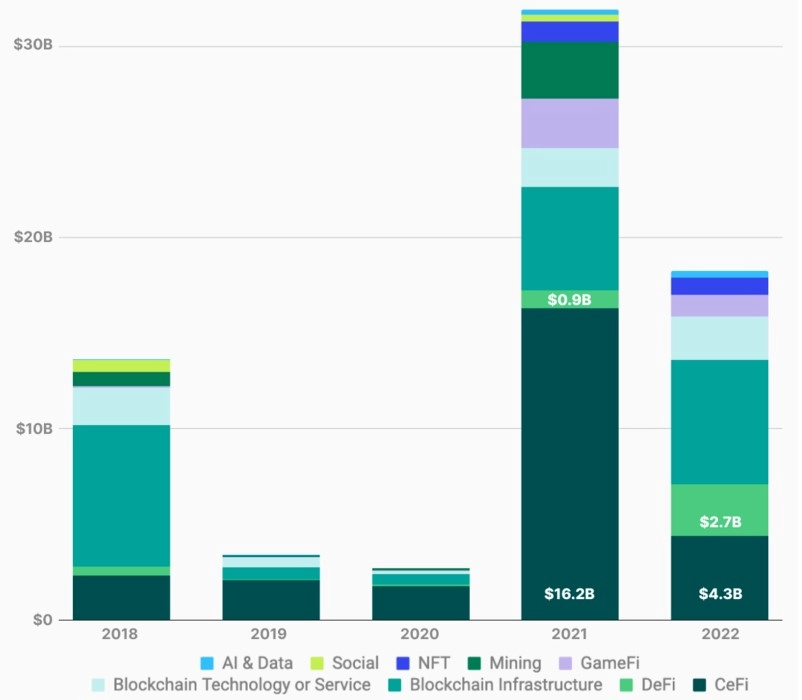

Digital asset investment firms, decentralized finance (DeFi) invested $2.7 billion in 2022, an increase of 190% compared to the previous year. In the same period, investments in central finance projects fell 73% to $4.3 billion.

The increase in DeFi financing came as the market turned from a bull to a bear. Overall crypto financing figures have dropped from $31.92 billion in 2021 to $18.25 billion in 2022.

CoinGecko’s March 1 report was prepared based on data from DefiLlama. According to this report, the numbers show that DeFi could be a new high-growth area for the crypto industry. The report states that the drop in funding for CeFi may indicate that the industry has “reached a degree of saturation”.

Koinfinans.com As we reported, according to data from CoinGecko, DeFi investments increased nearly three times and 65 times more investments were made compared to 2020. Luna Foundation Guard (LFG), the largest DeFi fund, made a huge profit from the $1 billion LUNA token sale in February 2022. Ethereum-specific decentralized exchange Uniswap and staking protocol Lido Finance raised $164 million and $94 million in total. This sale came about three months before the disastrous May collapse of Terra Luna Classic (LUNC) and TerraClassicUSD (USTC).

On the other hand, FTX and FTX US raised $800 million in January 2022, accounting for 18.6% of CeFi funding. However, they went bankrupt after only 10 months. CoinGecko said that $2.8 billion and $2.7 billion raised by blockchain infrastructure and technology companies over the past five years are among other areas of investment.

Institutional Investment Flows to DeFi and These Sectors

Henrik Andersson, chief investment officer at Australian-based wealth fund manager Apollo Crypto, said his firm has recently looked into four specific sectors within crypto. stated.

Henrik Andersson, chief investment officer of Apollo Crypto, stated that his firm has recently focused on four specific industries. First, there are the “NFTfi” projects where it emerged from the combination of DeFi and NFTs. The second and third are on-chain derivatives platforms and decentralized stablecoins, which FTX believes emerged due to its collapse and recent regulatory actions.

I haven’t bought any NFTFI token

Just waiting for @nftperp to launch a token.

Anything perp derivatives outperforms other categories

Wen launch 👀 pic.twitter.com/yaW6HNkIGN

— DeFI Saint 🦇🔊 (@TheDeFISaint) February 17, 2023

“In light of the FTX collapse and regulatory movements, we have seen increased interest in on-chain derivatives platforms such as GMX, SNX, and LYRA. Decentralized stablecoins like LUSD/LQTY have also benefited from the current regulatory environment.”

You can follow the current price action here.