The Dax group Infineon sees a rapidly increasing demand in the coming years.

(Photo: Infineon)

Munich Driving with foresight: the dream of every driving instructor comes true with the new radar chips from Infineon. The innovative sensors can see 300 meters and more ahead. That’s about 50 meters further than before. The semiconductor manufacturer will be presenting the components next week at Electronica, the world’s leading electronics trade fair in Munich.

Infineon is already the world’s leading manufacturer of radar chips. However, the business has so far been comparatively small. That could change in the coming years. “The need for radar sensors is increasing dramatically,” says Burkhard Neurauter, head of radar chip development at the Dax group, the Handelsblatt.

Car brands are installing radar chips in more and more models because customers are increasingly ordering assistance systems. “Radar technology has long since found its way into the golf class,” says Neurauter.

Infineon expects an annual increase in radar modules worldwide – each of which can contain several radar chips – of 24 percent by 2027. For comparison: According to the Boston Consulting Group (BCG), the entire chip market will only increase by five on average over the next five years increase percent.

Top jobs of the day

Find the best jobs now and

be notified by email.

Market researchers from Yole estimate Infineon’s sales of radar chips at $256 million in 2021. If Infineon grows as fast as the market in the future, revenues in 2030 will be well over a billion dollars. Germany’s largest chip manufacturer does not publish any figures on the business itself.

It is extremely important for Infineon that the innovations at Electronica are well received by customers. Because the rival NXP has caught up: According to Yole, the Dutch increased their market share from 23 to 30 percent last year, while the Munich company slipped from 60 to 53 percent. Number three in the field is the Franco-Italian STMicroelectronics with six percent.

The radar chips are thus one of the few areas of the semiconductor industry that is dominated by European suppliers. This also applies to the associated control units, the so-called microcontrollers. Here the balance of power is reversed – NXP is ahead of Infineon.

Radar chips play an important role on the road to autonomous driving. As a rule, they are combined with cameras or lidar systems in order to record the surroundings as completely as possible. Lidar uses lasers to measure distance.

Only Tesla does without radar

Only one manufacturer does without it: Tesla, the electric car pioneer from America. “Tesla is the only one swimming against the tide and relying entirely on cameras and software,” says Albert Waas, chip expert at BCG. “Everyone else is convinced that only the combination of cameras and sensors is safe enough.”

>> Read here: How the chip companies in Europe can close a dangerous gap in the supply chain

Infineon emphasizes that radar chips offer advantages that automakers cannot avoid. “The radar technology is very robust in all environmental influences, whether fog, rain, snow or ambient light,” says chief developer Neurauter.

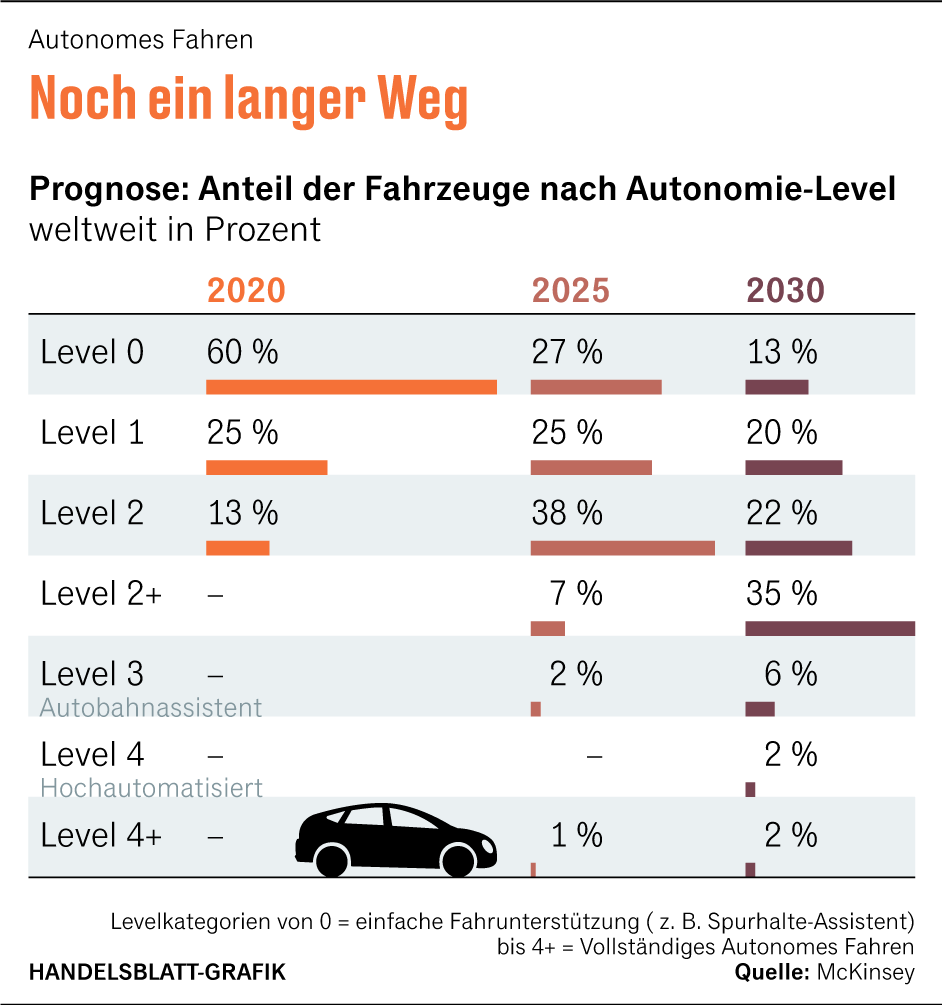

However, the various systems are also expensive. For the so-called Level 2 of automated driving, BCG calculated the costs for the necessary chips to be 290 dollars per vehicle. At this level, drivers can at least temporarily take their hands off the steering wheel.

It will be even more lucrative for Infineon and its rivals in the subsequent stages. “The number of radar modules will double for levels 3 to 5, from an average of five today to more than ten,” says Infineon manager Neurauter. At level 3, the person behind the wheel can temporarily turn away from the traffic, at level 5 the vehicle drives completely independently.

The buyers have to dig deep into their pockets for this: Infineon currently sells a radar chip for around five dollars, according to the industry. The associated microcontroller costs the customer twice as much. This means that the buyers have to calculate at least 100 dollars per vehicle for the radar chips and the corresponding microcontrollers alone.

Together with all other semiconductors for automated driving, the chip bill at Level 3 currently adds up to $1,360, BCG estimates. No wonder Tesla boss Elon Musk tries to get by with as few different technologies as possible.

More: Paradoxical world of chips: Industry is struggling with overproduction and delivery bottlenecks at the same time