Despite the tough stance taken by US regulators throughout March, most altcoins managed to hold on to critical resistances, along with Bitcoin. In this article, you can find altcoins that may break in the short term according to technical analysis.

Network growth metrics signal bullish for this altcoin

On-chain data shows that the growth of the Polygon (MATIC) network is increasing as the price consolidates. As Twitter analyst Ali Martinez points out, the bearish trend in the indicator a while ago caused the price to drop by 40%. “Network growth” is an indicator from Santiment that measures the total number of new Polygon addresses.

When the value of this metric is high, it means that a large number of new addresses are currently active on the network. Generally, new addresses are assumed to come from new users joining the network, and therefore, a high value of this metric could be a sign of rapid adoption of the altcoin.

On the other hand, low indicator values mean that the network is not currently observing many new incoming users. This type of trend may indicate that its adoption is losing relevance. Here is the graph showing the growth trend of the Polygon network over the past few months:

As the chart above shows, Polygon network growth was in an overall downtrend earlier in the year. This means that the total number of new users joining the network every day is constantly decreasing. But while this was happening, the MATIC price was skyrocketing.

MATIC price targets

The price of Polygon is rising slightly on a daily and weekly scale at the time of writing. This rise in the metric implies that the user base is growing rapidly right now. As mentioned earlier, this type of adoption can be constructive for the network in the long run as it provides a solid foundation for sustainable growth.

Increasing network activity indicates that more people are using Polygon, while this metric price signals upside in the long run.

Altcoin price predictions: What levels are HBAR, Celo and Injective Protocol targeting?

HBAR’s 4-hour chart shows that HBAR price had a good week as investors reacted to the growing ecosystem. Hedera Hashgraph managed to climb above the key resistance at $0.068, the March 14 high. The altcoin climbed above the 50-day EMA, while the RSI approached the overbought level.

HBAR also rose above the Ichimoku cloud. Therefore, there is a possibility to continue higher with the next key resistance level to watch at $0.078, the February 13 low. This price is about 13.45% above the current level.

Celo (CELO)

Celo is an EVM-compatible Blockchain platform that enables developers to build quality applications in industries such as DeFi and NFT. The price of Celo jumped as the number of Celo Domains in print exceeded 200,000. cryptocoin.com As we reported, the developers also announced that Celo’s European DAO is coming soon.

Celo has been in a strong uptrend for the past few days. It broke above the key resistance level of $0.6861, the March 20 high. The altcoin climbed above the 50-day MA. Also, the Stochastic Oscillator has moved slightly below the overbought point. Therefore, technical analyst Crispus Nyaga predicts that the rally in Celo price could continue as buyers target the key resistance at $0.85, ~20% above the current level.

Injective (INJ)

