Cryptocurrency miners had a difficult 2022 year due to the increase in energy prices around the world, the cost of financing that became more difficult due to the tight monetary policies implemented by countries, and the 65% decline in the market value of Bitcoin.

With the revelation that mining company Core Scientific has filed for bankruptcy protection recently, questions about the industry continued to rise.

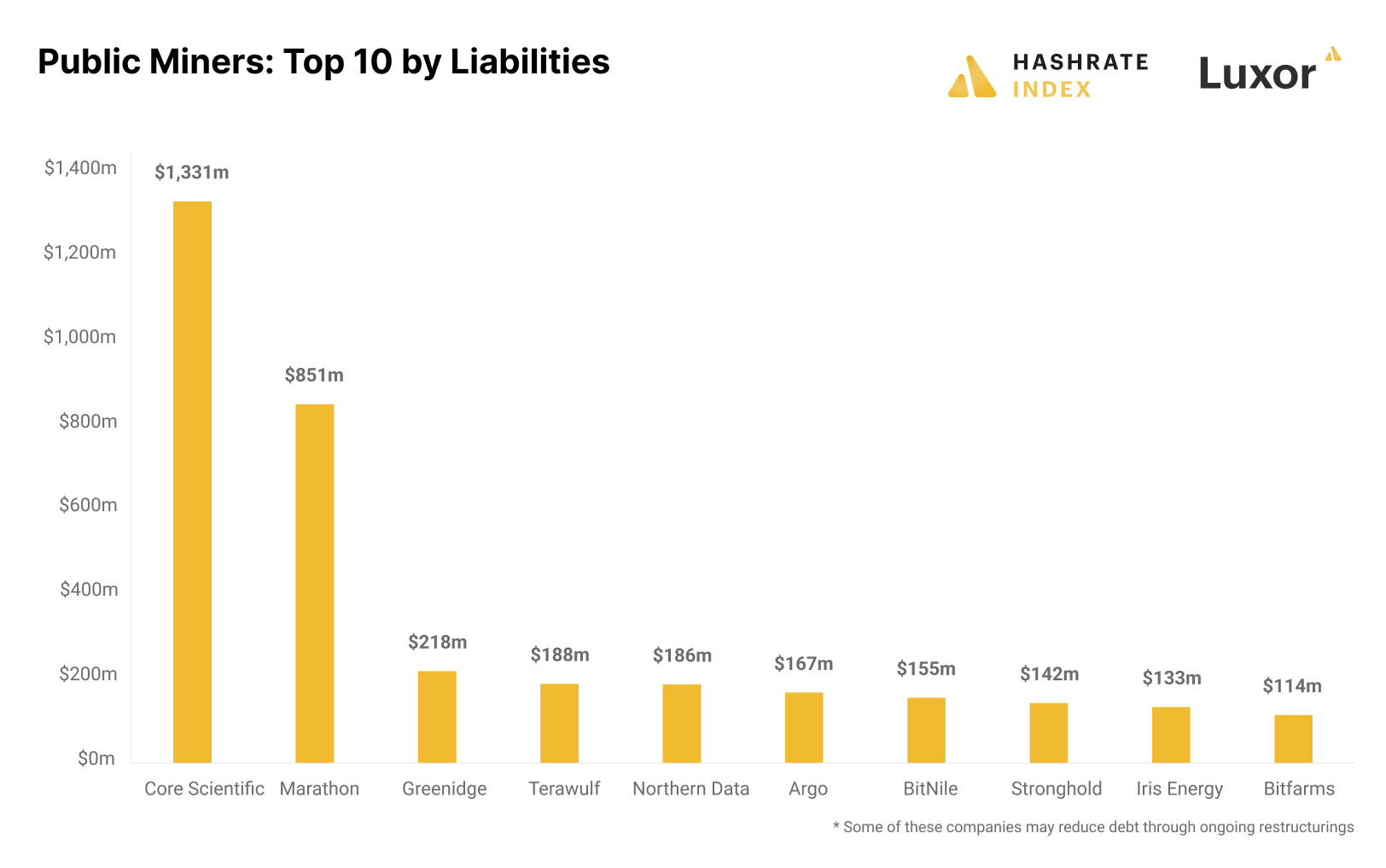

Giant Debt of Crypto Miners!

Hashrate Index, one of the leading research companies in the market, has determined how much loan debt Bitcoin miners have in its recent study. According to the report, while the bull market continued in 2021, companies sought massive resources to grow. Saving institutions, on the other hand, did not hesitate to provide the sought-after resource to the miners due to the rise in Bitcoin price.

However, due to the changing conditions, the account at home did not fit the market. Central banks have turned to tight monetary policy to find a solution to the inflation figures that are about to get out of control around the world. Thus, interest rates rose, it became more difficult to get loans, spending decreased, and people avoided risk to earn guaranteed deposit income. Cryptocurrencies, which are shown as the most active market with risk aversion, suffered great losses.

As a result, the liabilities of Bitcoin miners, who lost a great deal of their profitability, continued to increase. According to Hashrate Index data, the debt of publicly operating BTC miners has reached $ 4 billion.

The total debt of 10 mining companies was recorded as $2.6 billion in the report. The BTC miner with the most debt was Core Scientific, which recently announced its bankruptcy. The sunken miner has more than $1.3 billion in liabilities.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!