Cryptocurrency market is having its worst week since the beginning of 2023, together with the negative developments. Finally, the situation of crypto bank Silvergate caused the selling pressure to continue in the market. A large amount of upward transactions in demand leverages were liquidated, and some investors were wiped out from the market.

Short Positions Increase!

According to the data, the consecutive negative news about crypto companies caused investors trading in the derivatives market to take short positions. bitcoin The positive increase in the funding rate clearly demonstrates the situation.

Bitcoin is currently trying to hold on to the $20,000 level. The fact that we encountered this price level in June 2022 also poses some risks for investors who cut short.

Cryptocurrencies have been significantly affected by macroeconomic changes in recent months. While talking about interest rate hikes in the light of rising inflation last June, we witness a slowdown in price increases in the USA today.

Despite better macroeconomic conditions, Bitcoin trading with the same price impact represents a buying opportunity for some of the community.

If investors take the opportunity to buy this week’s decline, market players who open a large amount of short trades may be in a difficult situation.

BTC Analysis

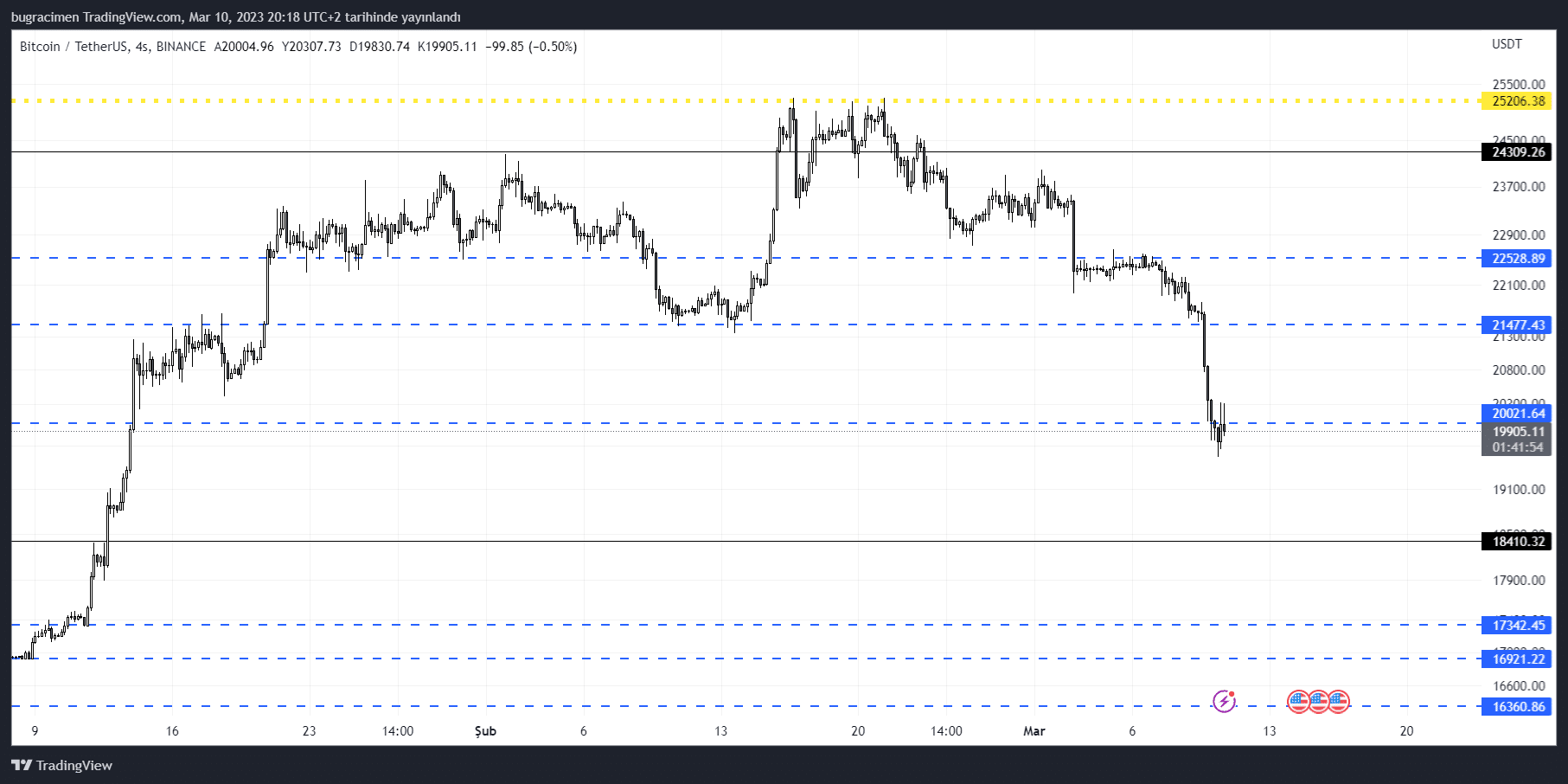

The leading cryptocurrency Bitcoin went into free fall after failing to break the $22,500 resistance at the beginning of the week.

Failed to hold $21,500 support BTC Currently trading just under $20,000. If this level is also lost, the decline may continue to $18,000.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!