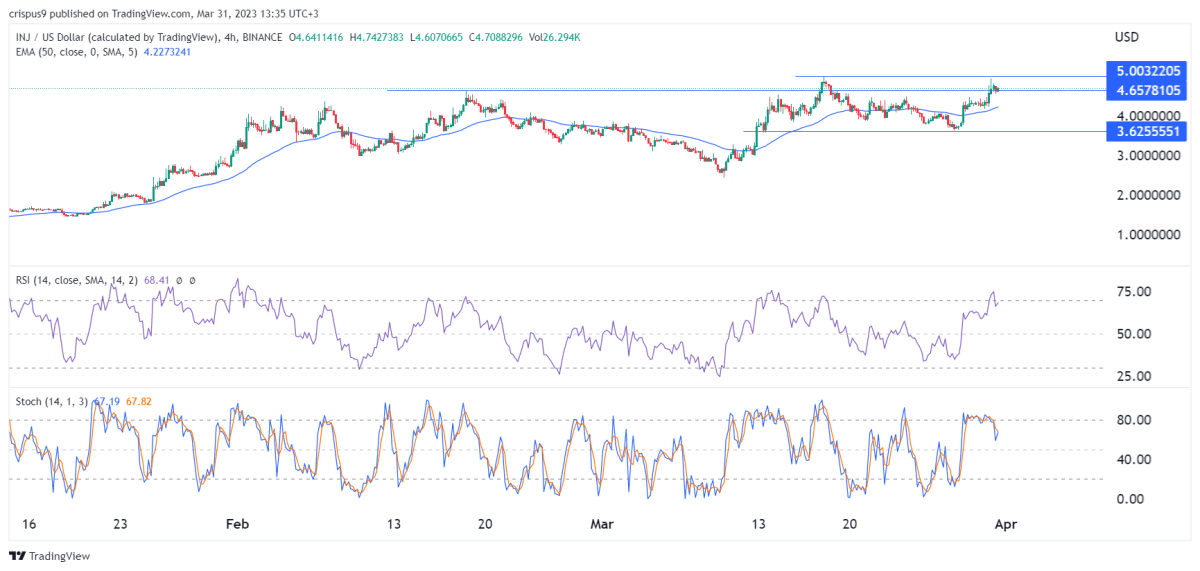

INJ price has been in a strong uptrend for the past few years. Injective Protocol has risen nearly 90% above this month’s low. Thus, it reached 280% above the lowest level of the year. The RSI and Stochastic Oscillator moved to the overbought level while the token broke above the 50-period moving average.

Therefore, Injective Protocol will likely continue to rise as buyers target the key resistance at $5.5. This view will be confirmed if it rises above the year-to-date high of $5.0.

Uniswap (UNI) bulls cleared $5.5, what’s next?

Uniswap (UNI) climbed above $6 as the bulls fiercely defended the $5.5 support zone last week. On-chain data shows Uniswap has benefited from the recent DeFi boom.

The introduction of the new Concentrated Liquidity mechanism during the V3 product update saw Uniswap consolidate its status as the largest crypto Auto Market Maker. On-chain data reveals that crypto investors are accumulating UNI while intensifying their DeFi activities on the Uniswap platform.

According to data compiled by Glassnode, the supply of Uniswap tokens locked in smart contracts has been on an uptrend since February.

The chart above shows how UNI investors locked an additional 1.4 million tokens (0.24% of the total UNI supply) in smart contracts between February 2 and March 31. The additional UNI that was locked last month was worth about $8 million.

Which direction do the metrics point for UNI?

When the supply of tokens locked in smart contracts increases, it temporarily reduces the number of tokens that can be traded on exchanges. The relative scarcity caused by the recent increase in DeFi activity could lead UNI to further price increases. Another critical metric supporting this bullish stance is the drop in UNI token supply on exchanges.

Glassnode’s Balance on Exchange metric tracks the flow of tokens to exchanges when daily outflows are deducted. The chart below shows how UNI tokens in recognized exchange wallets have consistently dropped over the past month. Since February 26, the supply of UNI on exchanges has dropped from 41.4 million tokens to 37.6 million as of March 31.

When the equilibrium in the stock markets falls for a long period of time, it causes relative scarcity in the stock markets, which often triggers a price increase. Ultimately, UNI holders can expect a prolonged price increase if Uniswap investors continue to remove tokens from exchanges and lock them into smart contracts.

UNI price prediction: Altcoin bulls target $7?

IntoTheBlock’s Global Money In/Out data shows that only 24% of Uniswap traders are currently in profitable positions. This can mean significant room for growth before most owners start making a profit.

Currently, UNI will likely break its current resistance with a maximum price of $6.14, at which 34,000 addresses purchased around 60 million tokens. If this happens, UNI could rally towards the next key resistance in the $7.61 area. Around this region, another 34,000 addresses had purchased 38 million UNIs.

Still, the bears could reverse the trend if it drops below $5.66, the minimum price at which 34,000 addresses bought 60 million UNIs. If this happens, it could trigger an influx of sells and push UNI further down towards the next crucial support at $4.8. The $4.8 region is the average price at which 33,000 addresses bought 20 million UNIs.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.