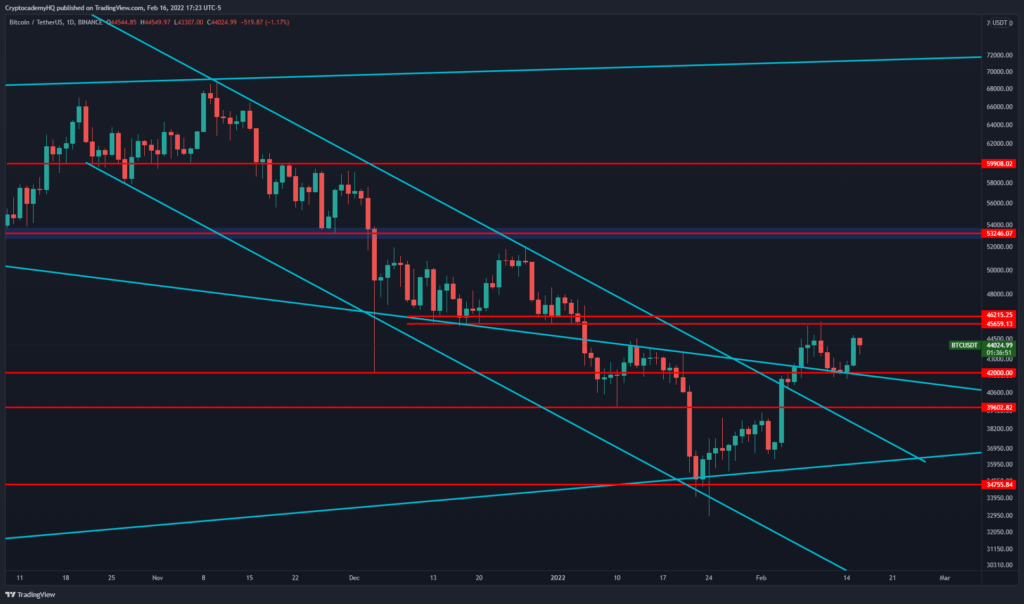

Crypto analyst Justin Bennett analyzed the recent chart movements of the two leading crypto assets, BTC and ETH, and outlined the levels they must reach to confirm bullish breakouts.

In the latest issue of the Cryptocademy newsletter, Bennett said that as long as Bitcoin (BTC) can hold the $40,000 support level, reaching $50,000 is possible for the leading crypto.

“Bitcoin looks healthy after bouncing from the $42,000 support this week. This is a support area extending to $40,000 that we’ve been discussing for weeks.

Buyers need to take $46,000 on a daily close basis to confirm a bullish breakout and open the $50,000 zone.

Just remember that the annual opening is $46,200, so this level will play a critical role. I continue to like Bitcoin more as long as it is above the $40,000 zone.”

At the time of writing, Bitcoin is down 3.35% to trade at $41,956. BTC fell below $42,000 for the first time since Sunday.

Also examining the leading smart contract platform Ethereum (ETH), Bennett shared a chart highlighting the bearish trend of ETH dating back to November last year.

“Ethereum is trying to exit a descending channel stretching from the November highs…

You can see how the market made a false breakout/divergence in January. Therefore, it is not surprising to see ETH/USDT trending in the opposite direction.”

The crypto guru said there are two key resistance lines that ETH must cross to convince itself that it can recapture $3,600.

“A convincing close above $3,120 is likely to keep ETH higher. However, I would still like to see buyers take out $3,280 to create the first higher high that revealed $3,600.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.