Last week, the collapse of centralized crypto exchange FTX sent shock waves in the market. Therefore, the cryptocurrency market has not had a good time. Just when many altcoins looked as if they were about to break out of the downtrend, they fell significantly from their previous support levels. However, there are some promising crypto assets. Here are eight altcoins that analysts expect to rise…

Analysts are hopeful for Bitcoin and these 8 altcoins

cryptocoin.com As we have also reported, the FTX crisis had a negative impact on the markets. However, some analysts predict bullishness for some altcoin projects. Analyst Rahul Nambiampurath; this week it reviewed Trust Wallet Token (TWT), PAX Gold (PAXG), GMX (GMX), Bitcoin Cash (BCH) and dYdX (DYDX). Prasanna, another analyst, studied Bitcoin, XRP and BNB.

Trust Wallet Token (TWT)

One of the most notable performers on this list is Trust Wallet’s Trust Wallet Token (TWT), which jumped over 70 percent by the middle of the week. The fall of the FTX exchange has turned investors’ attention to non-custodial wallets, and Trust Wallet is one of the most popular options. With an unattended wallet, the crypto investor has sole control of the private keys of the cryptocurrency wallet, proving that the funds are theirs.

Demand for decentralized wallets has increased following the collapse of FTX, which offers centrally controlled custody wallets, and this may have benefited Trust Wallet. TWT started at $1.16 last week and is currently around $2.43.

PAX Gold (PAXG)

The market capitalization of the PAXG token increased by 5 percent to its current figure of $560 million, and the price is currently hovering around $1,732. PAX Gold is a stablecoin created by Paxos and backed by physical gold. One token represents 1 ounce of London Good Delivery gold bar. At a time when most financial markets are volatile, some investors may turn to real-world assets or related assets such as PAX Gold. The FTX crash spooked investors, and it looks like crypto investors are leaving where possible.

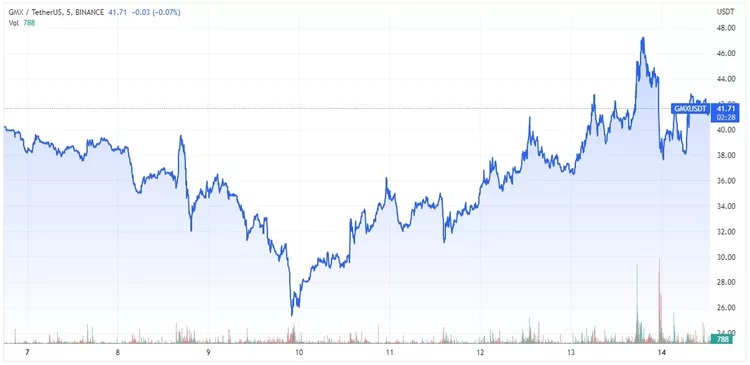

GMX (GMX)

The market capitalization of the GMX token rose 10% last week to $337 million. GMX is a decentralized exchange that offers both spot and perpetual contracts. Here, too, investors seem to be turning to decentralized finance alternatives, and GMX’s low fees and zero price-impact transactions may be attractive to them. It stands out among the DEXs that investors can pass on after the collapse of FTX. Earlier last week, the GMX was worth $37.70. It is currently around $41.71.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a little different among tokens to watch this week as its price hasn’t increased by a particularly significant amount. But the coin’s hashrate has increased by an impressive 30 percent, and the mining difficulty has reached 9%. The first determines how much computing power is used to mine crypto on a network, while the second measures how difficult it is to mine a block. Another reason BCH has been successful is because the recent social media sentiment about the project has been positive. The increase in mining difficulty and hash rate may be contributing to this.

dYdX (DYDX)

The DYDX token value of the decentralized exchange dYdX rose 28 percent. Thus, dYdX became another DEX that experienced a price increase during the week. The token is currently trading at around $2.30. Like GMX, dYdX is likely seeing a price increase because there is more interest in DEXs after the FTX event, according to the analyst.

Bitcoin (BTC)

According to analysts, Bitcoin is most likely the cryptocurrency that most investors should rely on, especially during market downturns. The first and foremost cryptocurrency has been around for 13 years and is considered to be much more stable than many modern cryptocurrencies. If Bitcoin’s value falls, almost every coin falls too. Bitcoin price determines the direction of the market. As a result, no other coin or token other than stablecoins is as secure in a crisis as Bitcoin. But outside of the FTX crisis, external market factors are generally positive. This could cause the Bitcoin price to stabilize in the next few weeks.

Binance Coin (BNB)

In the short term, BNB has benefited greatly from the expiration of the FTX token. After Binance announced that it would liquidate its FTX tokens, many investors were enraged at the world’s largest crypto exchange. He made accusations of market manipulation. However, FTX eventually found itself in a difficult financial situation. Even if many investors are outraged by Binance’s behavior, the situation among cryptocurrency exchanges cannot be changed. According to the analyst, there is a chance that the altcoin price will increase significantly in the coming weeks and months.

Ripple (XRP)

Before the crash, XRP had one of the best performances among top cryptocurrencies. This was mainly because more and more positive information about the status of the legal dispute between Ripple Labs and the US Securities and Exchange Commission (SEC) became available to view. In its current state, Ripple could win the case and give the XRP price a significant boost in the coming months. Many analysts believe that the XRP coin is still quite low priced. Ripple’s payment network has been operating for several years and is extremely well positioned.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.