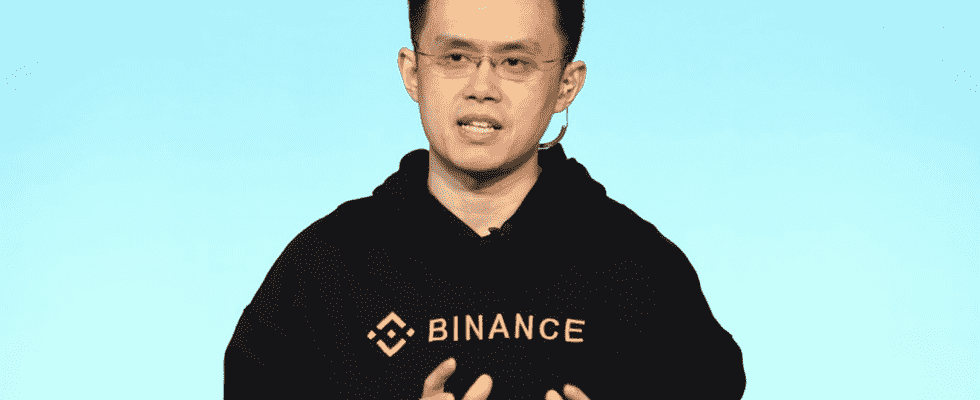

Binance CEO Changpeng Zhao (CZ) made statements about the future of the crypto industry, the FTX event and the $1 billion bailout fund.

Binance CEO CZ made statements about the fate of the crypto industry in an interview with Bloomberg. Thinking that the sector should be saved now, not in 2023, CZ stated that the situation and the course do not look bad when viewed in general terms.

Looking at the overall situation, the industry is in good shape.

According to Bloomberg reporter (UN) “Which dominoes will fall in the coming days because of FTX’s bankruptcy and affect the industry?”, the following response came from CZ:

At this point, things are a little complicated. When such a big stock market crashes, we know that many industry-related institutions and investors are directly or indirectly affected by this event. For now, we do not know how many companies are affected by this, but there is a great bond within the industry and this bad atmosphere is spreading to many players. Besides Genesis, a few more companies could be affected by the FTX event. But overall, the industry is doing well. A few more dominoes may fall, but the effect will be much less.

The reporter brought up the tweet that CZ shared recently and then deleting it, “You tweeted about a liquidity crisis between Coinbase and Grayscale and then deleted it. Should we be worried about this?” he posed the question.

I didn’t mention a liquidity problem in that tweet. I presented 2 different items there, the first was that Grayscale was holding 635 thousand Bitcoins, which was stated by Coinbase. The other article was that there were 600 thousand Bitcoins in the stock market. At this point I just posed a question about whether the numbers are correct. But I am aware that this post caused many misunderstandings in the community and I deleted the post.

We want to see blockchain data for transparency

UN: “It is thought that by posting such posts you are creating fear and anxiety and trying to build your own empire. What is your comment on this matter?”

We don’t know what problems other companies have. It is not possible for us to know this unless there is open wallet addresses and transparency. I’m not tweeting to build our own empire. In fact, I might even accuse myself of tweeting late on FTX. We’ve let FTX grow this much and it’s too late to ask questions about it. My only goal at this point is to create more transparency. Coinbase is a company that has been in service for 10 years and has been offered to the public. I am sure they have sufficient financial grounds and they are very strong. They are audited by major companies, but we don’t see that in blockchain. People care about this because the strongest indicator of transparency is that offered on the blockchain.

Industry needs saving now not in 2023

UN: “You denied a report published by Bloomberg last week. The report alleged that you met with investors in Abu Dhabi to raise funds for the Crypto Industry Recovery Fund. Didn’t this happen?”

Bloomberg’s claim is wrong. I was in Abu Dhabi last week and yes I interviewed a lot of people including Abu Dhabi global market regulators. But my goal was not to raise funds for the bailout fund.

BM: “So when are you going to use this fund? Will it be in 2023, can you inform us about it?”

It will be much sooner and faster. The industry needs saving now, not in 2023. This is a very fast moving industry and we need to react quickly on a daily basis.