Ripple (XRP) price moves above and remains above the “neck” line of an inverted head-and-shoulder pattern. XRP investors, on the other hand, continue to expect a rally of around 20%. But what levels should XRP investors pay attention to?

As Ripple (XRP) price moves above the “neck” line of an inverted head-and-shoulders pattern, an additional bullish point and pattern began to develop, reinforcing the previous bullish argument. XRP in the next ten days BTC and ETHIt seems highly likely that it will outperform .

XRP continues to rise after the breakout in price. Besides, XRP seems to need more buyers to move away from support, which has turned into short-term resistance. While the upside momentum is strong, any weakness could trigger a bull trap.

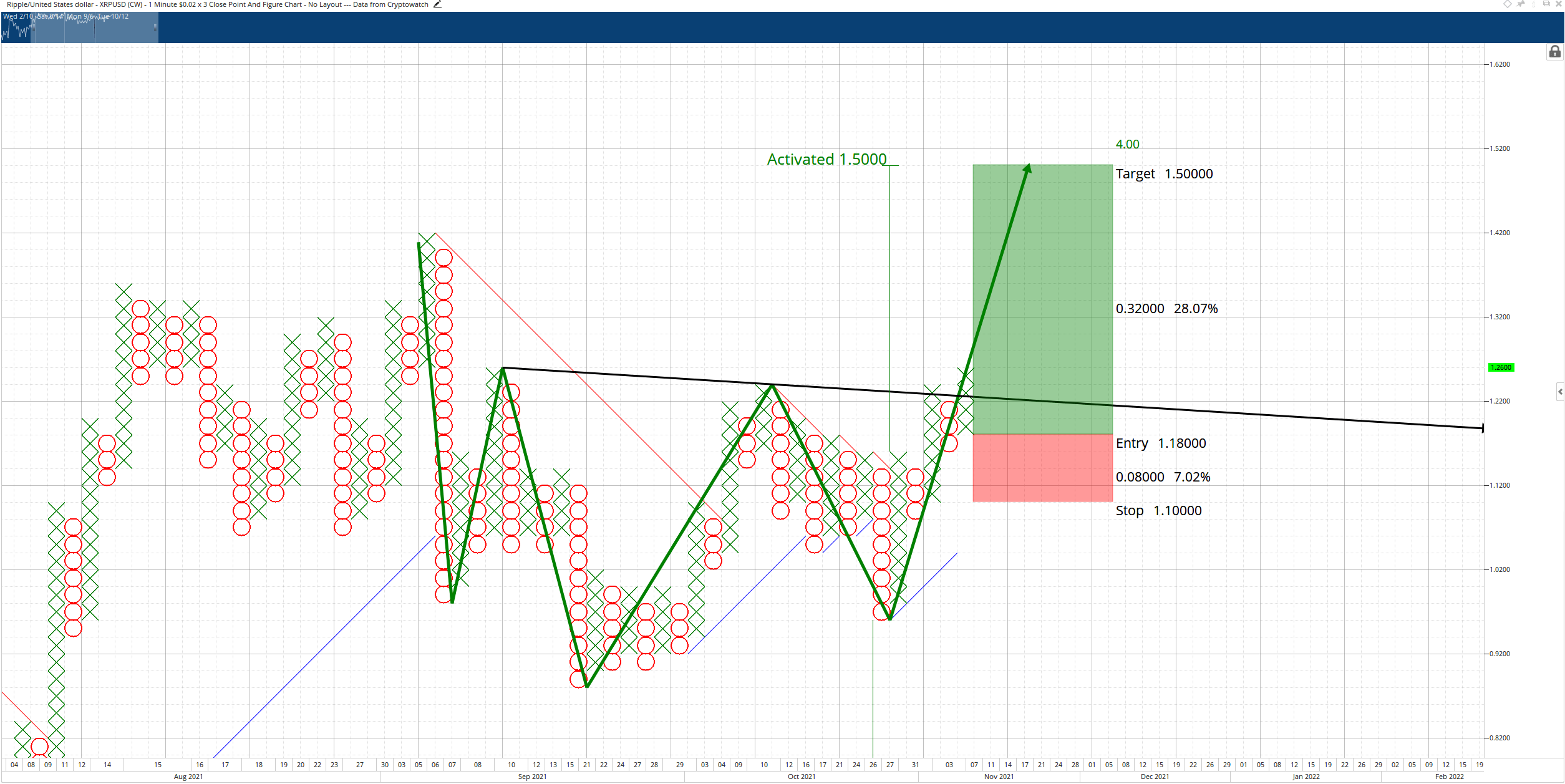

Looking at the overall picture, Ripple (XRP) price continues to reject short-term selling pressure and continues to rise towards $1.5. The XRP price had theoretically reached the “long-term investment” level on October 28. This call showed itself at $1.18.

Two major spikes were seen following this entry call. First, XRP traded above the neckline of the inverted head-shoulder triangle and closed. Second, a bullish trigger has developed and the projected profit target from this pattern is seen at $1.50.

According to the 0.02 Dot and Figure chart, there is still a downside risk. However, the triple-top rise continues and the XRP price is currently in the second phase of the triple-top.

If a new bullish column forms and the price drops to $1.19, this will confirm the fake bull pattern. This bearish pattern may create a selling pressure and push the price back to the $1 levels. However, this scenario does not seem very likely for the asset, which is currently in an uptrend.

If this scenario happens, bullish scenarios in XRP will be invalid.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.