since the beginning of the year compared to the previous year, they have even multiplied them – and after many years of deep crises were as profitable as they were at the last time before the financial crisis of 2007/2008, when the steel industry had experienced an unprecedented boom.

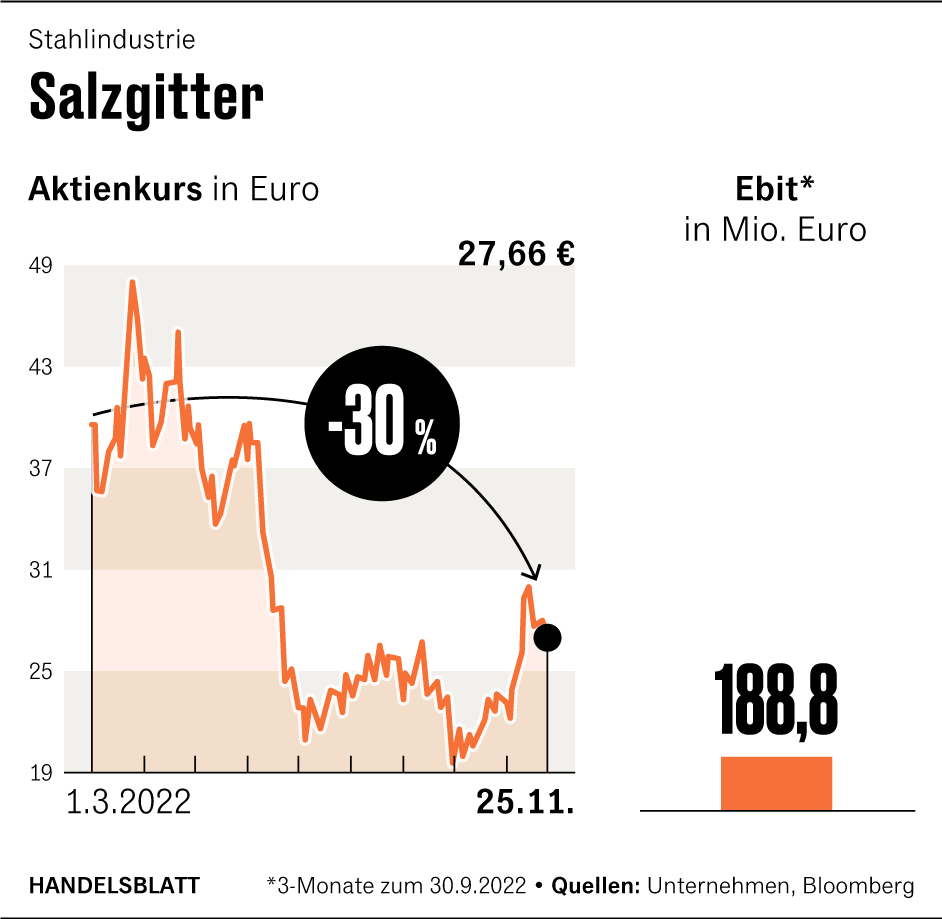

At Thyssen-Krupp, for example, the steel division’s adjusted earnings before interest and taxes (EBIT) rose by an incredible 934 percent to 1.2 billion euros in the past fiscal year, which ended in September. At Salzgitter, EBIT doubled on a non-adjusted basis in the first nine months of the financial year to just under 1.15 billion euros. The Swiss manufacturer Swiss Steel was also able to increase its operating profit by 12.3 percent to 90.7 million euros.

But the record mood is likely to be short-lived. Because the outlook for the industry for the coming year is bleak. In anticipation of a recession, steel prices have already fallen significantly in recent weeks. At the same time, the production costs increase drastically.

This development is primarily driven by the high prices for gas, which plays an important role at many points in the value chain, from generation to further processing.

Top jobs of the day

Find the best jobs now and

be notified by email.

According to data from the Steel Industry Association, German steel production in October fell by 14.4 percent year-on-year. Industry observers such as Bastian Synagowitz, an analyst at Deutsche Bank, assume that this trend could intensify in the coming year. “We believe that around 15 percent of the capacities in Europe are currently shut down,” said the expert in his most recent industry study. “If the current situation continues, we expect even larger cuts.”

Investments are released only gradually

The downturn hit the industry at the worst possible time. Because most manufacturers want to invest heavily in the construction of new plants from 2023 in order to convert their CO2-intensive production to climate-neutral processes.

For example, Thyssen-Krupp is planning to build a direct reduction plant costing around two billion euros in order to replace the climate-damaging coal in the production process first with more climate-friendly natural gas and then with climate-neutral hydrogen. But in view of the uncertain environment, the group wants to step on the brakes when it comes to new investments.

Nobody could say how big the challenges would be or how long they would last, said ThyssenKrupp CFO Keysberg when presenting the record results. “But we are also preparing for the most difficult scenario.”

This also includes a restrictive and gradual release of investments – depending, among other things, on how the overall economic situation is developing and what progress the business has made in securing earnings.

Implementation risk of decarbonization increased by war

Even without the current crisis, the transformation to CO2-free manufacturing processes poses a high risk for the industry. Because so far it is unclear when sufficient quantities of climate-neutrally produced hydrogen will be available in Europe to be able to completely supply the energy-hungry industry. For a transitional period, many producers therefore wanted to use natural gas, which would save two thirds of emissions in a first step. But because of the Ukraine war, this strategy is now in question.

Bastian Synagowitz from Deutsche Bank, for example, judges that the risk of implementing decarbonization in the steel industry has increased as a result of the war. “Energy prices like the ones we saw in early 2022 would drive costs to prohibitive levels,” the analyst said.

A key question is whether and how quickly European companies can replace Russian gas cheaply with green energy and hydrogen. “This poses significant risks to the timelines and execution of the industry’s decarbonization strategies.”

>> Read also: Major investor Cevian separates from Thyssen Krupp shares – course reacts clearly

The German steel manufacturers are still sticking to their goals. The most important intermediate step is specified by the EU, which intends to reduce total European emissions by 55 percent by 2030 compared to 1990. In order to achieve this goal, the steel industry should reduce its emissions by at least 30 percent.

According to calculations by the Boston Consulting Group (BCG) strategy consultants, every third blast furnace would have to be replaced by a direct reduction plant by then, such as Thyssen-Krupp and Salzgitter plan to build next year.

Salzgitter sees natural gas supply secured

When asked how the European energy markets will develop before these plants are completed, Salzgitter CEO Gunnar Groebler is comparatively optimistic. “We assume that we will no longer be talking about a natural gas shortage in 2025,” said the manager in an interview that was recorded in the run-up to the Handelsblatt hydrogen summit. Of course, the issue of price will continue to play a role – “but we consider the availability of natural gas to be quite secure.”

The industry’s hopes are likely to lie above all in politics, which is currently trying to open up new supply routes for natural gas for companies. But the capital markets are significantly less optimistic – probably also because the unexpected steel price rally has come to an end.

In the past few weeks, investors have largely responded with indifference to the record reports from steel producers – and in the case of Thyssen-Krupp even with a price loss of more than four percent.

Most analysts already see the forthcoming recession priced into share prices. However, according to Deutsche Bank expert Synagowitz, another price decline cannot be ruled out. Only the coming year will show whether the optimists or the pessimists will be right.

More: Restructuring expert Hans-Joachim Ziems: “We will see the self-cleaning powers of the market”