Ripple (XRP), which Turkish crypto investors also have in their basket, has seen tremendous price gains recently, with an increase of 14% in the last week alone. This represents a more than 40% increase in altcoin price over the past 30 days.

XRP is one of the best performing cryptos

cryptocoin.comAs you follow, one of the cryptocurrencies with the biggest price increase in the market in the last seven days was Ripple (XRP). Around this time, the altcoin jumped from $0.44 to $0.54, partly due to increased trading volume on South Korean cryptocurrency exchanges, particularly Korbit and Bithumb, where XRP was the most traded crypto asset in the previous 24 hours. This bullish trend is associated with greater investor confidence in the context of the current SEC lawsuit.

At the time of writing, Ripple’s native token XRP is changing hands at $0.5122. This slight correction came in response to the overall crypto market currently in the red zone. The next level of resistance is at $0.55, while the support levels are at $0.45 and $0.40, respectively. The spectacular rise of the altcoin price has been one of the main talking points in the crypto industry in recent weeks. Embarking on a two-year legal battle, Ripple Labs saw the price of its native token increase by 15% in the previous seven days and by nearly 16% from a month ago.

There is a lot of activity around altcoins in South Korea

Surprisingly, there is a lot of activity in the South Korean crypto markets. In the last 24 hours. XRP was the fourth most traded asset on Upbit, the country’s largest exchange, accounting for more than 6% of overall trading activity. XRP’s market share was around 28% a few days ago, outpacing cryptos with larger market caps like Bitcoin and Ethereum.

However, it accounted for 22% of the total volume on Bithumb, another major exchange. South Korean exchanges have historically seen higher prices for popular tokens than offshore markets. The phenomenon is known as Kimchi Premium and is fueled by the country’s high desire for cryptocurrency. While this is advantageous for arbitrage trading, South Korea’s strong capital restrictions that limit the flow of money that can leave the country make it difficult and unprofitable.

To this end, Koreans are known to engage in various activities, including promoting their products. The head of blockchain analytics firm CryptoQuant noted this recently.

Wash Trading in XRP?

A large part of this is Wash Trading, a type of market manipulation where traders buy and sell the same product to inflate their trading volumes and create the illusion of liquidity. When the price rises significantly, traders then sell their positions, causing prices to fall. In this case, the price of XRP has dropped 8% by press time after hitting a five-month high on March 29.

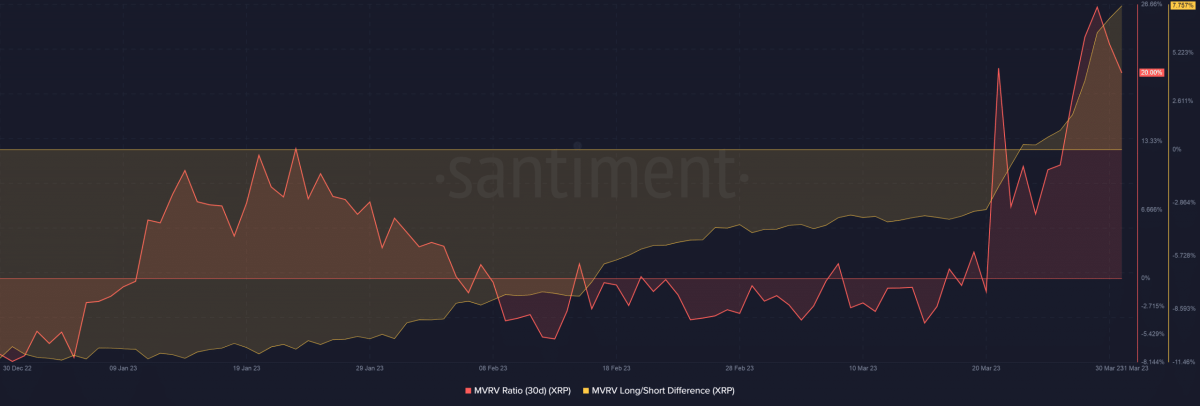

Meanwhile, due to the recent gain, XRP’s MVRV Ratio hit a six-month high on March 29 but then fell. The increased MVRV Long/Short Spread showed that long-term bulls take profits when they sell their tokens.

As mentioned earlier, the price of XRP has dropped from its peak on March 29. According to Coinglass, the number of long positions placed for the coin has gradually decreased since then, with the Long/Short Ratio dropping below one at the time of writing.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.