Gold prices managed to finish the first full trading week of 2023 at an eight-month high. While the precious metal can be considered overbought, the market mood indicates higher prices in the near term.

“There is a strong pull towards $2,000 below”

cryptocoin.comAs you follow, gold closed the week above $1,900. Kitco’s first Weekly Gold Poll for 2023 shows sentiment among both Wall Street analysts and Main Street investors is solidly bullish. Also, many analysts suggest that reaching the $2,000 target is only a matter of time. Phillip Streible, chief market strategist at Blue Line Futures, comments:

There is a strong pull towards $2,000. Thus, this effect will continue as prices rise.

While the momentum supports the rise in prices, analysts warn investors not to follow the market. “Gold prices will rise,” Streible said. But I’m willing to wait and be patient for a pullback. In the short term, I’m thinking of buying the dips,” he says.

Analyst advises not to buy at current levels

Daniel Pavilonis, senior commodity broker at RJO Futures, also confirms that gold is bullish. However, he advises investors not to buy at current levels. In this context, the analyst makes the following statement:

If you are on the sidelines and not in the gold market, then expect a pullback. If you have a long run, now might be a good time to take some profits and then pull back again.

Weekly gold price prediction poll: Strong bullish

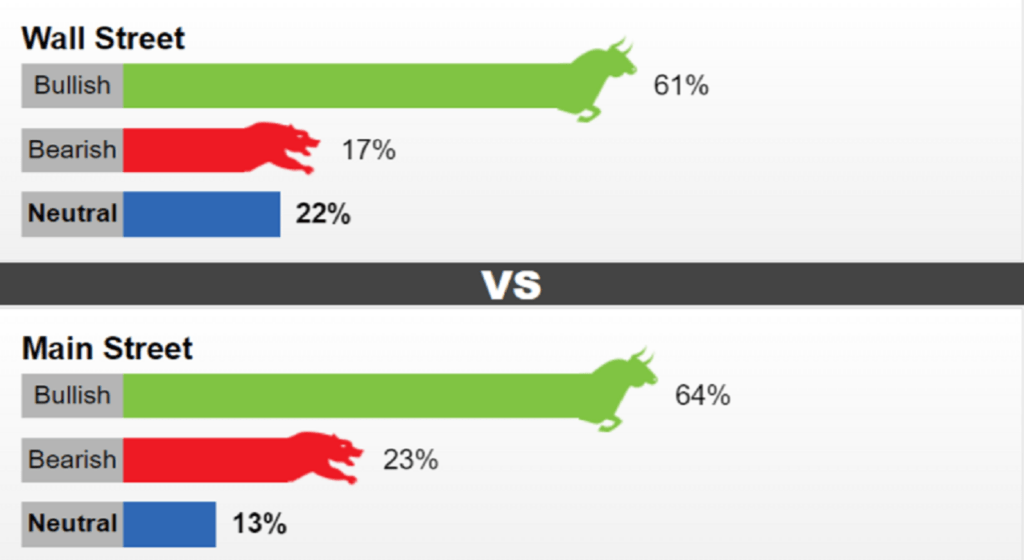

This week, 18 Wall Street analysts voted in the Kitco Gold Poll. Among the participants, 11 analysts (61%) expect gold to rise in the near term. At the same time, three analysts (17%) were bearish for the next week, and four (22%) predicted prices will remain flat.

Meanwhile, 825 votes were cast in online Main Street polls. Of these, 524 (64%) expect gold to rise next week. Another 190 respondents (23%) say prices will be lower. The remaining 111 voters (13%) remained neutral in the near term.

“This is a positive development for gold!”

Some analysts note that changing expectations regarding the Federal Reserve’s aggressive monetary policy stance remain the biggest bullish factor for gold. These analysts say cooling inflation data is giving the Fed room to further slow the pace of rate hikes next month, causing bond yields and the dollar to reverse some of last year’s big uptrend.

Kevin Grady, head of Phoenix Futures and Options, notes that as market expectations change, the momentum in the US dollar tends to be bearish. According to the analyst, gold is reaching overstretched levels. However, he adds that it may still have some room to move higher. In this direction, Grady makes the following assessment:

I was expecting a radical change in the market and I think we are starting to see it. The bond market is signaling that interest rates will be lower than the Fed says. So this is a positive development for gold.

“These are helping the gold price rise”

Adrian Day, head of Asset Management, says gold is bullish in the near-term as the market signals the Fed’s tightening cycle is nearing its end. The analyst supports his thesis as follows:

Any news that supports this thesis helps gold rise, just as last week’s US CPI report showed inflation falling. Any reaction from the Fed hurts gold. But we haven’t seen that yet.

“Gold needs some rest”

However, not all analysts are convinced that gold can maintain its current momentum. Ole Hansen, head of commodity strategy at Saxo Bank, remains a long-term bullish on gold. However, he says, there is an increased risk of prices consolidating at current levels.

Meanwhile, SIA Wealth Management chief market strategist Colin Cieszynski says he is neutral on gold in the near term. In this context, he makes the following statement:

Gold has done well recently. But technically it’s a little too taken and needs rest.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.